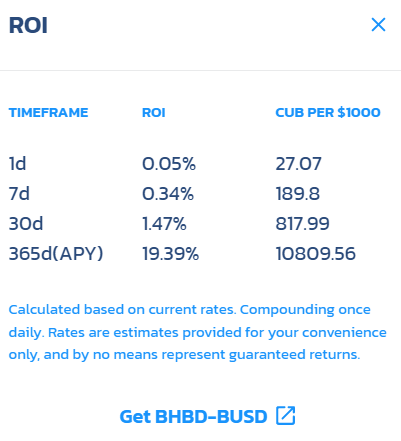

The BUSD-bHBD stablecoin liquidity pool pays 17.88% as APR and 19.39% as APY (compounded yield) whereas the HBD savings account pays 20% as APR.

The only advantage the LP pool is that one can withdraw one's stake immediately whereas the savings account has a 3.5 day waiting period.

However, HBD is currently selling at a discount. It's price is $0.973.

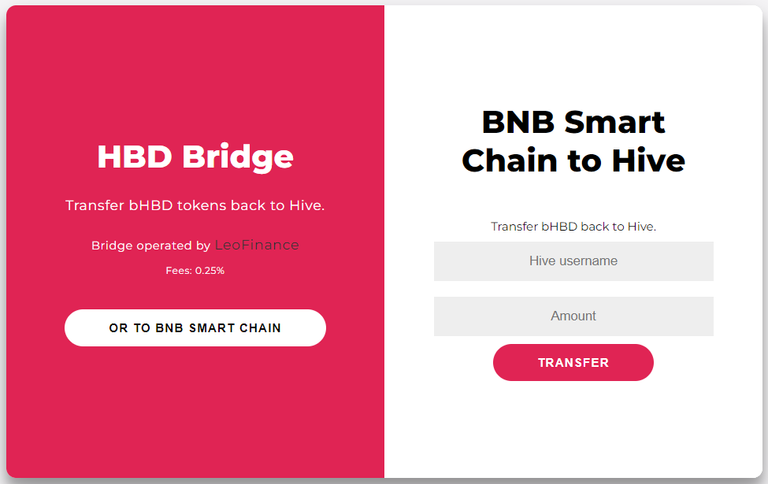

It might make sense for you to unstake at least some of your funds from the pool, swap the BUSD for bHBD and unwrap the bHBD into HBD to be able to use the savings account for a better yield at least for the time being. There is a fee that amounts to 0.25% of the funds wrapped or unwrapped. When the market conditions change, I would recommend that you withdraw your HBD and wrap it into bHBD and provide liquidity to the pool again.

You can do that using the Multi-Token Bridge here:

Posted Using LeoFinance Beta