Hello!

If you read my blog you already know that I like to track what are the Bitcoin ETFs doing. It's a good way to understand if there is enough demand at these prices. I like to track this information using the website: https://heyapollo.com/bitcoin-tracker/flows

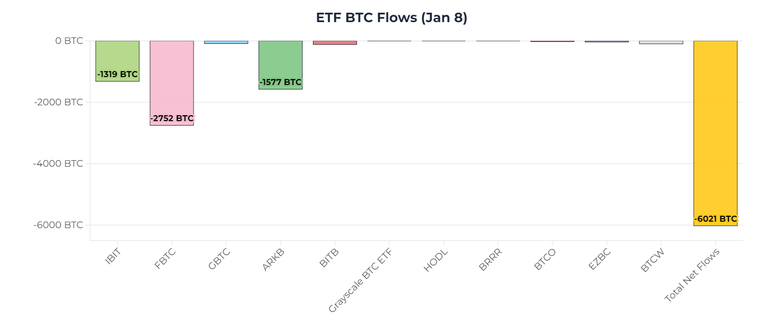

As you can see in the link here is the photo for the 8th of January, the last day updated:

A total of 6,000 Bitcoin were sold the 8th of January. Almost half of this amount was sold in the Fidelity Bitcoin etf and the rest was split between Blackrock IBIT ETF and ARK invest ETF called ARKB.

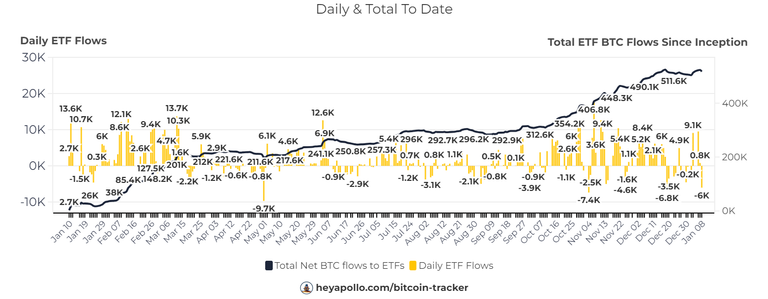

But, is this a lot of sell pressuse? Let's take a look at the whole picture. Let's zoom out and look at the evolution of the Bitcoin ETF flows since inception.

Here is the photo:

As you can see in the photo we have 2 clear bull periods. At the beggining we had a sharp increase in inflows, and then last October we also had a sharp increase. The other periods are flat or with a slow increase.

What this means is that there is nothing to be scared about. The demand has stopped and there is some selling pressure, but nothing out of hand.

We all can keep walking to the paradise, small journey to Valhalla!

Enjoy the weekend.

Posted Using INLEO