Hello!

Bitcoin ETFs got approved in January 12th of 2024. Well, it actually got approved before, January 12th was the day when they started trading. 8 months ago, the expectation was at all time highs.

When they got approved we saw a lot of inflows in the first months, we peaked at 211,000 BTC net inflows in March. Take in consideration that there were a lot of outflows coming from Grayscale GBTC, money that was locked and now paying a lot more fees than the market average.

Today there are 290,000 BTC net inflows. We got a slow ride to these levels since march.

However the biggest Bitcoin ETF (IBIT marker from Blackrock) has seen steady inflows lately.

Their clients are buying slowly everyday. They have seen steady inflows for a long time now.

What's the meaning of this steady inflows? Their clients want exposure to Bitcoin, they are slowly realizing that it's a new asset that is valuable. They want in in their portfolios.

Today, The Bitcoin Magazine published a chart showing that the Blackrock Bitcoin ETF (IBIT) has the third largest YTD flows among all Global ETFs!

THAT IS HUGE!!!!!

The Bitcoin ETFs are the fastest growing ETFs EVER! Do you know what this means?

Why the fuck are you selling your Bitcoin at these prices?

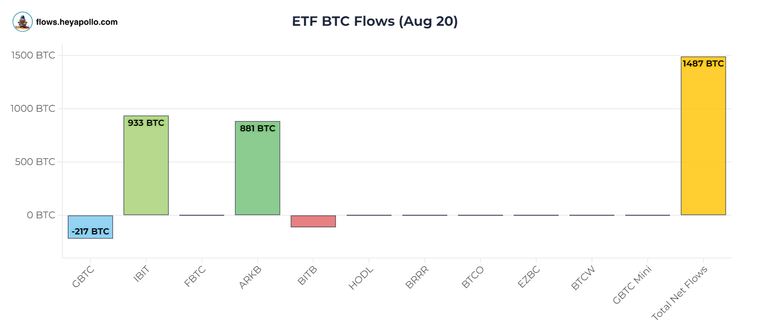

The tendency is clear, there are just 450 Bitcoins mined each day and just yesterday we saw an inflow of 1,500 Bitcoin from the ETFs.

See the chart below:

Slowly, then suddenly!

Time is on our side, be patient and you will be rewarded.

And Hive will shine again my friends. We'll get some money rotating from Bitcoin to alts in the late stage of the bull market.

Stay safe out there!

Posted Using InLeo Alpha