Hello!

The time has come. The Bitcoin ETFs now hodl more than 1 million Bitcoin in behalf of their clients. There is a lot of people that are not interested in self-custody that still believe in Bitcoin. They don't want all the struggle that comes with being able to store the keys in a safely manner.

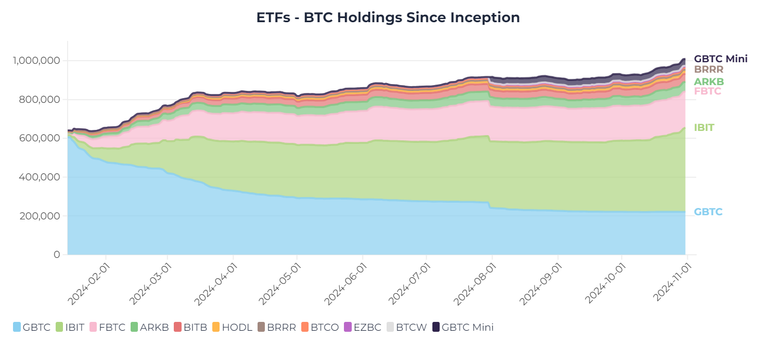

At the beginning of the year we has Grayscale hodling approximately 600,000 Bitcoin, and then we got the ETF approval and the big investment companies joined the party. After the initial fast growth of the ETFs from 600,000 to 800,000 we kinda of slowed down.

Here you have the chart:

After we got a period of consolidation or "slow accumulation" from 800,000 to 1,000,000 but if you take a look at what happened the last weeks we can see that the BTC hodlings are increasing fast. It looks like the accumulation is accelerating.

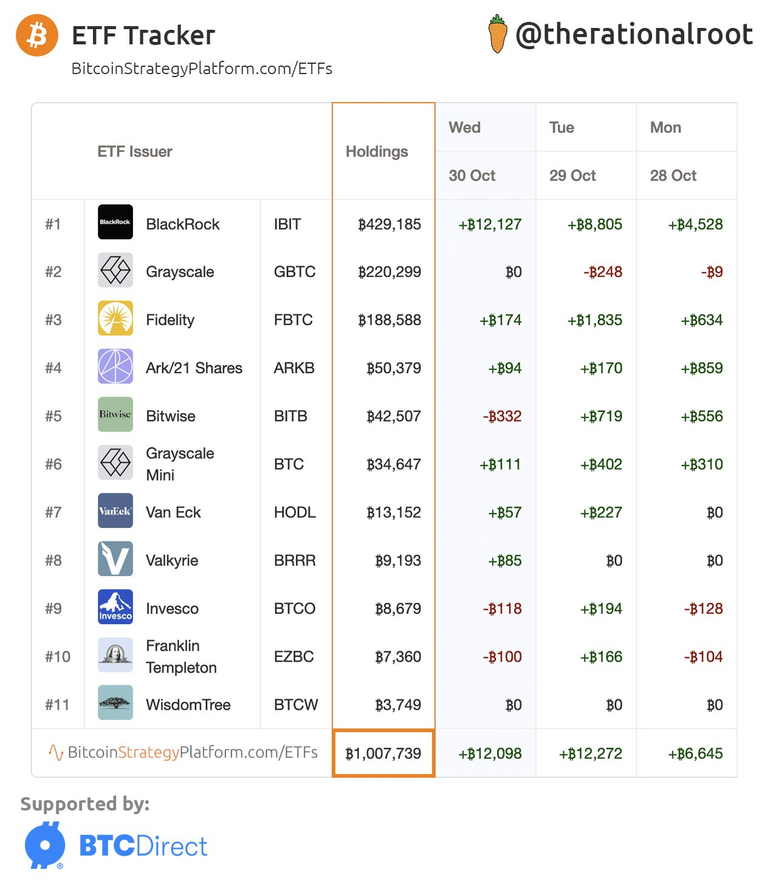

Here you have the approximate numbers by The rational root:

Blackrock is leading the course wit more than 400,000 Bitcoin, almost doubling what Grayscale currently hodls. Fidelity is really close and I believe that eventually they will become the second largest Bitcoin hodler.

Why is 1 million Bitcoin important?

Because Satoshi had control of almost 1 million coins, and that makes the ETF close to what Satoshi Nakamoto could potentially own. I personally believe that he has thrown away the keys to avoid the temptation to access the coins.

I hope you have a great day!

Posted Using InLeo Alpha