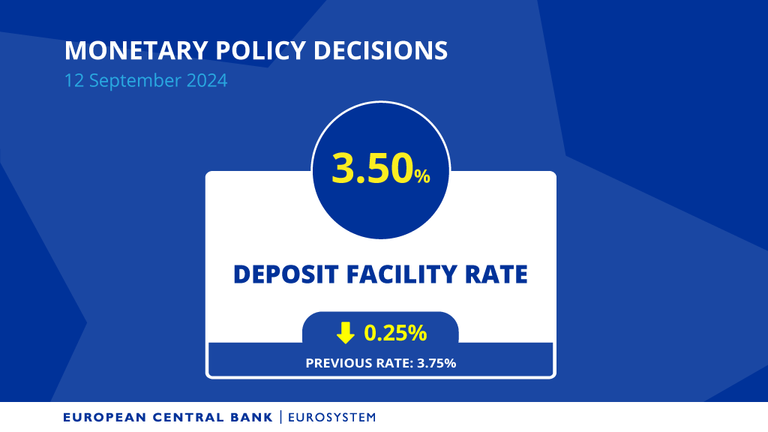

The European Central Bank (ECB) cuts interest rate by 25 basis points to 3,5%. It has been a long awaited cut. Christine Lagarde said the following:

Only a further sharp economic deterioration would prompt the ECB to speed up with back-to-back or larger cuts.

It means that there would be slowly and gradually rate cuts but not a big rate cut if the data doesn’t change fast to a worse scenario.

Some people are concerned that rate cuts maybe bearish for Bitcoin and cryptocurrencies, but I don’t think these arguments are correct.

In fact, I think that the opposite will occur. Given the money printing we had during the last period of Covid, I am confident that they will start printing a lot if the recession starts to hit.

They act like an addict, once you are used to a certain dose, you will always need a bigger dose to get the same effect. The deficits are expanding, the only true way to pay the debt is by printing money. It’s inevitable, it’s pure math.

The change in direction to rate cuts by the European Central Bank is a clear indication that QE will occur sooner than later. And this translates into price appreciation for assets, specially hard-capped assets with limited supply like Bitcoin.

Patience, the explosion of liquidity is coming.

Take care!

Posted Using InLeo Alpha