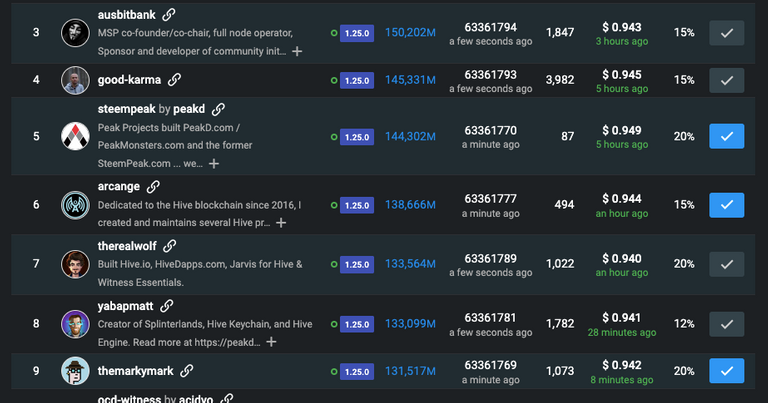

A few of the Top Witnesses have recently started signalling for a 20% return on HBDs in savings, a significant increase from the 12% we currently have.... but is a 20% yield sustainable....?

NB that 20% is new money printed, new HBD (effectively Hive) inflation added to the supply every print-block.

ATM the current supplies of Hive and HBD are:

- 377M HIVE

- 24M HBD….

- = 403 M Hive….

And with the price of Hive bouncing around the $1 mark that means the total HBD supply is 6% of the value of total Hive supply, so we are a long way off the 10% Hair Cut rule kicking in.

NB of that 24M HBD only around 3M is in savings and a further 6M liquid with 15 Million in DAO (which can't go into savings).

What are the likely effects....?

Firstly we have an increase in the total Hive-HBD inflation as this is new inflation - but only by a tiny amount - with 3M in savings being paid out at 20% rather than the current 12% , that's < than a 0.1 % increase to the overall Hive inflation, so even if the amount of HBDs in savings increases 5-10 times, it's still relatively small.

This move SHOULD increase the demand for HBD as 20% is an attractive return on a stable-ish coin, so more holding and buying of HBD to take advantage of the decent yield.

One would also expect some downward pressure on the price of Hive as there would be reduced buying pressure on the internal market - why buy and power up Hive when you can get double the yield on HBDs?

You might also expect some people to PD Hive to buy HBDs, creating further sell pressure and downward price action.

HOWEVER, I think the downward pressure is limited - the only way for people to buy significant amounts of HBD without too much slippage (given the relatively low liquidity) is through converting Hive and effectively burning it - relying on the 3 day average price to get yer HBD.

And by 'significant' we are talking anything over $1000 - liquidity is pretty thin!

There should be limited negative price pressure on Hive - once the TMC of HBDs hits 10% of the TMC of Hive, then the HairCut rule kicks in stopping the printing of new HBDs as part of Hive Rewards thus restricting the supply to control the debt level of HBD to Hive.

This SHOULD lead to a healthy demand for HBDs, pushing the price above $1 (just) at which point the HBD Stabiliser Fund starts selling HBDs for Hive, pushing the price up.

Hypothetically speaking ATM IF the total amount of HBD remains the same and Hive goes below $0.50 that's the point at which the Hair Cut rule kicks in, roughly.

Similarly if there's a sudden increase in demand for HBDs and we double the amount of HBDs in existence and Hive stays at around $1, the haircut rule would kick in then too...

Where does this leave the long term price of Hive...?

Obviously increasing the amount of HBD debt relative to Hive isn't a good thing - but the ratio we are currently talking about is relatively conservative, and I think there are mechanisms in place to handle a 20% APR on HBD savings.

Hell, it might even create more eyes for Hive, more burning of Hive and lead to an INCREASE in the price of Hive too if Hive gets burned along the way for HBDs....?

Long Term it just means money waiting to be dumped back into Hive, which could increase volatility down the line, so there are risks.

However, RIGHT NOW I am feeling pretty risk tolerant and I think I am up for a 20% return!

Posted Using LeoFinance Beta