I do like to have a chunk of cash as part of my portfolio, actually ATM I've got way too much cash, but I'm forever waiting for a little dip in gold and stocks to diversify, but anyways, I digress already (WTF...?!?).

It's good for brain-thing if I can have a separate stock of cash, what I call a slush-fund' in a separate savings account, for example, that isn't real savings, to cover both emergencies and large known expenditures over the coming 12 months.

For me, I've got a £1K float in my regular day to day account, that's enough for emergencies, I mean how much do you want to discount, how pessimistic do you want to be....? Fore me £1K is enough.

Then there's also any tax I know I'm gonna have to pay, that should really be a monthly payment, but I keeps that instead in savings for 6 months and pay it off, at 5% return that's £25 for every £1K you stash, may as well!

ATM I think I'm pretty flush with HMRC, I think I've paid tax on all of my regular employment which is over the no--tax threshold and so a good chunk of my self-employed earnings will be tax-free, so I think for the next year my actual owed tax is gonna be quite low, something like £500, but we'll call it £1000, they are fuckers and they get it wrong a lot of the time!

Then there's some big ticket items, like tyres (well not that big) and a new shower (I've been saying that for ages, it's hanging on, but it doesn't like this cold weather!

Anyways, you get the gist, now enter my favourite most recent discovery...

Regular savings accounts with relatively high interest...

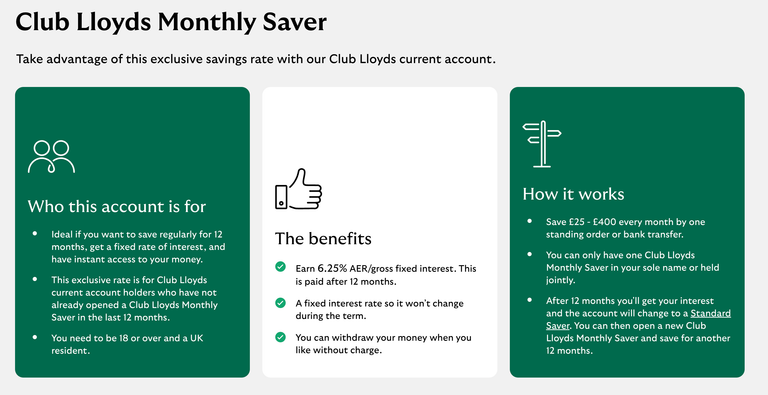

I noticed that a couple of banks I'm already with offer these regular savers, one of which is Lloyds. Their regular savings account offers 6.5% interest but you are only allowed to put in a max of £400 a month.

And it only pays that high rate of interest for a year.

Still, over 12 months that's a total of £4800, take a half way amount of £2400 and that's £150 a year interest. Conmpared to my best full-fat savings account at 4.75 interest which pays £114 interest on that amount, that's around £40 extra just for switching over accounts, which is almost no hassle at all!

NB It was very easy opening one of these but I did need an already existing Lloyds account.

I will have to remember to transfer the monies back to my other savings account as this will revert to their shitty savers rate of around 2% after 1 year, but I am quite on the ball with things like that!

The problem...

Is that this isn't really a slush-fund for year on year big ticket expenditures as if I take any money out I lose the advantage of the high interest rate, because it's limited deposits.

So this doesn't solve the problem I set myself at all, but, hey, I stumbled on a way of making myself an extra £40 a year!

Posted Using INLEO