LVMH, a luxury brand group based in Paris, but with branches all over Europe, the US and Asia, has had a pretty bad year in 2024, after 4 previous years of rising share prices...

Who are LVMH...?

In case you've never heard of them LVMH founded in 1987 with the merger of Moet and Louis Vuitton, and have gradually added other luxury brands to the group.

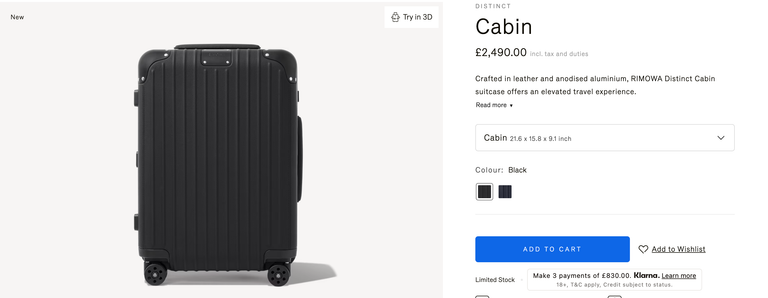

They have investments spread across luxury wines and spirits, but also fashion. One of their more recent additions was the luggage company Rimowa, from which you can buy a cabin bag for £2500. I shit you not.

So we are not talking private jets, yachts or Aston Martins here, but the kind of thing that the super rich but also 'millionaires next door' might well buy.

This group is a pretty good indicator for what the top 1% in the world might buy, rather than just the top 0.01%!

So a good time to buy some stock in luxury companies...?

While 2024 has been a bad year so far, this could just be the luxury brand market consolidating after 4 years of solid growth.

The potential upside for the kind of tatt that LMVH sells rests on a future in which an extreme minority of people have several times what they need to survive, and people who feel the need to brandish quality items to flaunt that wealth.

The super rich fairing better than just the rich....?!?

With LVMH some of their products have done better than others... those that sell to the super rich have done better than those who sell to the merely comfortable.

So £10K bags are doing better than £1K bags!

However elsewhere, the luxury private jet market hasn't had a great 2024 either. Perhaps the super rich are spending less on jets and more super high end fashion... In the same sort of way I might give up my holiday but keep my nail bar monthly treats..?

It's a fickle, risky market..

Given the inelastic nature of luxury brands, and the fact that new fashion or drinks start ups can go 'BOOM' and become uber fashionable out of nowhere, I mean all it takes is a few influencers to champion one particular new brand, I'm not so sure investing into classic status companies is a great idea.

I mean LMVH in particular feels a little old-wealth, rather than new wealth.

Personally I'd opt for a punt on a new micro distillery or fashion start up, Vesting in the well established luxury goods market just doesn't FEEL like it's going to yield that well.

Or tech, crypto, or yr bog-standard necessity companies like B and Q, they'll all probably fair better than classic luxury brands going forwards!

Posted Using InLeo Alpha