With the Russian invasion of Ukraine well-underway, international condemnation has been historically strong. The vast majority of economic powers have levied sanctions against Russia. We hear a lot about these sanctions in the news, but how exactly could they force Russia to withdraw? To answer that, let’s talk about perhaps the set of sanctions that are most concerning to Putin. With my sincerest apologies, that means explaining about how banks are supposed to work at least the well-functioning ones, like those in the United States.

Banks have many clients, each of whom deposits their money into the bank. However, that money does not just sit there. Banks must cover their overhead and operating costs, and they want eek out some profit as well. As such, they take vast majority the clients’ money and loan it out to others. They keep only a small fraction of deposits on reserve within the bank.

This allows bank to cover any clients that come in for cash withdrawals. Those who have taken out loans eventually must pay them back with interest, allowing the bank to continue running as a business. Simple enough, right? Well.. not quite.

Let’s reset things back to where the bank has made the loans and is only holding a fraction of deposits in reserve. Where the business runs into trouble is when all their clients storm the bank at the same time and ask for their money back. The bank simply cannot cover all of their obligations and becomes bankrupt. This is known as a bank run. They create all sorts of spillover problems for a country’s economy as a whole, and they were one of the causes of the Great Depression. Fortunately governments have come up with a simple solution to this problem: deposit insurance.

In the wake of the Great Depression, Franklin Roosevelt created the FDIC. Under this reform, if there were to be a run on a bank, the FDIC simply injects that bank with a ton of money. In turn, the bank cannot face an ability to pay problem. Even better, the fact that clients know that their money is FDIC ensured means that they don’t need to rush to the bank out of fear that others are doing the same, and that they will lose all of their money if they don’t.

From the U.S. government’s perspective, FDIC insurance is easy to implement. U.S. clients will want U.S. dollars, and the Federal Reserve is perfectly capable of creating as much of that as they need to. Meanwhile, in Russia right now, it’s not that simple.

The war itself is creating a financial crisis in the country, causing citizens and businesses to rush to their banks to withdraw currency. If all they were asking for were Rubles, then everything would be fine. The Central Bank of Russia could simply cover it. But that’s not what they want. The Ruble is unstable. They want to withdraw their foreign currency.

If you know a little about Russia’s finances, this might not seem to that much of a problem at all. The Central Bank has a mountain of foreign currency reserves: about $469 billion as of January 31. The solution would then seem simple: just inject that foreign currency into Russian banks, guarantee their solvency, and remove the urge of Russians to make the bank run in the first place. But it’s actually not that simple.

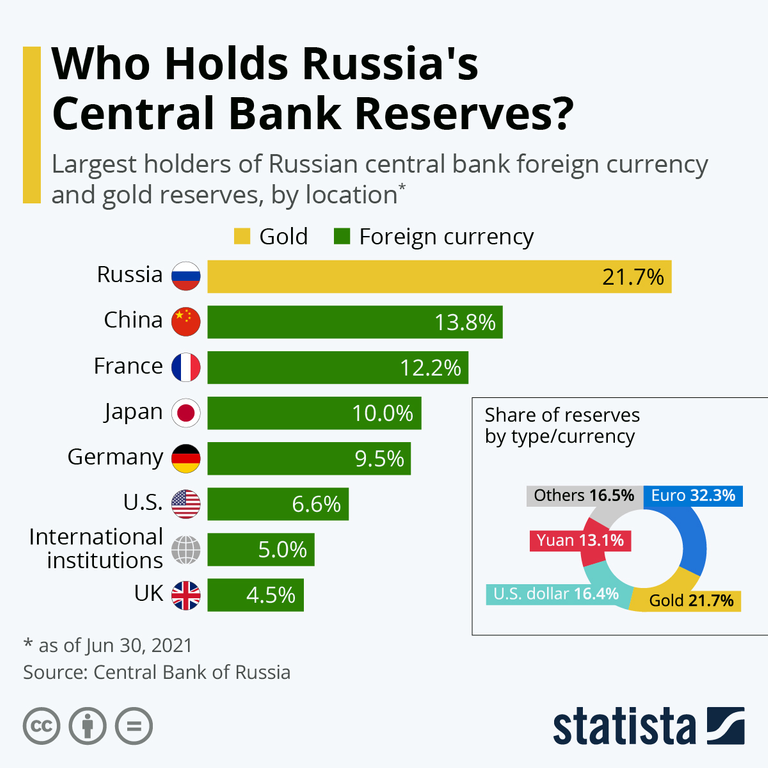

Russia owns $469 billion; they don't have $469 billion. Rather, the vast majority of that money is in the hands of other central banks, like the European Central Bank more specifically, the central banks that have now levied sanctions on Russia.

With that said, all is not desperate for Russia. $60 billion of those foreign reserves are Chinese yuan. Russia and China have improved their relationship over the last few months, so probably Russia will have access to that. The Central Bank also claims to have $132 billion in gold. But that presents its own logistical problem: they’d have to sell it to someone. And given the instability in Russia, that buyer would likely want to take physical possession of it.

In normal times, Switzerland might seem like the right place. But it’s landlocked by EU countries that are a part of the sanctions, and Switzerland has declared that it won’t act as an intermediary to break them. Another option is China. This is plausible but would make for an interesting situation needing to transport literal tons of gold all the way across Asia.

All of this is to say that Russian banks are about to face a massive solvency problem. Moreover, Russian citizens are fully aware that this is happening. As such, their incentives are to initiate a run on the banks. This, in turn, makes the solvency problem even worse. The end result is that a lot of Russian banks are likely to fail.

From the perspective of the war, the obvious first-order consequence of the economic upheaval is to make it difficult for the Russian military to resupply what they need for the war effort. If the war ends rather quickly, this might not be an issue. However, it would make a long-term occupation of Ukraine a much greater challenge. This is the fallback outcome for the sanctions regime.

The loftier goal is to mobilize domestic resistance to Vladimir Putin’s government. Wanting to rid themselves of the sanctions, they may coordinate to rid themselves of Putin. Or perhaps more likely, Putin will internalize that threat and end the invasion.