Leofinance Mantra: Build taller and wider by reaching across blockchains.

I was asked this question that went like this: Does launching new projects on different blockchains work to build a broader based community? Or does it just dilute the investment capitol of a core group of individuals who follow Leofinance Projects across the blockchains?

Now this question was posed by someone who is proposing that the strategy doesn’t work. And while our primary reflex may be to quickly criticize them as being unfaithful we have to resist that impulse, and remember we have only one brain, 2 eyes and 2 ears.

One other person essentially doubles our ability to receive and process information for free.

And we should never ignore the chance to double our intellectual and perceptive capabilities for free.

The world is not flat, but our perceptions are to a degree…

We perceive the world this way…

I think most of us agree the world is not flat, it’s not a simple 2 dimensional construct, which is easily viewed from one vantage point or point of view.

But the reality is this…

But we are each limited viewing a 3 dimension construct with binocular vision, a 2 dimensional piece, but not being able to simultaneously see the top, bottom, and backside, because the world is also not transparent. Our point of view is limited. So you ignore other peoples points of view at your peril.

So I believe the answer to this question is both yes, and no.

- They said: Does launching new projects on different blockchains work to build a broader based community? Or does it just dilute the investment capitol of a core group of individuals who follow Leofinance Projects across the blockchains?

- I can see how they view it this way because they are correct. I can also see how they are also wrong.

- So how can it be both yes and no? Because in the same ways the world isn’t flat, it isn’t black and white.

- The world is black, white, gray and other colors in between.

- Where we see only white light, a prism sees a rainbow of colors.

- When we understand this suttle point, we begin to grasp complete understanding.

- This is only possible when you recognize other peoples perspectives as being equally valid to your own.

- ‘And that is where the fun and creativity begin.

.

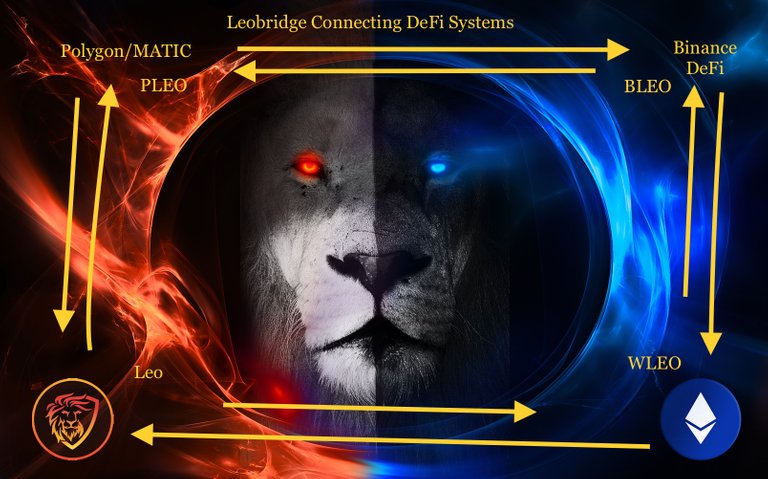

Leofinance launched on Steemit, then Hive, then Ethereum, then Binance and now Polygon.

Number of members

- It certainly is true that many members of the community on Steemit, where it was Steem Leo, followed Khal to Hive where the community became Leofinance.

- And so the community may have be populated initially by simply members only from Steemleo.

- But over time, the number of community members on the new blockchain Hive, began to exceed the number of members on the old blockchain Steemit.

- So one assumes this represented community growth.

Capitol growth

- So yes, when we moved from Steemit to Hive, many old members moved with the community and resettled on Hive. And many brought their investment capitol with them, so their capitol could have been divided between the two blockchains, causing capitol dilution, if the move was that simple.

- But it wasn’t that simple, it was a blockchain fork, of which, all you really need to know is their investment capitol was duplicated.

- So if they had 1000 Steem on Steemit, they now had 1000 Hive on the hive blockchain.

- So essentially on this rare event their capitol doubled, and was not diluted.

Your probably wishing you were here then…it was lucrative, but very stressful, so yes and now… :)

- So if we answer the question it’s yes, no and option 3.

- Yes some moved capitol over, but since their capitol was duplicated, some sold some of it, others saved all of it, and others did a mixture of the above.

Okay Steemit to Hive doubled capitol of old members, and brought in 10 times as many new members.

What about wLEO? Binance? Polygon?

The assumption, once again is this: New project, same audience, same investment capitol pool, equals capitol dilution, and same investors moving to a different location right?

Once again, the answer is yes and no, but I think mostly no, and here’s why:

- If Leofinance kept creating new projects on Hive-Engine I think you would be exactly right. New project, same audience, same investment capitol pool equals capitol dilution, just as you have said.

But I don’t think that’s what happens.

I think what’s different here is Khal reaches out to a new pool of investors with each project.

- He moves the projects to different blockchains, in order to reach a different pool of investors.

- I think an important point is… while many of us on Leofinance can figure out how to move capitol around, many of us can’t.

- There are still people on Hive who haven’t invested off Hive in any capacity.

- I think there is a bell shaped curve of expertise amongst investors, and the majority stay on one blockchain.

- I think this is the target group for Leofinance, on each blockchain, people who stay on one blockchain.

- I think we pick up some members and their investment capitol with each new project on a new blockchain.

How do I know this happens?

First, I have seen it.

- I remember meeting and helping blockchain specific investors who strictly used Ethereum when we launched wLEO on Uniswap.

- I remember meeting and helping blockchain specific investors when we launched on Binance Smart Chain, who only started investing with PanCakeSwap and found out about Cubfinance through about 20 or so YouTubers including @cryptowendyo.

Second, the number go up..

- I watch the market cap of Leo, I watch the total value locked wLEO, the total value locked in Cubfinance and now I watch the total value locked on PolyCub.

- The number on wLEO wasn’t half of Leo, it was much greater over 1 million. Number go up.

- The number on Cubfinance wasn’t one half the market cap of wLEO, it was 4 million. Number go up.

- A few days ago, the market cap of PolyCub is not one half of Cubfinance, it was 6 million. Number go up.

Dilution Some happens

- Now there will be investors from Hive who brought capitol to Ethereum, then Binance and now Polygon.

- So yes, there are investors who move from blockchain to blockchain, following Leofinance projects due to safety factors.

- I am one of them, and there are many of us.

- Does this mean there is capitol dilution as you have said? Certainly.

- Some sold some of their Leo to get into Cubfinance.

- Some sold their Cub to get into PolyCub.

- But it’s not as simple as selling, and therefore diluting capitol across blockchains.

- There was an airdrop for Cubfinance, for holders of Leo, so not everyone had to sell Leo to invest in Cubfinance, and some sold Cub to get their Leo back.

- So was there capitol dilution, yes, and new capitol created by the air drop, yes, and new capitol was brought into the ecosystem by new investors. So number go up.

I think our viewpoint or point of view about investors is often black and white . . .

when in reality it is more like a how a prism breaks light into many, many colors, there are probably many types of investor scenarios in PolyCub.

But my gut instinct is that when it comes to investment capitol and community members, the number go up. And the total value locked numbers would seem to support this.

Summary

So the answer is yes and no, but mostly yes. Yes old investors follow Leofinance projects due to trust, familiarity and CertiK audits. Those old investors use old capitol, get air dropped new capitol, and many invest new capitol due to high yields. But I think there is also new capitol, from new investors, and the number goes up, as in total value locked.

That’s my take, my perspective, my point of view. Limited as it’s by only one brain, two eyes and two ears.

What does your point of view tell you?

@shortsegments

Posted Using LeoFinance Beta