What is Polycub? and Why is it a look into the future.

- Leofinance’s decentralized finance or “DeFi” project on Polygon, is called PolyCub.

- Polygon.

- Polygon is a second layer solution or, more precisely a side chain of the Ethereum blockchain, and it has fast, nearly free transactions.

- I think PolyCub is a look into the future of Decentralized Finance, because of three important reasons: Governance, Yield Sustainability and True DeFi.

Governance

Governance

Governance

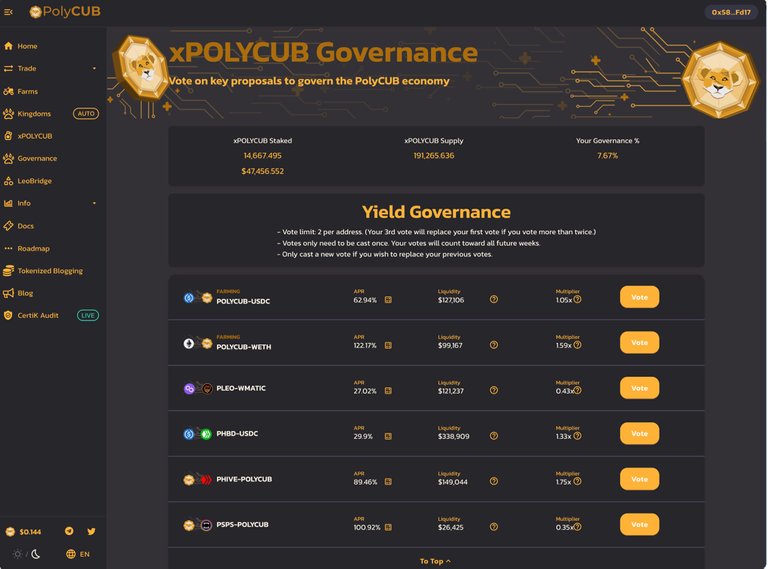

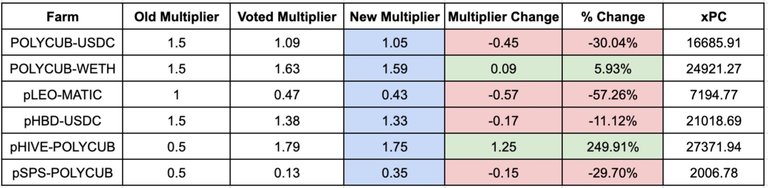

- This is a DeFi Primative or First, where farming rewards as in the portions of “daily token inflation” are proportioned or awarded to respective farms by vote of staked users.

- PolyCub has DAO style voting, which is based on modified stake based voting for relative fairness in a stake based governance model.

- PolyCub has this now, not in the future.

The first vote results shifted yield on the farms. User choice!

DYOR: You can learn more by reading these references:

Link👇

👇

👇

Link 👇

Yield Sustainability

- Poly has developed mechanisms to achieve reasonable and sustainable APR for the yield farms.

- These APRs are sustainable due to multiple streams of income for the project treasury, which pays these yields.

- The project features:

- Project owned liquidity which generates income daily.

- Bonding and Lending which generates income daily.

- A multi-token bridge which generates income daily.

- External investments of assets which generates income daily.

DYOR: You can learn more by reading these references:

👇

Multi-Token Bridge Income Generation

👇

👇

Multiple Streams of income, deflationary Tokenomics and programmed scarcity

True DeFi not CeFi

- Polycub is not a Centralized Finance platform or “CeFi” platform like Voyager, BlockFi and others where thousands of investors lost millions of dollars. In those platforms the administrators took the depositied money of those investors and invested it in risky investments with high returns. When those investments failed, those investors lost all their money. The irony is that the investors didn't know where their money was being invested.

- PolyCub is actually a solution to the problems of Centralized DeFi (CeFi) because the administrators of PolyCub don't invest your money, you do. You choose.

- Plus PolyCub allows you to protect yourself from the biggest reasons investors lose their money deposited on Centralized DeFi projects; lack of self-custody, lack of liquidity, and permissioned withdrawals. the need to ask someone for your money back!

PolyCub features include: - self custody of funds, controlled by your MetaMask wallet, and your private keys or seed phrase.

- immediate liquidity, you can withdrawal your funds immediately from the polyCub farms or LP pools.

- And permissionless withdrawals; you can withdrawal it immediately and you don’t have to ask anyone for permission.

These three things mean an investor who uses PolyCub has three important things helping them protect their funds. - Lastly, PolyCubs software code has been audited by CertiK, a prestigious third party code auditor. Which means Leofinance has taken additional steps to protect investors funds.

Summary

- I have reviewed why Polycub is a revolutionary, and an innovative DeFi Primitive or First in class DeFi project.

- I have discussed the unique traits of PolyCub Governance, Polycub Yield Sustainability and PolyCubs True DeFi traits which provide important protections of investors funds.

- I have also provided multiple references so you can do your own research (DYOR), and make your own decisions (MYOD). Because ultimately you are responsible for protecting your money.

- Authors on Leofinance provide education so you can better understand the risks of cryptocurrency, and decentralized finance.

@shortsegments

Other articles you may want to read.. ..

####### Article number one:

Learn about Leofinance and how it compares to Facebook. Link

You want to invest in DeFi, but your not ready yet?

Try EasyDeFi! It’s DeFi made easy!

Article number two:

Learn how to open a bank account, buy cryptocurrency, send it to Polygon and then to PolyCub.

👉 Juno:Cryptobank: from bank to PolyCub link

Article Number three:

Learn about the Solana Store: selling Solana phone, NFTs and cryptoknowledge in a shopping mall.

👉 Apple Store? No Solana Phone Store! link

What is Polygon

Link

Posted Using LeoFinance Beta