A cryptocurrency exchange is required to trade cryptocurrencies. We will go over two categories of cryptocurrency exchange in this post and compare them.

Centralized Cryptocurrency Exchange

A centralized cryptocurrency exchange is a platform for buying and selling digital assets. It makes use of a middleman or third party to facilitate transactions. The buyers and sellers trust their assets to this middleman to monitor the transaction and secures the assets on behalf of the buyer and seller. Transactions are not recorded on the blockchain.

Such transactions necessitate the submission of personal information for verification. If it is a company, corporate details must be presented to the exchange in order for it to validate your account.

The more information you supply to these exchanges, the larger your withdrawal quota will be. Verified users of these platforms can contact the exchange's support team in the event of a technical fault or if they forget their password.

Cryptocurrencies are frequently housed in digital wallets, a person can lose hundreds or thousands of dollars in digital currency holdings just by forgetting the wallet's key. An exchange will prevent this from happening because it protects the individual investor's holdings.

Coinbase, Binance, Gemini, GDAX, and others are some examples of centralized cryptocurrency exchanges. These brokers are custodians, preserving and safeguarding your money. The exchange is operated by a company that owns it in a centralized manner.

Decentralized Cryptocurrency Exchange

Decentralized exchanges are a non-centralized option that eliminates the middleman. These are peer-to-peer exchanges. All assets and funds in this transaction are kept on the blockchain. They are never stored by an escrow provider, and transactions are purely based on smart contracts and atomic swaps and trades.

Decentralized exchanges either run on an AMM (Automated market maker) or traditional order book model

In the order book model:

- An order is placed by a token owner to swap his or her assets for another asset offered on DEX. The owner of the token determines the number of units they must sell, the token's price, and the time limit for accepting bids for the assets.

- Other users can offer bids by putting a purchase order after the selling order has been made.

- Once the sellers have chosen the time, both sides evaluate and execute all of the offers.

In the AMM Model:

- Liquidity for an asset and its swap pair are pooled in a smart contract. Those who pool funds are eligible to receive the fees generated from the swaps using this pool.

- When someone makes a swap in the pool, the balance of assets in the pool is automatically rebalanced to 50/50 value, and the price of the tokens changes to reflect the new supply.

- When there is not enough liquidity in a pool, and a large swap is made, the trader will run into high slippage issues; meaning the lack of liquidity will result in an above-market purchase price.

The advantage of the DEX is that if is completely private and anonymous. It allows two people to directly trade value without having the need to transfer assets to a third party. The fees are low and are redistributed to liquidity provider and not to a centralized authority.

A disadvantage of decentralized exchanges is that fiat currency is not accepted. Liquidity can be thin making it harder to make large orders. Also, there is a risk of impermanent loss for liquidity providers.

A decentralized cryptocurrency is significant because it enables a trustless value exchange system. This is achieved by eliminating the need for a third party to validate the value transfer. This eliminates the need for a middleman and allows two people to directly trade value. It also increases system security because there is no single point of failure. Similarly, because no single body controls the currency, a more democratic system is possible. But then when someone loses money, there is no one to turn to! And because cryptocurrencies are digital rather than physical, they are also prone to cybercrime and hacking.

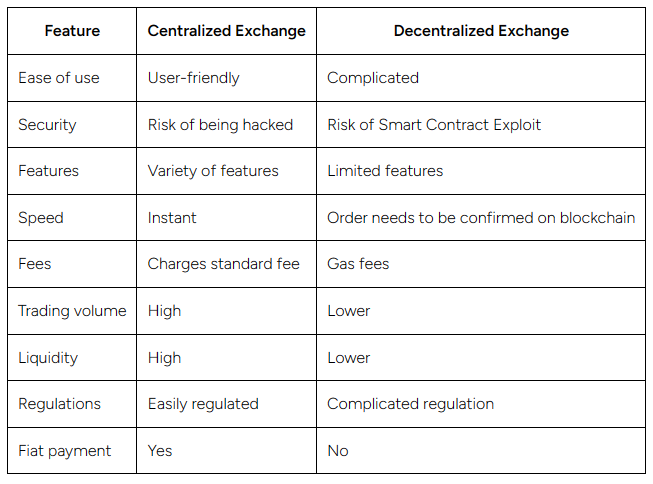

Centralized Exchange Vs Decentralized Exchange

Source

The crucial difference between centralized and decentralized exchanges is whether or not a middle man is present.

Another difference between DEXs and CEXs is whether users prefer to hold their own crypto or entrust it to the exchange. Before trading, most CEXs require users to place assets in their custody.

Holding your assets oneself adheres to the self-reliance concept that pervades the crypto sector. You have complete and total power over them. Private keys can be lost or destroyed if not handled properly.

Since I am more concerned with generating money today or tomorrow rather than what will happen in ten to fifteen years, a centralized exchange is more user-friendly and potentially safer.

The decentralized exchange is certainly a game-changing invention that will most certainly become the industry standard in the future.

In terms of short-term benefits, CEXs offer a safe entry into the world of crypto trading, while DEXs are a riskier with higher returns if you play the game well.

I think that you should do both CEX and DEX!

And keep in mind the saying: never invest money that you cannot afford to lose.

References:

https://www.coindesk.com/learn/centralized-exchange-cex-vs-decentralized-exchange-dex-whats-the-difference/

https://www.investopedia.com/tech/what-are-centralized-cryptocurrency-exchanges/

https://www.emizentech.com/blog/cryptocurrency-exchange-app-features.html#

https://www.zenledger.io/blog/decentralized-exchange-vs-centralized-exchange

https://www.upgrad.com/blog/centralized-vs-decentralized-cryptocurrency/

https://finematics.com/impermanent-loss-explained/

https://ecency.com/post/@leoglossary/leoglossary-c

😍#ilikeitalot!😍

Gold and Silver Stacking is not for everyone. Do your own research!

If you want to learn more, we are here at the Silver Gold Stackers Community. Come join us!

Best Regards,

I am not a financial adviser. This article is not meant to be financial advice. My articles on cryptos, precious metals, and money share my personal opinion, experiences, and general information on cryptos, precious metals, and money.Thank you for stopping by to view this article.

I hope to see you again soon!

I post an article daily. I feature precious metals every other day, and on other days I post articles of general interest. Follow me on my journey to save in silver and gold.

@silversaver888

Posted Using LeoFinance Alpha