An Underdog Comeback Story

This profitable mega business treats shareholders well with dividends and share buybacks. The company is also in the process of restructuring the business that can lead to solid stock price appreciation.

You can think of this situation as a company going from bad to less bad. Once the share price gets cheap enough and additional negative news does not drive the share price lower, then the share price could be set for a massive rally on any positive news.

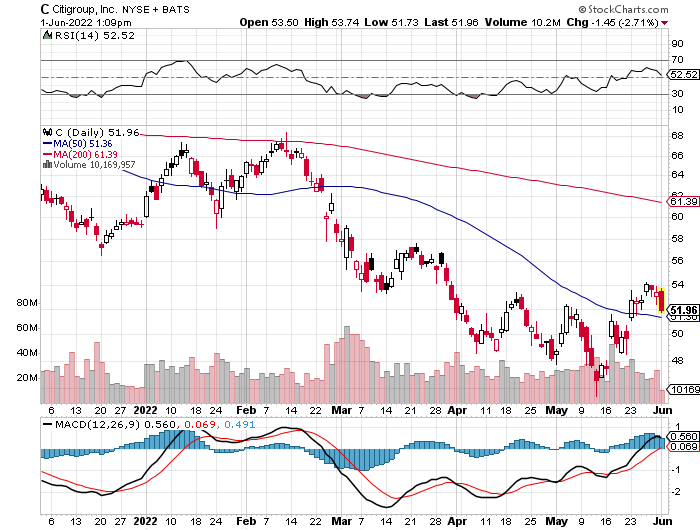

Citigroup (C) is priced as low as it was during 2008 based on price to book ratio. But the rule of thumb valuation for a reasonably run bank is the price to book should be close to 1.

With Citigroup's share price in the dump, it is a prefect time to pick up shares before they complete their new business plan. They plan on fixing their earnings mix by selling off undesirable assets and focusing all attention on the most profitable ones. The cost of transformation is $48 billion in 2021 of which $10 billion is being spent to upgrade technology to make the bank more efficient.

These changes should boost returns and the stock price should follow.

Citigroup is trading at a discount and set to make a comeback. Consider buying the stock today.

Disclosure: I wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in this article. The information provided should NOT be considered advice. The topics discussed are risky and have the potential to lose a substantial amount. I am not an investment professional and therefore do not offer individual financial advice. Please do your own research before investing.

Need a Hive account? Sign up free here!

Posted Using LeoFinance Beta