Hi Everyone,

Many people in many countries are facing what is being called a “cost of living crisis”. Prices of goods and services are increasing faster than wages and salaries. In real terms, people’s income is falling. They are able to buy less than what they could several months ago or even a year or more ago. This is causing lower income and even middle income families to struggle to maintain a reasonable standard of living.

In this post, I will discuss the nature of the “cost of living crisis”, why it will cause hardship for many people, the current response to this crisis, and why this response will not alleviate suffering in the medium and long run.

Recession, stagflation, or something else?

Is this “cost of living crisis” a recession? Before we can answer that question we need to define recession. Below are two definitions of recession from Investopedia and Economics Help.

A recession is a significant, widespread, and prolonged downturn in economic activity. Because recessions often last six months or more, one popular rule of thumb is that two consecutive quarters of decline in a country's Gross Domestic Product (GDP) constitute a recession (Investopedia).

A recession is a period with a significant decline in economic activity characterised by falling GDP, rising unemployment and a decline in real incomes Economics Help.

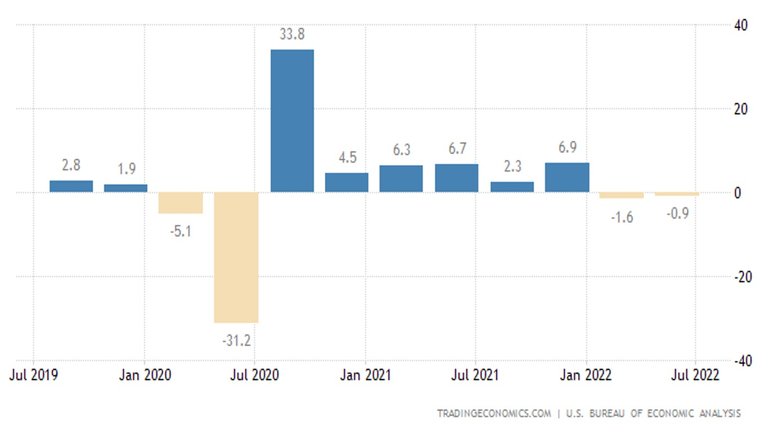

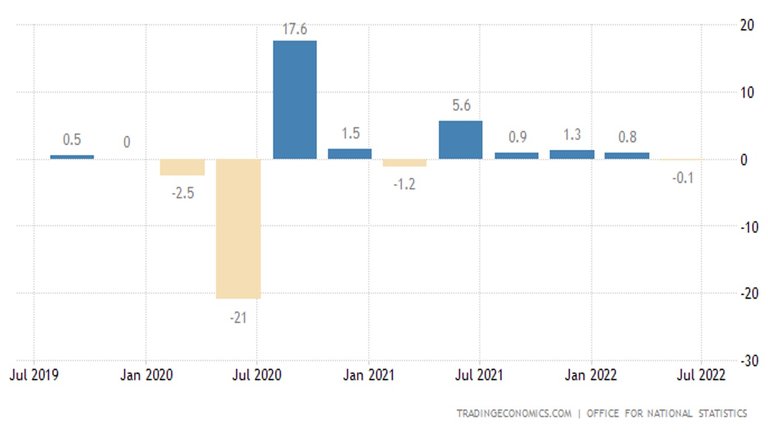

Two key indicators of a recession are falling GDP (real) for at least 2 quarters (6 months) and increasing unemployment. Below are the GDP (real) for the USA, UK, and Euro zone (i.e. countries using the Euro Zone).

Figure 1: Quarterly GDP Growth USA

Source: Trading Economics

Figure 2: Quarterly GDP Growth UK

Source: Trading Economics

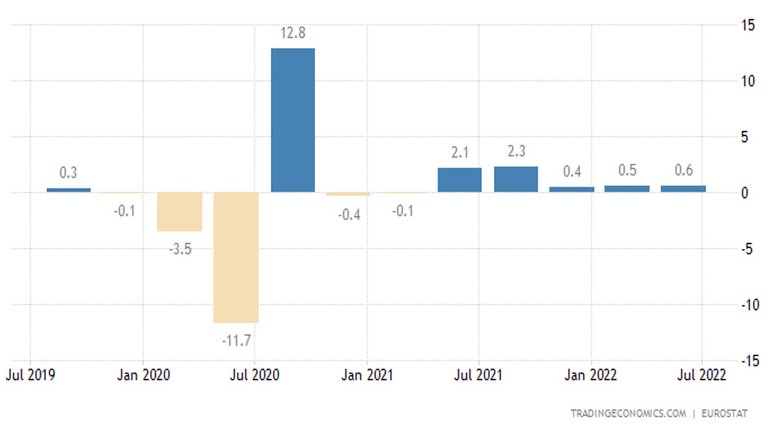

Figure 3: Quarterly GDP Growth Euro Zone

Source: Trading Economics

The USA, UK, and Euro Zone have had several quarters of negative real GDP growth. Currently, the USA has two consecutive quarters of negative growth. The UK has one quarter and the Euro Zone has positive growth but it is low (three quarters below 1%) and had five quarters of negative growth over 2020 and 2021. Arguably, GDP growth indicates the western world is borderline in a recession. Below are the unemployment trends for the USA, UK, and Euro zone for the past 25 years.

Figure 4: 25-Year Trend for Unemployment USA

Source: Trading Economics

Figure 5: 25-Year Trend for Unemployment UK

Source: Trading Economics

Figure 6: 25-Year Trend for Unemployment Euro Zone

Source: Trading Economics

The USA, UK, and Euro Zone have the lowest unemployment rates this century. Unemployment rates this low should indicate high economic activity instead of stagnating economic growth.

Normally for a recession to occur there is reduced demand. Reduced demand reduces economic activity; this reduces real GDP per capita. Reduced economic activity normally results in some firms becoming unprofitable and failing and other firms are forced to reduce costs, which could involve not hiring more people or even releasing some people. Therefore, unemployment increases.

There was reduced demand because of Government policies during Covid-19. Hence, in 2020, GDP decreased (i.e. massive plunge as can be seen in Figures 1 to 3) and unemployment increased. For the UK and Euro Zone, relative to the crash in GDP, the increase in unemployment was fairly mild. Government schemes supported employers so that staff did not need to be laid off. The shutdown of the economy was also only promised to be temporary. As restrictions eased, demand mostly returned. However, supply could not be easily returned to normally. This was further hindered by restrictive Government policies.

We are likely facing a supply-side driven recession. Failures on the supply-side could also led to inflation as costs increase. Therefore, we may have stagflation. What is stagflation? Below are two definitions of stagflation from Investopedia and Business Insider.

Stagflation is an economic cycle characterized by slow growth and a high unemployment rate accompanied by inflation. Economic policymakers find this combination particularly difficult to handle, as attempting to correct one of the factors can exacerbate another (Investopedia)

Stagflation is a combination of the words stagnation and inflation. It describes an economic condition characterized by slow growth and high unemployment (economic stagnation) mixed with rising prices (inflation) (Business Insider)

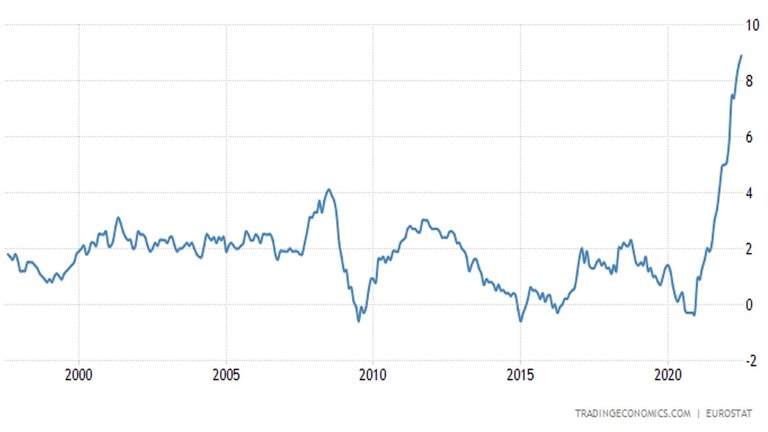

Slow economic growth is apparent based on data from the USA, UK, and Euro Zone. However, high unemployment has not occurred. How about inflation? Below are the inflation trends for the USA, UK, and Euro Zone for the past 25 years based on changes to the Consumer Price Indices (CPI).

Figure 7: Inflation Trends in the USA (1997 – 2022)

Source: Trading Economics

Figure 8: Inflation Trends in the UK (1997 – 2022)

Source: Trading Economics

Figure 9: Inflation Trends in the Euro Zone (1997 – 2022)

Source: Trading Economics

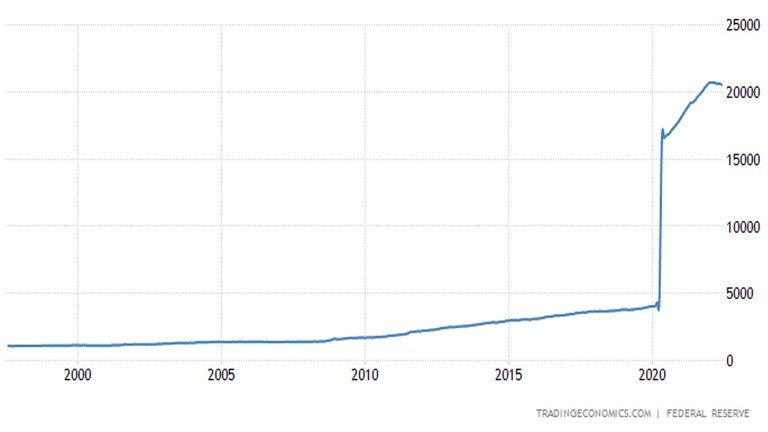

Inflation for the USA, UK, and Euro Zone is the highest it has been this century and appears to be continuing to climb sharply. Supply-side failures could account for some of this inflation. However, much of it is also being caused by the excessive printing of money. Below is the money supply (M1) (i.e. notes and coins in circulation plus travellers checks and demand account balances) for the USA, UK, and Euro Zone for the past 25 years.

Figure 10: Money Supply (M1) for the USA (1997 -2022)

Source: Trading Economics

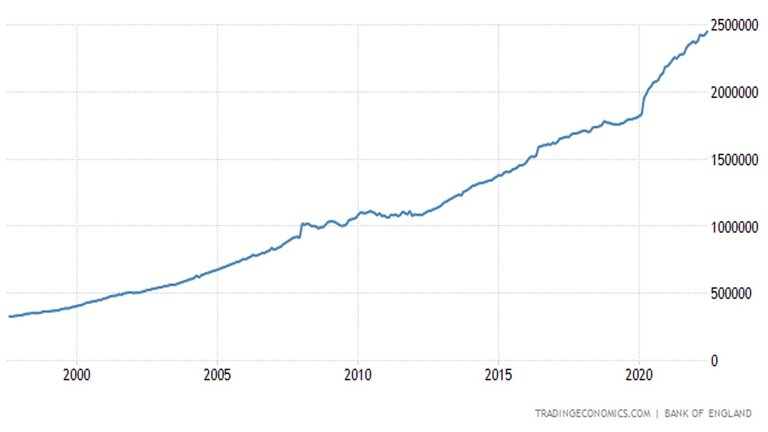

Figure 11: Money Supply (M1) for the UK (1997 -2022)

Source: Trading Economics

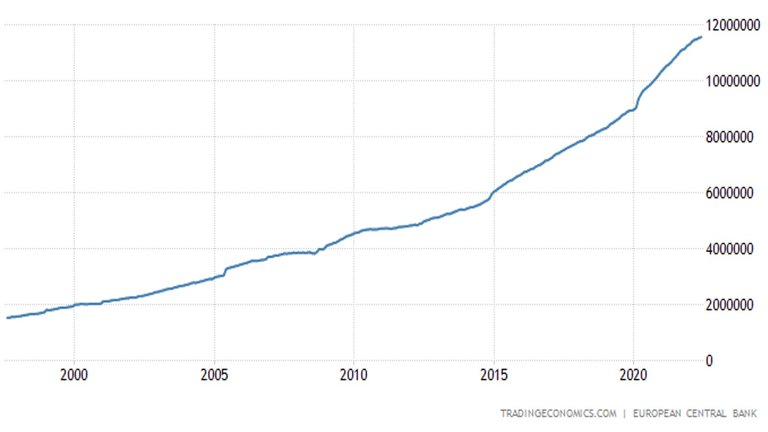

Figure 12: Money Supply (M1) for the Euro Zone (1997 -2022)

Source: Trading Economics

The increase in money supply, USA in particular, was going to inevitably lead to inflation. The reduced demand for goods and services (i.e. reduced velocity of money) during the period of Covid-19 restrictions delayed the impact of the excessive increase in money supply.

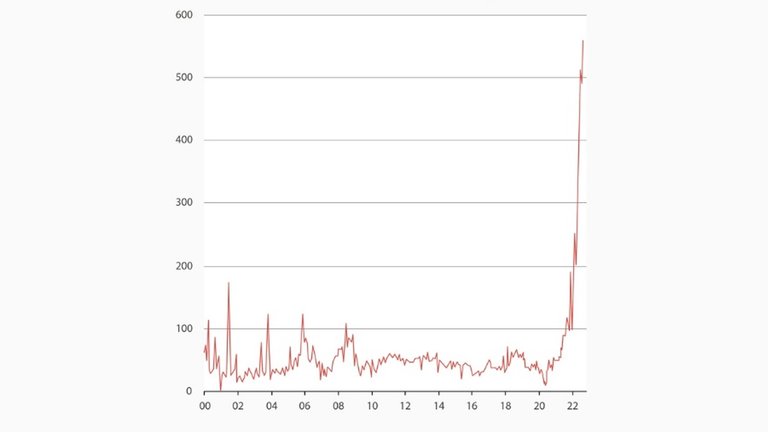

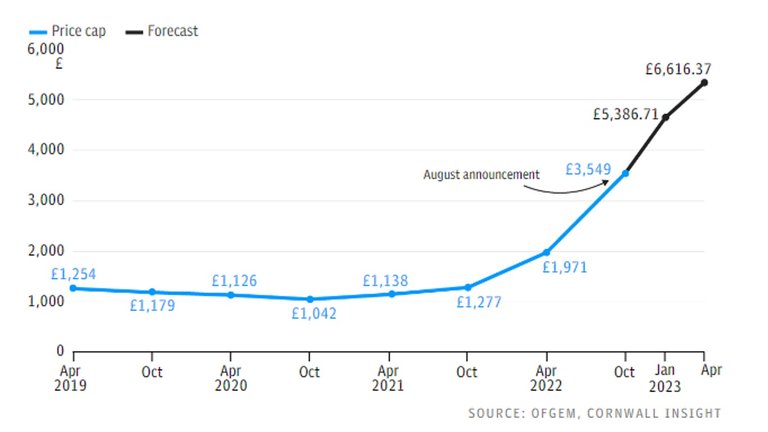

The sanctions placed on Russia, energy in particular, has hastened and magnified the extent of inflation. Below are electricity prices for the Euro Zone and energy caps in the UK

Figure 13: Electricity Prices in the Euro Zone, € per Megawatt hour

Source: Refinitiv cited by RT

Figure 14: UK Energy Price Cap

Source: Telegraph

Note 1: The price is not the actual cost of electricity but a regulated cap based on estimated household consumption of electricity.

Note 2: Price increases in the Euro Zone look considerably worse than the UK because of the x-axis scale.

We should consider the “cost of living crisis” to be both a recession and stagflation. Unemployment figures are very low because of labour shortages linked to Government responses to Covid-19. As businesses begin to fail (mostly small and medium businesses), unemployment will eventually increase.

The “cost of living crisis” has been triggered entirely by Government actions (i.e. lockdowns, Covid-19 regulations, destruction of small businesses, excessive printing of money, sanctions on Russia, and military support for Ukraine). Governments appear to be deliberately destroying their economies. If they continue to do so, the world could be on the verge of complete economic collapse (to be discussed further later in the post).

Why is the crisis causing so much concern for so many people?

In the context of most western countries, we could argue that there has not been a recession since 2010. This would be accurate based on recognised definitions of recession. We could argue that Western countries have also not experienced stagflation any time in recent history. Inflation has been consistently kept below 4%. The western world predominantly experiences booms with a considerably smaller duration in recession or downturn. However, despite the long boom/s, people are finding themselves in financial difficulty very quickly.

Recessions are part of the business cycle. They relate to business success and wealth. They are determined or defined by individual success and wealth. Some people are negatively affected by recessions. Small business owners have less customers; some may be forced to close. Lower economic activity causes some people to lose their jobs. Other people may have pay freezes. Contract workers will receive less jobs; thus, less money. However, most people in most jobs are not directly affected by most recessions. Most large companies survive recessions. They normally benefit from the failure of smaller companies.

Booms are also part of the business cycle. For businesses, they are opposite to recessions. Demand is high, opportunities for success are high. People are spending more but that does not necessarily mean everyone is earning more (opportunity for debt accumulation). Nominal salaries are likely to be increasing but prices are also increasing. This greatly reduces the increase in real income.

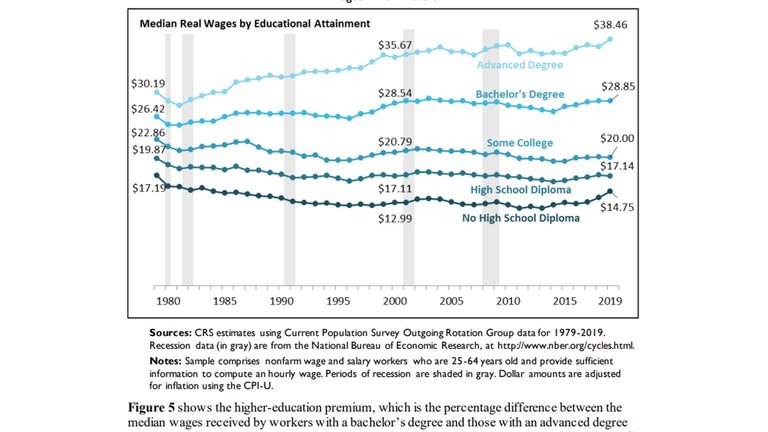

The real impact for many during a boom may not be that different than during a recession. Considering, western economies boom more than they bust (i.e. in recession), the long-run impact on business is positive. Therefore, in the long-run, people should be continuously benefiting from economic growth, even if, for many, the benefit does not closely align with the business cycle. Unfortunately, this has not been the case for most people. Figure 15 contains the growth in real wages for graduate and non-graduates in the USA since 1980.

Figure 15: Real wages for graduates and non-graduates in the USA since 1980.

Source: Congressional Research Service

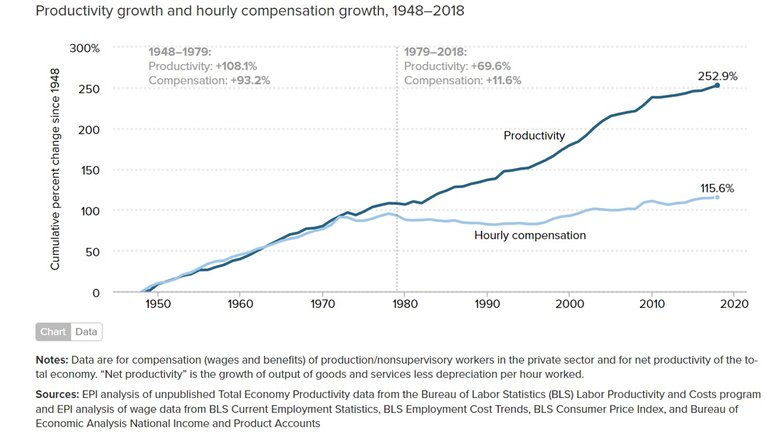

In the USA, since 1980, real wages have barely increased for graduates and have actually fallen for non-graduates. This is because productivity gains are no longer being passed onto the workforce. Figure 16 shows the relationship between real wages and productivity in the USA since 1950.

Figure 16: Productivity Growth and Hourly Compensation in the USA (1950 to 2020)

Source: Economic Policy Institute

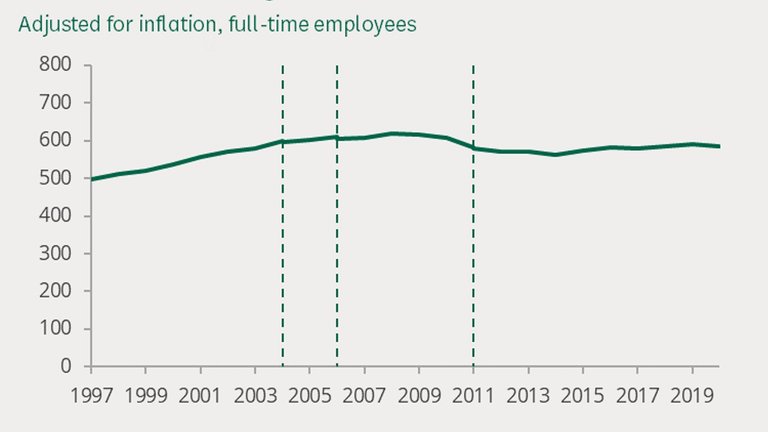

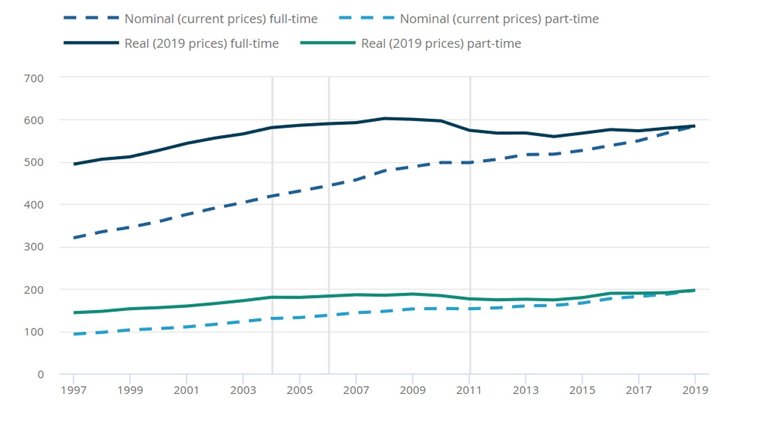

The problem of stagnating real wages is not unique to the USA. The UK has the same problem. Figures 17 and 18 show the changes in real wages from 1997 to 2020 for UK employees.

Figure 17: Real Median Earning UK (1997 – 2020)

Source: Yahoo Finance

Figure 18: Real and nominal wages for part-time and full-time work in the UK (1997 – 2020)

Source: Office of National Statistics

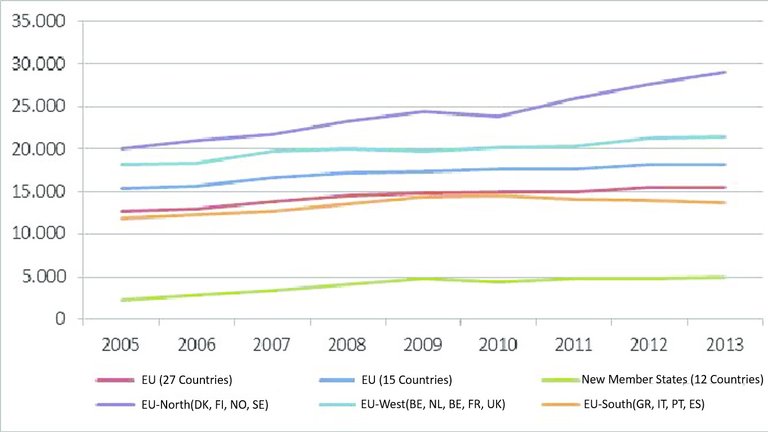

The European Union countries also suffers from stagnation of wages as can be seen in Figure 19.

Figure 19: Median Income (Euro per Year) for various groups of countries within the EU (2005 – 2013)

Source: Reaearchgate

For the USA, UK, and the European Union, real median wages have stagnated throughout recessions and booms. Therefore, offering limited opportunities to improve standard of living or adequately prepare for a crisis that seriously jeopardises real wages (e.g. stagflation).

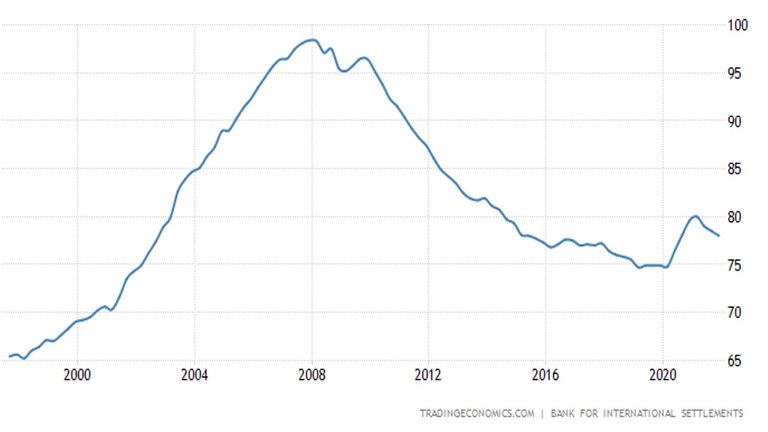

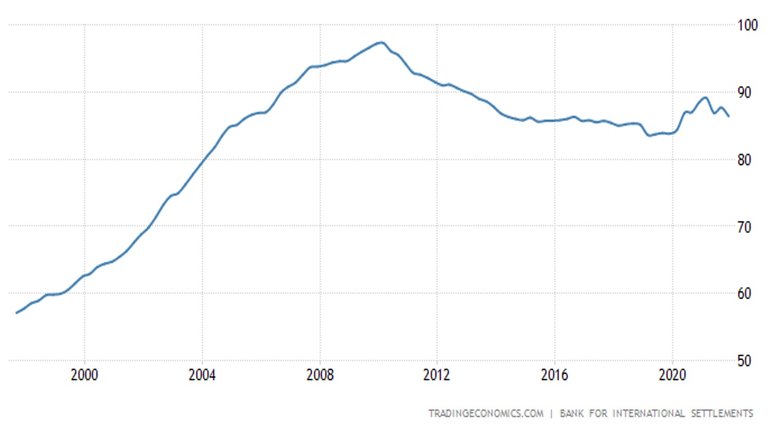

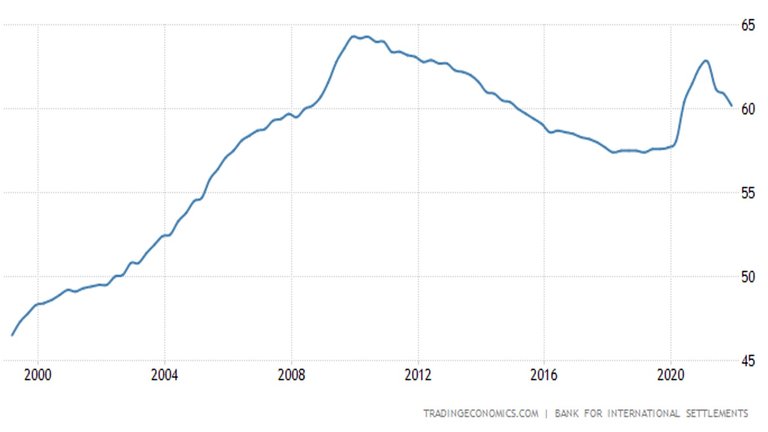

Real wages and income have not been increasing but people still strive for an improved quality of life through higher consumption of goods and services. This has been achieved through debt. Figures 20, 21, and 22 contains the household debt as a percentage of GDP from 1997 to 2022 for the USA, UK, and Euro Zone.

Figure 20: USA Household Debt as a percentage of GDP (1997 – 2022)

Source: Trading Economics

Figure 21: UK Household Debt as a percentage of GDP (1997 – 2022)

Source: Trading Economics

Figure 22: Euro Zone Household Debt as a percentage of GDP (1997 – 2022)

Source: Trading Economics

For the UK and Euro Zone, household debt peaked during the 2008 to 2010 financial crisis and has remained high ever since. For the USA, household debt has fallen as a percentage of GDP but still remains high. For additional context for the USA, see Figure 23

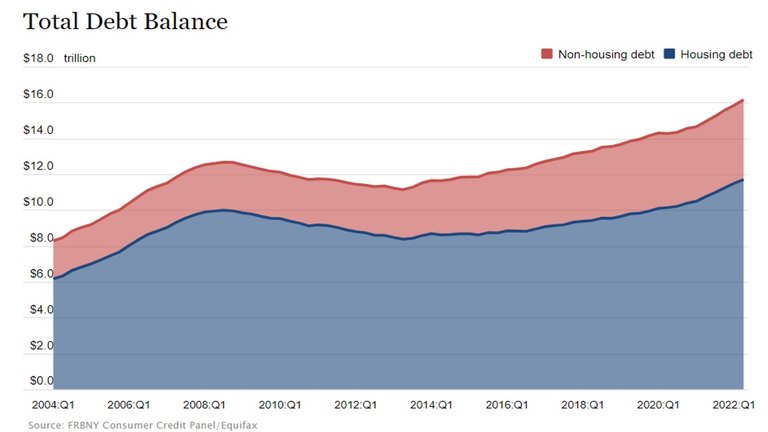

Figure 23: USA Total Household Debt (2004 -2022)

Source: Federal Reserve Bank of New York

The nominal value of household debt is still increasing. This is still a huge burden on the majority of the population who are not experiencing growth in income that aligns with growth in GDP.

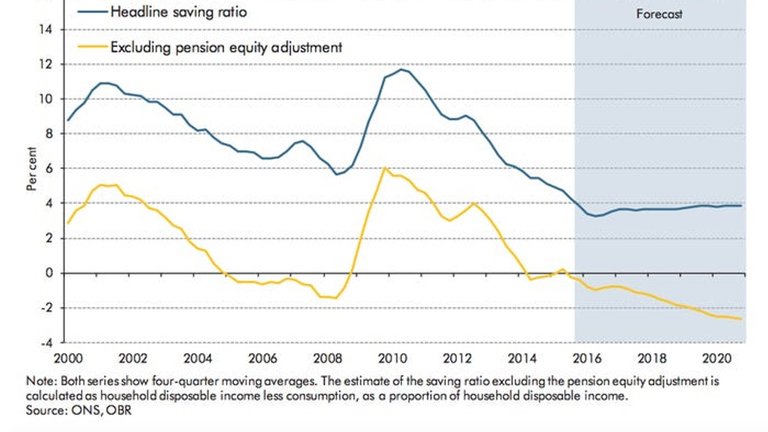

As debt climbs, savings remain low. Figures 24, 25, and 26 contain the household savings rate for the USA, UK, and Euro Zone from 1997 to 2022.

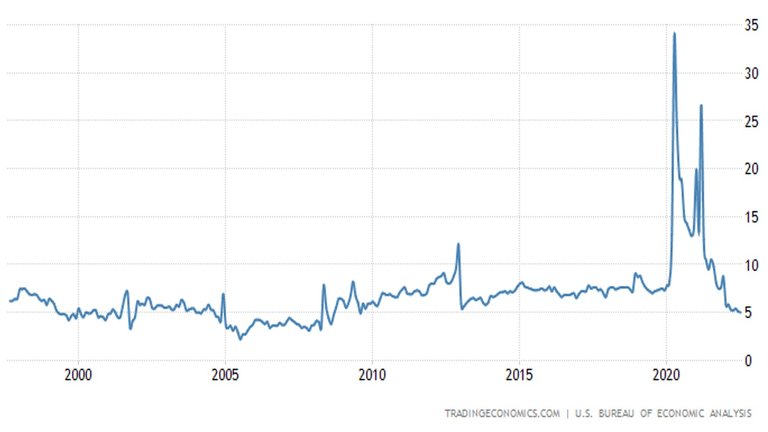

Figure 24: Household Savings Rate in the USA (1997 – 2022)

Source: Trading Economics

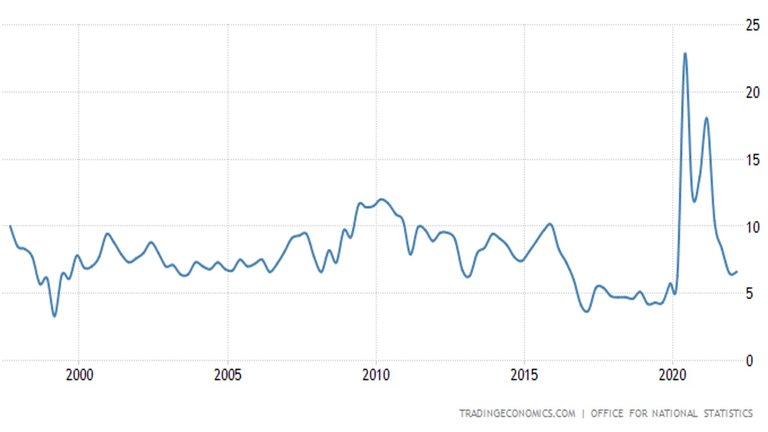

Figure 25: Household Savings Rate in the UK (1997 – 2022)

Source: Trading Economics

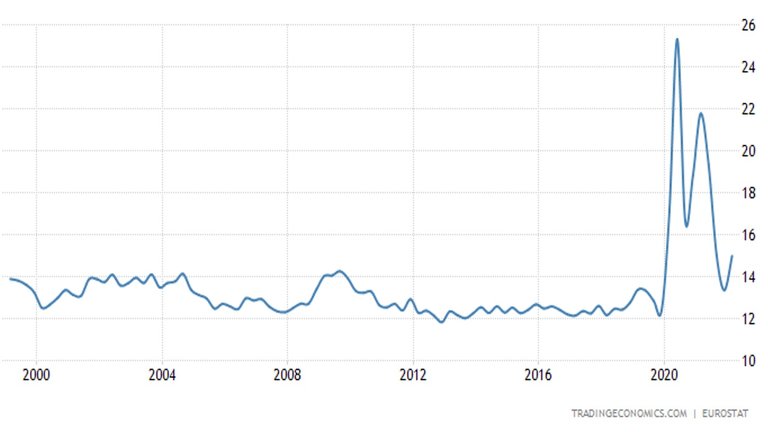

Figure 26: Household Savings Rate in the Euro Zone (1997 – 2022)

Source: Trading Economics

In 2020 and 2021, during the period of strict Covid-19 restrictions, savings briefly increased. Once the economies reopened, savings dropped to their previous low levels. The values included in the above figures also includes pensions. If pensions are removed savings are close to zero and even negative. See Figure 27 for the UK

Figure 27: Household saving in UK with and without pension savings (2000 -2015)

Source: Office for National Statistics cited by Business Insider

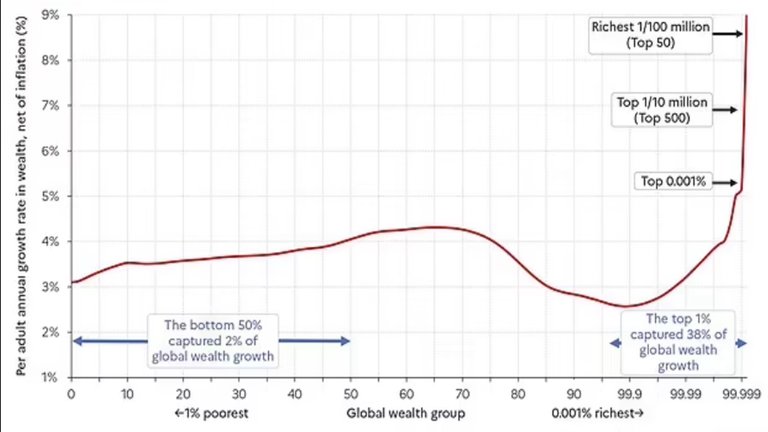

Even when the economy is booming, most people are benefiting very little from the aggregate increase in wealth. Figure 28 displays the increase in wealth across the world from 1995 to 2021.

Figure 28: Average Annual Wealth Growth Rate (1995 – 2021)

Source: Bauluz et al 2021 cited by Daily Mail

Wealth is accumulating to the top 0.001% population of the world. The poorest 50% captured only 2% of wealth created in past 26 years. Booms are for the rich. For everyone else, there is just stagnation. Unfortunately, many people are responding to nominal increases in income. This has led to higher consumption, higher debt and a false sense of wealth.

The current “cost of living crisis” is different from past recessions because of stagflation. People are not struggling because they are unemployed or receiving less work. People are struggling even though they are employed. This is because wages are not sufficient to maintain existing standards of living. This is because people do not have sufficient savings to cover the difference between desired expenditure and earnings. This is because people are not sufficiently prepared for an economic crisis of this nature.

It goes deeper than the current crisis

Understandably, people are unhappy to have less real disposable income. They want their income to increase or to at least cover the higher costs. However, the “cost of living crisis” is not a problem in itself. It is a collection of symptoms from a much bigger and long running problem relating to governance from bad and corrupt Governments. The main reason Governments are bad and corrupt is the political system that creates them (see my posts Raise your hand if you live in a Democracy and Political Systems and Freedom for explanations on how political systems ensure that we have bad and corrupt Governments). However, public focus goes very little beyond the immediate symptoms. In this instance, it is “the cost of living crisis”.

Most aspects of the “cost of living crisis” were easy to predict. In my posts, Covid-19 – Part 6: Expected Social Costs and Covid-19 – Part 8: The road ahead from early 2020, I predicted most aspects of this crisis would occur if Government intervention in Covid-19 persisted. For many countries, intervention persisted in some form for almost two years. Many supply chains were irreversibly damaged and the enormous increase in money supply to compensate for lack of activity has led to the contraction of economies and high inflation. As can be seen from the huge spike in energy prices, the western response to the war in Ukraine has rapidly hastened both economic contraction and inflation. The current “cost of living crisis” has been manufactured by Governments and Big Business and has been aided by fearmongering and propaganda from the mainstream media.

What can be done?

In the UK and in many other countries, people are responding to the crisis by protesting and/or striking. These protests are led and/or organised by trade unions, community groups and politicians. The protestors are demanding higher salaries, increased minimum wages, lower energy bills, and handouts (The Guardian). There is nothing wrong with sending a message that the current crisis is unacceptable. However, this message serves little to no useful purpose if it does not link to the bigger picture. Instead, the demands being made offer, at best, some relief to the symptoms but more likely worsen the problems, which will worsen the symptoms.

There are several areas of concern regarding the demands being made. They are being led by people and groups that are part of the Establishment. The demands they want people to make involve Government intervention, which is the problem that has led to the current crisis. Relying on interventions creates reliance on Government and eventual loss of even more freedoms. Government interventions also require funding. This could involve more creation of money and more inflation or higher taxation and reduced disposable income. Both would prolong the crisis.

Demanding higher wages could be an effective short-run solution for employees. This is because of low unemployment. Currently, businesses cannot easily replace employees because there is a shortage labour. If they cannot replace the striking workforce. They will either pay the existing workforce more money or accept the loss of revenue, which for many large businesses would exceed the additional cost of paying higher wages. However, businesses that provide goods and services with inelastic demand (e.g. provide essential goods and services or in a market with limited competition) will be able to pass the higher costs of the salaries onto their customers through higher prices. Considering these markets are typically dominated by large businesses (see my post Oligopoly – The market structure that does not let the market decide), this will create more inflation. Businesses in more competitive markets will not be able to pass the costs onto their customers. This could lead to business failures and increased unemployment. This would weaken the bargaining position of employees who work in businesses that are able to pass costs onto their customers.

Attacking the “cost of living crisis” directly will not lead to any long-term success. The focus should be on the Government as a whole and the system that brought them to power. In my post What would get me to the ballot box?, I discuss a gradual approach to changing Government by changing the system that puts them in power. The following key areas were discussed in the following order in the post.

- Change voting system (e.g. Condorcet and Borda Count Voting Systems)

- Replace House of Lords (UK Government) with elected representatives

- Reduction in size and power of Central Governments

- Abolish parties and party systems

- Equal opportunity for exposure for candidates

- Reduced role and permanence of representative democracy and positions

Instead of protesting for more Government intervention. People should be protesting for less Government intervention. Instead of demanding a change in Government. People should be demanding changes to the system that guarantees a bad Government. Instead of demanding higher wages. People should be demanding more employment opportunities with a wider range of businesses and companies, which would occur naturally if Governments did not protect Big Business. Instead of demanding low prices. People should be demanding more competition amongst firms, which will naturally lower prices.

People should be demanding a system of governance that is both representative of people’s needs and designed to fulfil these needs. Existing systems will not do this because they cannot do this. The current "cost of living crisis” is a strong example of how every western Government have failed their people. This is not a coincidence, it is by design. People need to demand that the existing systems are replaced. If they are not, any short-term wins through strikes and protests are meaningless as circumstances will become worse. The most likely path we are heading towards is the Great Reset. We need to change that path.

We can find better approaches to problems when we understand their nature and their relationship with their symptoms. This also enables us to tackle the problems at the points where we have the best chances of minimizing harm and most likely to succeed. My post, Causes, Problems, and Symptoms, discusses various approaches to tackling the negative impacts of problems. The post discusses how they can be targeted at different points. My post Prevent, Solve or Manage and supporting series of posts, discusses different strategies to tackle problems at different stages. The prinicples outlined in these two posts can be applied to current problem of bad and corrupt Government and its symptom of the “cost of living crisis”.

Final Thoughts

The current “cost of living crisis” or something similar was inevitable and is occurring now because it has been triggered by recent Government action. The economy and most people are vulnerable because of Government and their relationhip with Big Business (see my post The Masters of Production for a discussion of the relationship between Government and Big Business). Government run businesses are monopolies that control both price of output and wages to employees. Big business have monopoly power (i.e. mostly oligopoly market structures) because of lack of competition and monopsony power as major employers. Therefore, they have considerable control over prices as well as wages. Market forces have a limited role. Therefore, wealth accumulates to Big Business and not to its employees nor its customers.

Data suggests that this accumulation of wealth has been occurring since the 1970s. Any major form of economic crisis that caused disposable income to fall sharply would have extreme and far reaching consequences. Governments’ actions over the past 3 years have triggered this crisis but the magnitude is caused by years of stagnating real growth in income for the majority of the population.

More posts

If you want to read any of my other posts, you can click on the links below. These links will lead you to posts containing my collection of works. These 'Collection of Works' posts have been updated to contain links to the Hive versions of my posts.

Hive: Future of Social Media

Spectrumecons on the Hive blockchain