Hi Everyone,

Decentralisation is a topic frequently raised when cryptocurrencies are discussed. Many in the Hive community take pride in the level of decentralisation that has been achieved since the split from Steem. The biggest and most significant move would have been the inception of Hive and the breakaway from the control of Steemit. In this post, I want to explore how decentralised Hive is when compared to basic criteria. The criteria I am using are outlined below.

- The number of people directly involved in the decision-making process.

- The level of consent given to those making the decisions.

- The extent of transparency of the decision-making process.

- The extent of accountability decision-makers face.

- Diversity of backgrounds, capabilities, experience, etc. of the decision-makers.

- The number of people affected by the decisions made.

- The extent of influence of powerful third parties on decisions and decision-makers.

This post covers some of the history of Hive and why it was created. It looks at how the decision-making operates in various areas such as governance, content, projects, and DApps. Even though, the content in this post is targeted at an audience less familiar to Hive, I believe most of my regular audience will still find it useful.

Hive Decision-making protocol

The Hive blockhain provides us with an interesting example of decentralised decision-making. Hive has two key mechanisms for decision-making. They are delegated proof-of-stake and proof-of-brain.

Delegated proof-of-stake is a decision-making mechanism that is supported by stake (i.e. amount of Hive staked/invested in the blockchain). Accounts that hold a higher stake have more influence on decision-making on the blockchain. They can exert that influence by voting on witnesses (i.e. people responsible for the running, maintaining, and upgrading of the blockchain). They can exert influence by voting on funding for projects that they believe will enhance the blockchain, the community, or the Hive ecosystem in general. These votes are used to distribute funds accumulated in the Decentralised Hive Fund (DHF). These funds are financed from newly created Hive, donations, and reallocation of hardforked Steemit funds (explained in next paragraph).

It all began with Steem

Delegated proof-of-stake does not guarantee decentralisation. In some ways, it ensures some form of centralisation. Hive was created from Steem when Steem was hardforked (i.e. replicated and split from the original blockchain) in March 2020. Steem was hardforked to create Hive because Steemit was threatening to control the Steem blockchain with its excessively large stake (Steemit held over 30% of staked Steem). Stake was being used to nominate all top 20 Steem witnesses (the top 20 witnesses hold the most responsibility for the operating of the blockchain). This gave Steemit complete control over how the blockchain was being run. Most of the Steem community did not agree with this approach. Some of the biggest stakeholders decided to hardfork Steem to create Hive. Most Steem accounts and coins held (staked and liquid) were replicated on the newly created Hive blockchain. The Steemit accounts and a few other accounts and stake were not directly replicated. The coins that would have been replicated to these accounts were placed in a separate development fund (i.e. DHF).

Steemit had been the biggest stakeholder of Steem ever since Steem was conceived. At the beginning, Steemit controlled significantly more than 50% of all Steem in circulation. Many did not consider this a problem and did not believe this would lead to the centralised control of the blockchain. Steem had pledged its stake for development purposes only and claimed they would not use this stake to control governance.

Initially, Steemit did not use its stake for the purpose of direct governance. However, it also used very little of this stake for the purpose of development. They did little to upgrade their application (Steemit), they announced several projects, which were mostly only partly developed (e.g. Smart Media Tokens), upgrades through hardforks were infrequent and offered minimal upgrades, these hardforks were often not adequately tested and resulted in temporary glitches to the system. Steemit were periodically selling Steem to cover their losses; this was putting pressure on the price of Steem causing it to fall significantly in market cap ranking. The Steemit owner (Ned Scott) no longer seemed committed to developing Steemit or Steem. This lack of commitment was confirmed when Ned Scott sold Steemit to Justin Sun.

Justin Sun’s approach to Steemit and Steem differed to that of Ned Scott’s. He had plans to incorporate Steemit and possibly Steem into his other project (Tron). His plans did not align with most of the existing Steem community’s nor most of its existing largest stakeholders’ expectations. However, the excessively large Steem stake controlled by Justin from the acquisition of Steemit would enable him to control the direction of the blockchain completely. The Steem witnesses implemented a softfork (temporary and reversible change to the blockchain protocol) that would prevent Justin Sun from using his stake to control blockchain governance.

The softfork was soon reversed when cryptocurrency exchanges Binance, Huobi and Poloniex staked their clients’ Steem. They used the staked Steem to regain control over the Steem Blockchain by supporting Justin Sun’s controlled witnesses. This enabled Justin Sun to activate Steemit’s stake to support his witnesses. The exchanges withdrew their support of the witnesses and soon started to unstake their Steem (13-week process). The Steem community strongly put their support behind the previous Steem witnesses. This resulted in a deadlock where neither Steemit nor the community had control over the blockchain. A couple of weeks later Hive was launched. Steemit once again had full control of the Steem blockchain and many prominent members of the community unstaked their Steem and left the blockchain for good.

Does Hive have the same problems as Steem?

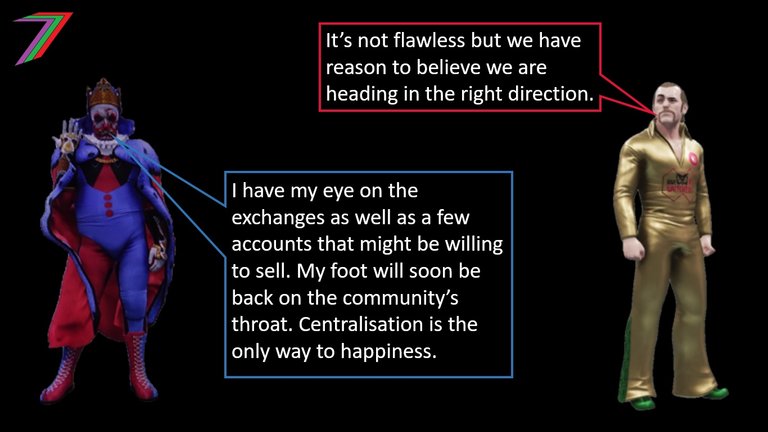

Hive does not have an entity such as Steemit that controls a very high proportion of the staked coins. However, this does not mean that another entity could not acquire huge quantities of Hive. A large percentage of Hive is stored on exchanges (approximately 30% of supply). It would not be too difficult for a wealthy entity to acquire a very large quantity of Hive from the exchanges and then stake this Hive to influence both Hive governance and project funding. A wealthy entity could also acquire several accounts that hold large quantities of Hive. Approximately 50% of all staked Hive belongs to just 40 accounts.

The high quantity of Hive on exchanges is likely because of the increase in price of Hive over the past year. The price of Hive, like all other altcoins (i.e. cryptocurrency that is not Bitcoin) fluctuates dramatically and frequently. This is particularly true when cryptocurrency is in the bullish cycle (approximately 1 year every 4 years). When the price falls or stabilises, the quantity of Hive on exchanges can be expected to fall. People will be less interested in selling Hive when the price is lower and more interested in earning returns from staking.

As Hive moves off exchanges, the percentage of Hive held by the largest accounts is likely to fall. As of mid-2020 (Hardfork 24), newly staked Hive is subject to a 30 day cool down period before it can be used to vote for witnesses and projects. This provides an opportunity for the community to respond if account/s start staking large quantities of Hive.

Hive is gradually becoming more decentralised as newly created Hive is being distributed to more users of the blockchain through the rewards pool. Hive users are rewarded for creating content (e.g. writing blogs, microblogging, uploading videos, and posting photographs), playing games, commenting on content, and voting on content. The method of distributing rewards is called proof-of-brain. Hive stakeholders vote on content using their stake. Each vote has a value based on the stakeholder’s voting strength, which is determined by value of stake, voting mana, and the size of the vote (e.g. 50% of vote). Voting mana is depleted by voting and is naturally restored over time. Downvoting has the opposite effect by removing rewards from content and returning it to the rewards pool. After 7 days, the content creator is paid out 50% of the value of the content in Hive Power and Hive Blockchain Dollars (HBD). The other 50% is paid out to the voters based on the value and timing of their votes.

How Decentralised is Hive?

The extent of decentralisation relies on a number of factors. At the beginning of this post, I outlined seven criteria, which I believe are relevant to determining the extent of decentralisation in general and are particularly relevant to Hive. Determining extent of decentralisation is not a simple task. There are many elements to it.

The criteria described in this post is not definitive in determining decentralisation but offers a guide to different aspects of decentralisation. I hope that my discussion, which involves comparing Hive to these criteria will shed some light on the extent Hive is decentralised in terms of governance and decision-making in general.

The number of people directly involved in the decision-making process

Direct decision-making in regards to running, maintaining, and upgrading of the blockchain is dependent on just 20 witness accounts. This should equate to 20 independent decision-makers but it is possible that one person or company could have several witness accounts. Anyone can create a witness account and become a top 20 witness, if they are supported by a sufficient value of staked Hive.

In terms of projects, anyone can make a proposal for funding. The project is funded if it passes a threshold value of votes. This is also determined by stake weighted voting. Currently, we are likely to see between 10 and 20 projects receiving funding. As Hive grows and the price increases, we are likely to see an increase in the number of projects funded.

In terms of content, anyone can create content on Hive and anyone, who has at least some stake, can contribute to rewarding content. Visibility on most DApps is determined by post value (higher value content gains more exposure) and age (newer content gains more exposure). Anyone is allowed to create DApps that operate on the Hive blockchain and become part of the ecosystem. Most written content is stored directly on the blockchain. The DApps are responsible for the storage of other content such as photographs and videos; links to this content are stored on the blockchain. Written content is protected on the blockchain and cannot be removed.

Hive also has communities. Anyone can start a community and anyone can join a community. Community owners and administration determine the rules of the community and the content permitted in the community. Communities preserve exposure and visibility of content that may have diminished in the main content of a DApp (e.g. some content loses exposure because of downvoting and can become hidden on some DApps, if the post’s value falls to zero; if the content abides by a community’s rules, it will not have diminished visibility in that community).

The level of consent given to those making the decisions

The top 20 witnesses do not require consent from the community regarding the decisions they make. However, witness voting is a perpetually ongoing process. If witnesses make decisions that the community disagree with, the community can remove their supporting votes and possibly push that witness out of a direct decision-making position. Therefore, it is in the best interest of the witnesses to seek consent and approval from the community before they make any major decisions.

Projects on the HDF rely entirely on consent from the community as they only receive funding if they have sufficient stake supporting them. The community, based on the amount of stake they hold, make decisions regarding rewards to content.

The extent of transparency of the decision-making process

All decisions and actions on the blockchain are permanently recorded. This creates complete transparency.

Actions off the blockchain but relating to the blockchain are not necessarily transparent. We do not necessarily know how much money or time goes into a project. Projects do not necessarily need to be open source either. However, the community can insist on updates on progress and are free to remove support from any project that appears to be taking resources with minimal progress.

The extent of accountability decision-makers face

The high level of transparency of the Hive blockchain enables stakeholders to hold decision-makers accountable for their actions, as they are able to observe their actions and behaviour. The ability to add or remove support through voting at any time enables stakeholders to hold, immediately, any decision-maker accountable for his or her actions. These decision-makers include witnesses, project owners, and content creators.

DApp creators and owners can be held accountable for their actions because there are several DApps that can be used interchangeably. Users can easily switch between DApps with no interruption or stoppage of their content (written content and links to videos and photographs are stored on the blockchain).

Diversity of backgrounds, capabilities, experience, etc. of the decision-makers

Users of the Hive Blockchain can choose to remain anonymous. Therefore, it may not be possible to have a complete picture of the backgrounds, capabilities, experience, etc. of all decision-makers. However, stakeholders can judge decision-makers on their actions and their contributions to Hive.

The HDF enables any user to display his or her initiatives, ideas and talents. Unique and valuable projects will have a higher chance of funding.

Anonymity is likely to increase the chances of greater diversity of decision-makers and decisions as users will be judged by contributions rather than preconceived opinions of them.

The number of people affected by the decisions made

Different decisions affect different people in different ways. The decisions that normally have the most impact on the most people relate to the upgrading of the blockchain (e.g. hardforks). Hardforks require a super majority approval from the witnesses (17 out of 20 + 1 (reserve) witnesses). Therefore, if 5 of the top 20 witnesses oppose a hardfork, it will be blocked.

Stakeholders could choose to keep support for the opposing witnesses, thus blocking the hardfork or they could remove support from theses witnesses and replace them with witnesses that support the hardfork. Hardforks can be adjusted until a sufficient number of witnesses agree for it to be implemented. If agreement cannot be obtained, the hardfork could result in the splitting of the blockchain into two (e.g. like what happened with Steem and Hive).

Projects funded by HDF will have a varying impact on the overall community. Some projects might target just a particular audience such as gamers. Some may target the overall community such as increased security around keys (keys allow varying levels of access to different features; e.g. there is a key that enables posting but not transfer of funds) or a marketing campaign. Even if a project targets just a particular group of users, it still may affect all users, if the demand for Hive (coins and tokens) changes.

The number of people affected by decisions depends on the number of people who use Hive and/or invested in Hive. Hive is still a new blockchain/ecosystem but it gained a head start as many of the users previously used the Steem blockchain.

The popularity of Hive has gradually grown from the popularity of some its DApps such as Splinterlands (virtual card game) and the bullish cryptocurrency markets in 2021. The popularity of Hive is expected to continue to grow as people move away from heavily censored mainstream social media and as Web 3.0 (new iteration of the web, which is decentralised, open and built by its users) gains more attention and popularity.

The extent of influence of powerful third parties on decisions and decision-makers

The influence being exerted on Hive’s decision-makers comes from its stakeholders. The level of potential influence increases with stake. If stake is in the hands of a few stakeholders, the influence they could exert can be very strong. This was evident when Steemit used its stake to control the Steem blockchain.

For Hive, approximately 50% of stake is controlled by just 40 accounts. However, it does not appear that any user controls more than 10% of the total stake. This share of stake is insufficient to gain control of the blockchain or guarantee funding to any particular project. However, if the content creators do not pay for promotion, this amount of stake is sufficient to remove exposure of content from the main pages of DApps.

The largest accounts could work together to control the blockchain. However, they would be reducing the value of their own stake if they did so. A key selling point of Hive is decentralisation. The existing large stakeholders have been invested in Hive since inception and have demonstrated commitment to keeping Hive as decentralised as possible. It is unlikely that their position on this will change.

The bigger threat comes from the exchanges. This comes in the form of someone buying excessive quantities of Hive or the exchange choosing to intervene directly by staking their clients Hive. It is rarely in the best interests of an exchange to intervene in a blockchain’s governance. Staking Hive is also very costly. It takes 30 days before the stake can be used to vote on witnesses. In that time, the Hive witnesses would have used a softfork to prevent that stake being used to intervene. Then it takes another 13 weeks to unstake; this would be very unpopular with the exchanges' clients.

The current distribution of Hive is far from ideal. This is most apparent when it comes to voting on content. Many of the same content creators are consistently rewarded the largest share from the rewards pool as the largest stakeholders do not have time to continuously search for new content creators. A much wider distribution of stake would solve this problem, as rewards would more closely align with popularity than the preference of a few users. Hive has several initiatives to remedy this problem. These include OCD and Curangel projects. These projects aim to highlight content from new content creators or content that might be under exposed or rewarded. Some of the communities post and promote content that they wish to gain more exposure and thus more rewards.

Overall view on decentralisation on Hive

It appears the Hive community and stakeholders are committed to increasing the level of decentralisation as much as possible. The transparency, accountability, and the ongoing requirement for consent from stakeholders greatly increases its level of decentralisation. The amount of Hive controlled by exchanges and the amount of stake controlled by just a few users decreases the level of decentralisation of the Hive blockchain. As more users join and more Hive is staked, this will become less of a problem. If the price can stabilise at a high value. For example, increasing the market cap into the billions. A hostile takeover becomes less likely as it will be too costly to do so.

In regards to just 20 top witnesses, this is less of a problem if stake is well distributed. The control from any of the top 20 witnesses is only temporary; votes can be removed at any time.

Increasing the number of top witnesses might be counterproductive. Quick decisions could become harder to coordinate. The quality of the top witnesses could be reduced if less capable witnesses are involved in decision-making. The pay of the top witnesses would also be reduced, as it would be spread over more people (witness rewards are a fixed percentage of newly created Hive). This might cause some of the more capable witnesses to quit. A consistently higher price for Hive might facilitate the expansion of the number of top witnesses as well as attract new talented witnesses.

Overall, Hive is considerably more decentralised than mainstream social media such as Facebook and Twitter. The level of decentralisation appears to be increasing over time, as more Hive is distributed through the rewards pool and when it is sold to new users. The changes made in hardforks often increase the level of decentralisation even further (e.g. communities and 30 day cool down period on new stake). It will be interesting to see how views on decentralisation change when or if Hive becomes considered mainstream.

More posts

If you want to read any of my other posts, you can click on the links below. These links will lead you to posts containing my collection of works. These 'Collection of Works' posts have been updated to contain links to the Hive versions of my posts.

My CBA Udemy Course

The course contains over 10 hours of video, over 60 downloadable resources, over 40 multiple-choice questions, 2 sample case studies, 1 practice CBA, life time access and a certificate on completion. The course is priced at the Tier 1 price of £20. I believe it is frequently available at half-price.

Future of Social Media