Hello SPIers, today talk about HBD. We have saved up a nice amount and ideally, we will be holding much less by the end of this year. What could we do with it?

But 1st!!

For those unaware, the interest paid for HBD savers has dropped to 19%. I dont remember anyone asking me about dropping the interest rate. 19% is still good I guess, its a 5% drop in interest paid out which is not the end of the world. Maybe this is a tester?

I obliviously dont think this is the downfall of HBD, anything over 12% on a stable token is pretty good. On HIVE there are no transaction fees and claiming interest is fast, easy, painless and free. You dont even have to claim it, it'll just auto-claim when you interact with HBD.

I'd take a 12% stable token return on HIVE over a 15% return on BSC or ETH based. Why?, with HBD, interest is paid in HBD and not some stupid farm or gov token that just drops in value. To compound your stable tokens on BSC or ETH, you need to convert the reward token into a stable token, and then either create an LP token or stake it directly. Lots of fees, lots of maintenance, lots of chances to make a mistake.

SPI's HBD

We've been saving HBD for a long time, a few years now and we've built up over 13k in total. I'd guess around 7-8k of this came from BSC defi liquidations during the first half of 2022, half of content rewards for the past 2 years and of course our 20% interest payment each month. This year alone, we will earn 2500 HBD in interest. Oh wait, i mean 2375 HBD 😢

In under 5 years, we have in HBD alone what we raised from selling SPI tokens during 2019/20 until the HIVE hardfork. The cherry on top is HBD is only about 10% of the total fund so we've had alot of growth since launch, at least in terms of dollars.

What's the Plan?

Depends really on what happens with HIVEs price.

#1

HIVE is currently 29 cent and if think it drops to 25 cent, i would have to convert around 8k HBD into HIVE. It takes 3 days to unstake HBD so there always the risk that HIVE tanks and recovers over the next 2-3 days and to be honest, this is often the case. This would get around 32k HIVE all the same. We'd hold onto 5k HBD for things during 2025, things that are probally not even released yet.

#2

If HIVE never see 25 cents are under again, during the second half of the year, around August, we can buy into 2-3 different cryptos. These will most likely be new tokens. New tokens that have not seen a bullrun yet but are already in the top 100. Things like Optimism, Immutable, Arbitrum, Mantle, Quant and about 10 more we can look at, the list will be larger in 7-8 months as new replaces the old. The same plan is to spend around 8-9k HBD and hold back 5k for 2025.

I would love to see HIVE drop to 25 cents, to be honest. I know thats not the right attitude but I'd like to get us 30k of HIVE from 8k HBD. More importantly, the BTC to HIVE ratio would fall and we'd get a further 200k HIVE for 1 BTC 🤯 What would we do with all that HIVE? Use half to boost HIVE income/dividends and delegate the other half to eds-vote to stockpile some EDS for SPI.

Nothing fancy are complicated, by the end of this year, we'll know which of the 2 scenarios works out for us. As said above, it all depends on what HIVE does over the next few months.

What are your thoughts on the HBD interest change?

What do you think about this recent HBD interest change? Do you think it's a tester? the first of many? How far do you think it could go? but most importantly, what would your exit APY? How low would it have to go before you pull out?

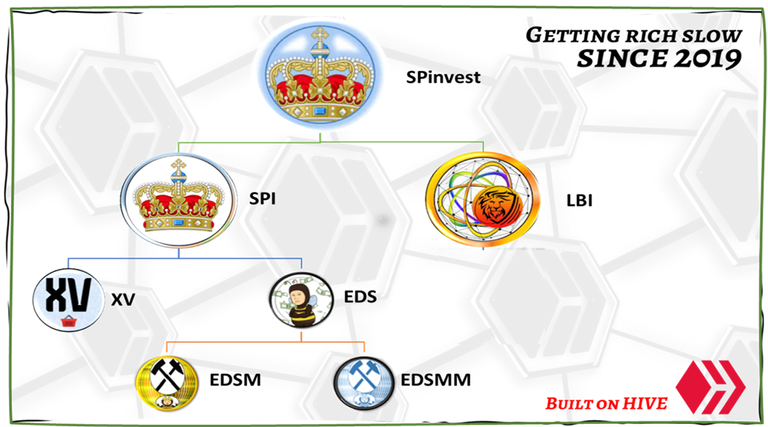

| Token Name | Main Account | Link to hive-engine |

|---|---|---|

| SPI token | @spinvest | SPI |

| LBI token | @lbi-token | LBI |

| Top XV token | @spinvest | XV |

| Eddie Earners | @eddie-earner | EDS |

| EDS miners | @eddie-earner | EDSM |

| EDS mini miners | @eddie-earner | EDSMM |

| DAB | @dailydab | DAB |

| DBOND | @dailydab | DBOND |

Stay up to date with investments, and fund stats and find out more about SPinvest in our discord server