Hello SPIers,

Over the past few months, several people have asked why the SPI APY is so low, under 5%. Today, we'll delve into the SPI dividend.

First, it's important to remember that SPI is a growth token. I would not hesitate to cut dividends if I believed the HIVE would be better invested elsewhere. The dividends are essentially a small weekly payout to reassure you that we're still active.

Understanding the SPI Dividend APY

The dividend APY shown in each week's report is based on that week's SPI token price/fund value. The ROI you receive from the SPI dividend depends on when you invested and the amount you invested.

Calculating the SPI Dividend

The formula for the SPI dividend APY is straightforward:

(dividend amount * 52.18)/Fund Value=APY

346 HIVE ∗ 52.18 weeks / 528,200 HIVE fund value = 3.4 (Based on the last report)

- If you bought SPI tokens at today's price of 5.70 HIVE, your dividend ROI would be 3.4%.

- If you bought SPI for 2.85 HIVE, half of today's price, your dividend ROI based on your investment would be 6.8%.

It seems simple, if you bought SPI for 1 HIVE each during SPI's first year, you might think your APY is 3.4% * 5.7 = 19.38%. However, this calculation overlooks two key factors:

- Between September 2020 and March 2022, dividends were paid in SPI tokens.

- On December 29, 2019, the token was split at a ratio of 5/1 (own 5, get 1).

To calculate the total SPI paid and airdropped, we issued 9000 SPI as dividends over 17 months, averaging 121 SPI tokens per week, which equals about 9.6% of the total supply. The token split post shows we minted 17,240 SPI, equal to 20% of the supply at the time.

Here is an approximate breakdown of the APY based on investment:

(BOI = Based on Investment)

| Price You Paid | Divs + Split | Multiplier | APY BOI | ROI BOI |

|---|---|---|---|---|

| 1 STEEM during 2019 | 20% + 10% | 1.3 | 25.2% | 7.4x |

| 1 STEEM/HIVE during 2020 | 10% | 1.1 | 21.3% | 6.3x |

| 1 HIVE during and after 2022 | 19.4% | 5.7x | ||

| 2 HIVE | 9.7% | 2.9x | ||

| 3 HIVE | 6.5% | 1.9x | ||

| 4 HIVE | 4.9% | 1.4x | ||

| 5 HIVE | 3.9% | 1.1x |

The table above should give you a better idea of your APY based on your investment amount and timing.

- During 2019: You received both the token split and SPI dividends, effectively paying 0.77 HIVE per SPI you hold, with an ROI multiplier of 1.3.

- During 2020: You received SPI dividends, effectively paying 0.91 HIVE per SPI you hold, with an ROI multiplier of 1.1.

- 2022 onwards: You can calculate your APY by dividing today's price by the price you paid and then multiplying the result by the last reported dividend APY (3.4%).

Example:

If you paid 2.5 HIVE for your SPI, and today's SPI price is 5.7 HIVE with a last reported dividend APY of 3.4%, you divide 5.7 by 2.5 to get 2.3. Multiplying 3.4% by 2.3 gives you a dividend APY of 7.8%.

Why is This Important?

Most will see the weekly report with a 3.4% dividend and think it's crap. However, many SPI token holders have been holding for a long time, particularly since 2019 and this post is aimed at these holders.

It's important to understand that holding SPI for a long time can pay off big time. Those who bought back on STEEM are getting 3.4% based on today's price but that is 7.4x more they bought in for and are really getting back 25% of the amount they invested. In 5 more years, these investors might be receiving more each year from dividends than they invested.

Knowing your investment's returns is crucial. While the current dividend APY is important, it will likely decline over time as the fund grows. For example, if the fund value doubles and our HIVE income remains the same, the APY will halve. This does not mean less HIVE is being paid out per SPI token held, it just means the APY is lower based on the amount paid out vs fund value. This is important to understand.

You give a non-SPI example.

- We bought 500 INCOME at 8.2 HIVE each for 4100 HIVE

- The token price today is 13 HIVE and our 500 is worth 6500 HIVE

- We receive 7.98 HIVE per week as income payments, 416 per year

- INCOME's APY is 6.41% based on the current token value of 13 HIVE

- Our INCOME APY is 10.13% based on the amount we invested at 8.2 HIVE each

There is no shortcut to high ROI's, you have to start low, wait for growth and then the higher ROI come. I'll take 5% on ETH over a farm token paying out 100% every day of the week. It's a quality-over-quantity thing.

To finish up

Understanding the SPI dividend and its APY is crucial for appreciating your investment's true value. While the current APY might appear low, it's essential to consider what your APY is based on what you invested and the long-term benefits and the impact of past dividends and token splits. This knowledge empowers you to make informed decisions and recognize the substantial returns long-term SPI holders enjoy.

It's never too late to jump in because in another 5 years, we'll have a token worth over 20-30 HIVE and I'll be rewriting this post to show how OG SPI holders are now recovering more each year as dividends than they invested. Thanks for taking the time to check out the post.

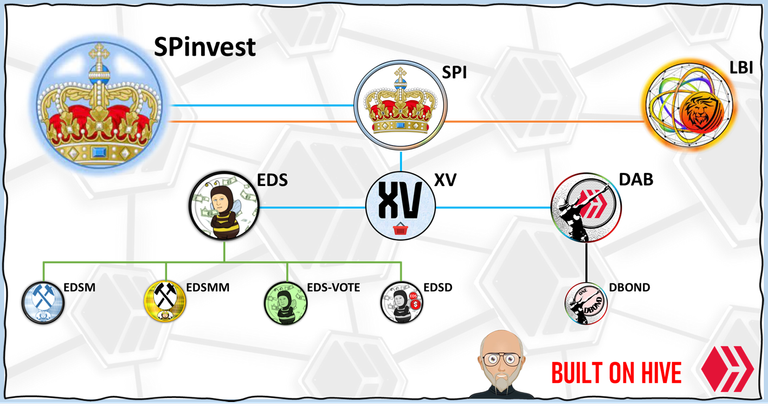

Getting Rich Slowly from June 2019

| Token Name | Main Account | Link to hive-engine |

|---|---|---|

| SPI token | @spinvest | SPI |

| LBI token | @lbi-token | LBI |

| Top XV token | @spinvest | XV |

| Eddie Earners | @eddie-earner | EDS |

| EDS miners | @eddie-earner | EDSM |

| EDS mini miners | @eddie-earner | EDSMM |

| DAB | @dailydab | DAB |

| DBOND | @dailydab | DBOND |

Stay up to date with investments, and fund stats and find out more about SPinvest in our discord server