Welcome to the weekly SPI Report

Each Sunday, @spinvest uploads an earnings and holdings report to keep investors up to date with fund performance and news. You can subscribe to these weekly reports in the comments.

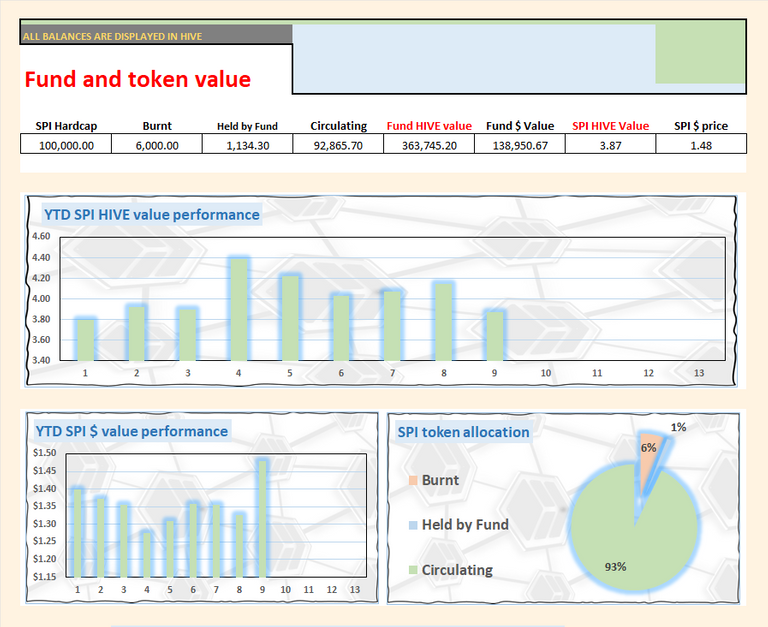

SPI is the flagship growth token for the SPinvest fund. Launched in June 2019. SPI tokens act as both a token of ownership and a governance token. Since launch, we've been able to 7x the HIVE value (including revaluations and token split) and 12x the dollar value of the fund.

We are now in our 5th year of operation and still going strong as we stick to our plan of investing the bulk of our holdings into time-served investments and HODL.

Our motto is = Getting Rich Slow

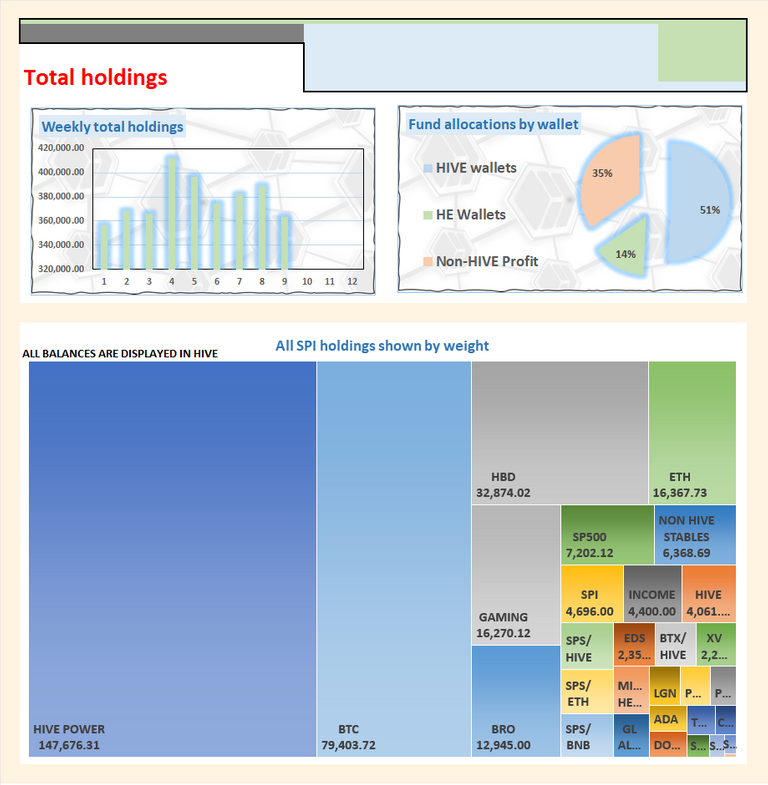

In our expansive portfolio, we are involved in over 30 investments, with a significant portion dedicated to HIVE, BTC, and ETH. We firmly believe in avoiding impulsive actions driven by the fear of missing out or chasing unattainable aspirations. Instead, we rely on tried and tested strategies that have proven to be the most effective and secure.

Our guiding principle is to accumulate wealth steadily, adhering to the philosophy of "Get rich slowly." We employ the power of compounding by consistently reinvesting in sound opportunities to amplify our returns over time.

When considering SPI tokens, it is essential to adopt a long-term perspective, aiming to hold them for a minimum of 3-5 years. Our rationale behind this recommendation lies in the belief that substantial returns require patience and allowing investments to mature organically. By committing to an extended investment horizon, you significantly increase the probability of maximizing your potential gains. This aligns perfectly with our overall investment philosophy and strategy, ensuring sustainable growth and profitability in the long run.

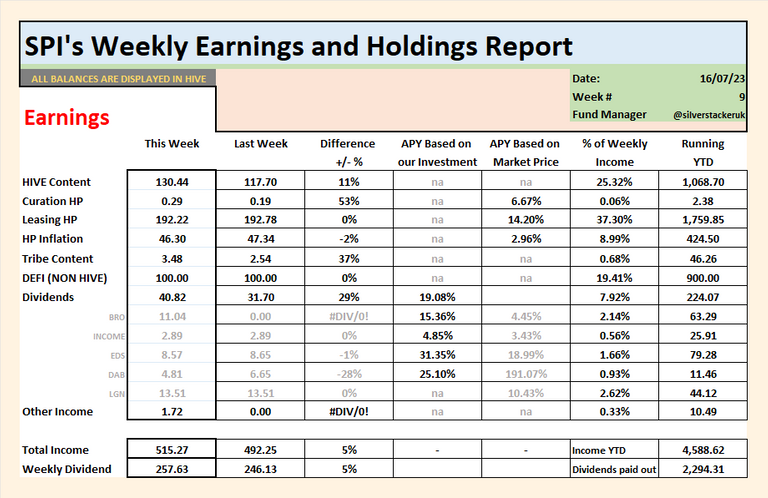

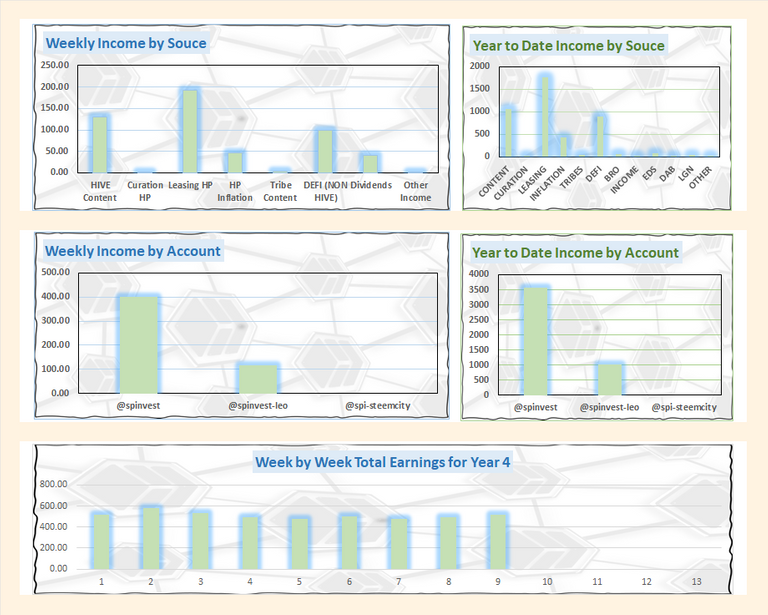

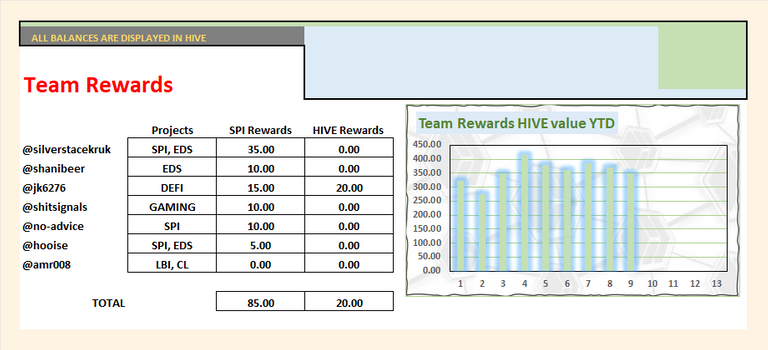

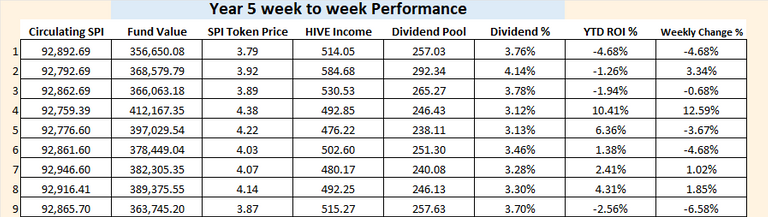

Earnings this week are up from last week but not by much. Good news I was able to double our INCOME holdings which will not do much for our earnings but we will see that double going forward. We got 100 HIVE from JK6276 this week as per normal and everything is about the same. Leasing is still king for us followed by HIVE content.

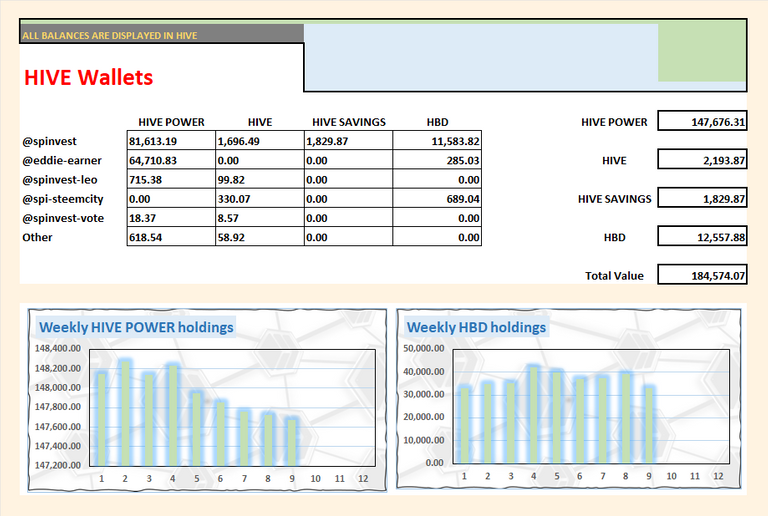

The HIVE POWER balance is still dropping by around 100 HIVE per due to the EDS set-up. This is something that will fingers crossed, reverse in a few more months as @edsvote gets stronger, picks up more HP delegations and provides EDS with bigger power-downs.

HBD wallet this week took a hit because the price of HIVE increased by 15-20% this past week. We are still targeting this wallet to be worth around 60k HIVE before converting it into HIVE. For those that are interested, the HIVE we get from converting HBD will most likely end up with EDSvote to help support that project.

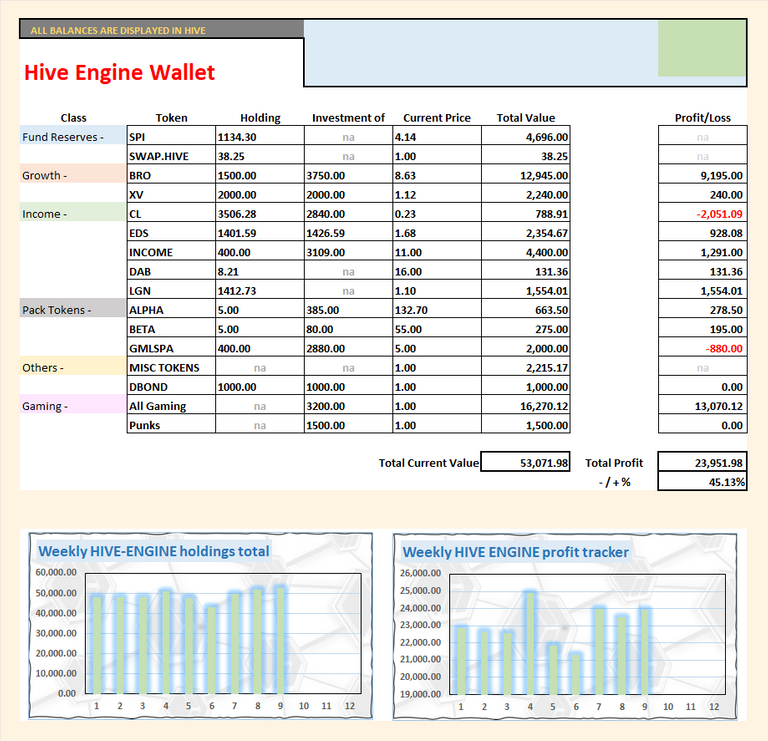

As said above, we doubled our bag of INCOME tokens. I was able to buy via a private off-market deal of 200 INCOME for 750 BUSD which worked out at 10 HIVE per token. These are currently priced at 11 HIVE so insta paper profit for us.

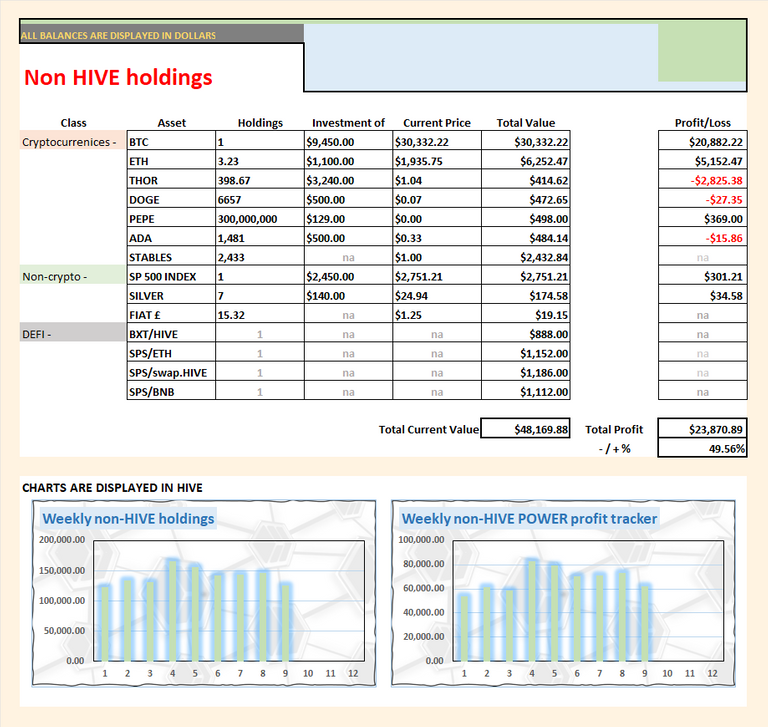

Not much changes in our non-HIVE wallet this week. Im holding with no plans to buy/sell anything and JK6276 is running our defi holdings so i have little to report.

I do notice that the SP500 is up over 10% from when we invested. This has outperformed our investments into ADA and DOGE which were bought at the same time.

The fund this week has lost over 25k in HIVE value this week because HIVE is up 15-20% for the week while the rest of our holdings are up a few per cent. I hate to see the HIVE value go down but I do love to see the dollar value increase. I can take it either way, to be honest, and when HIVE is dumping hard, im happy to see the HIVE value increase.

Looking out, I still see the crypto market as being in a bear market. I know that sounds stupid because of all the decent hype around Blackrock and XRP but this news will be long forgotten in a few short months time. Does anyone remember 2019 the crypto market pump of Bakkt launching Bitcoin futures? What about Libra from Facebook that pumped the markets and turned them into nothing? China started to talk about CBDCs are ETH's Istanbul upgrade. No, dont remember.

Blackrock applying for a BTC ETF is amazing news because they have an excellent track record of getting things approved but this do not mean, we'll see a BTC EFT from Blackrock anytime soon, it'll take 3-5 years before we see an actual product being released so crypto pumping now is very premature and very much hype.

When we look at the crypto market over a 5-8 year chart, we are pretty much on par with past market cycles. SPI bought up most of its BTC in late 2019, or early 2020 when it was priced at under $10k which was half its ATH in 2017 and today with BTC at $30k, we are in the same spot.

Forget what's happening in the daily/weekly news, it means very little in the grand scheme of things. We are not day trading at SPI and long-term investing is our focus so thinking out 2-6 years ahead and ignoring the FUD or FOMO is key. Why risk the biscuit for the crumbs?

The next big move from SPI will be to either convert its HBD balance into HIVE or convert its BTC into HIVE. We are looking at at least 60k HIVE for our HBD and at least 250k HIVE for 1 BTC. I have been planning the HBD into HIVE trade for nearly 2 years and the BTC into HIVE trade for around 18 months and dont expect to pull the trigger on either for at least another 12-18 months.

As always, we move forward and take each week as it comes. Seeing the fund swing 5% in a week is massive but in crypto, it's kinda normal. Looking back I always thought as SPI grew, its swings would get smaller but hey, that crypto baby!!

Dividends will go out this evening and as always have a great Sunday folks.

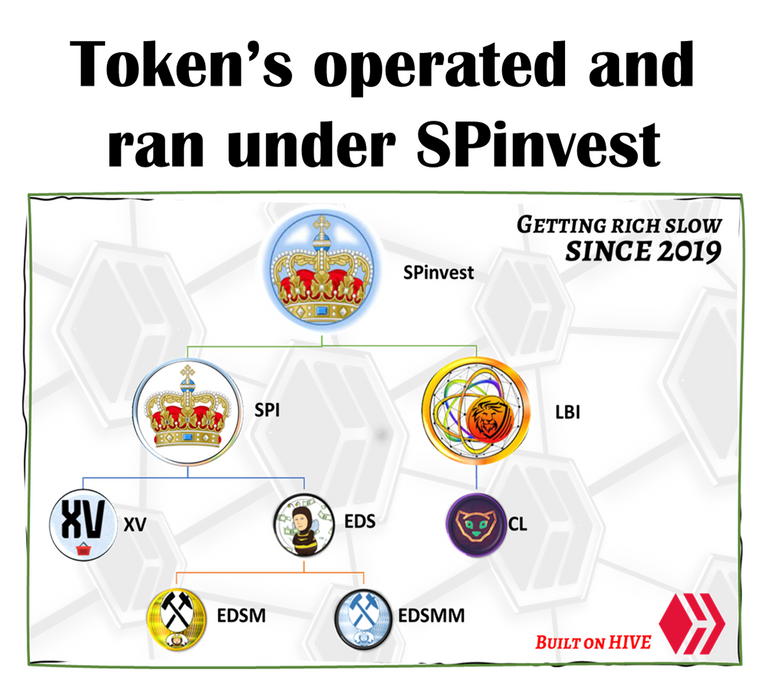

Links to all projects under SPinvest

| Token Name | Main Account | Link to hive-engine |

|---|---|---|

| SPI token | @spinvest | SPI |

| LBI token | @lbi-token | LBI |

| Top XV token | @spinvest | XV |

| Eddie Earners | @eddie-earner | EDS |

| EDS mini miners | @eddie-earner | EDSM |

| EDS micro miners | @eddie-earner | EDSMM |

| CUBlife | @lbi-token | CL |

Stay up to date with investments, fund stats and find out more about SPinvest in our discord server

Tag @spinvest to a comment below saying "I wanna Subscribe" and I will tag you in future SPI weekly reports.

Sub List:-