Welcome to the weekly SPI Report

Each Sunday, @spinvest uploads an earnings and holdings report to keep investors up to date with fund performance and news. You can subscribe to these weekly reports in the comments.

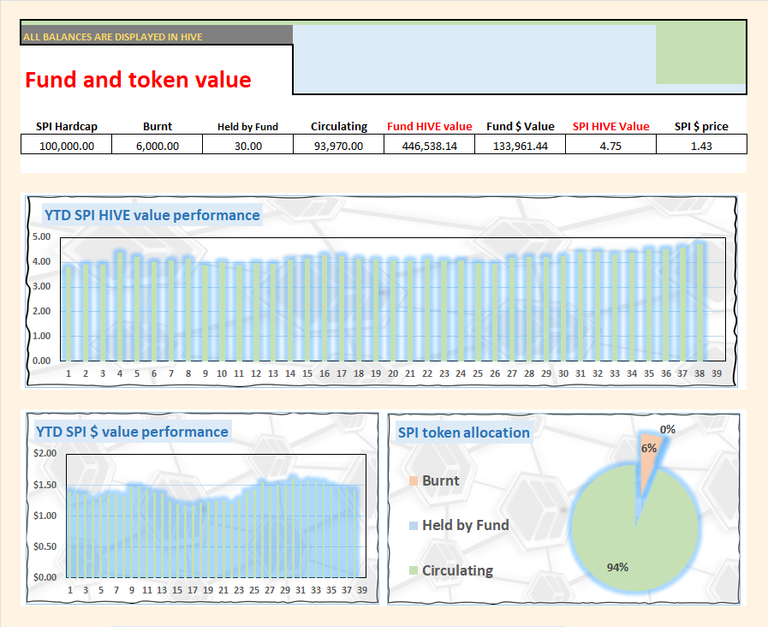

SPI is the flagship growth token for the SPinvest fund. Launched in June 2019. SPI tokens act as both a token of ownership and a governance token. Since launch, we've been able to 7x the HIVE value (including revaluations and token split) and 12x the dollar value of the fund.

We are now in our 5th year of operation and still going strong as we stick to our plan of investing the bulk of our holdings into time-served investments and HODL.

Our motto is = Getting Rich Slow

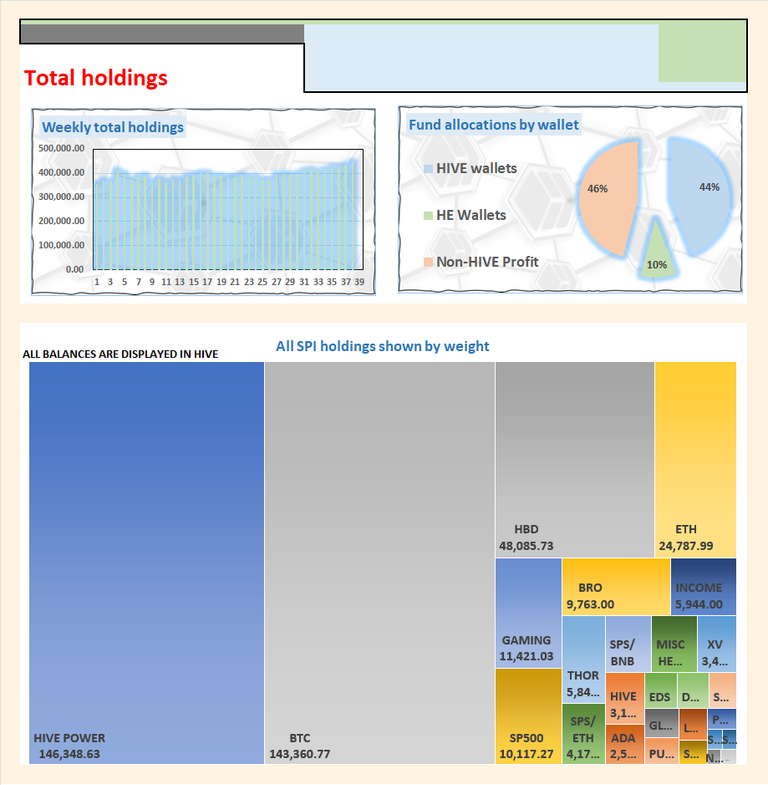

In our expansive portfolio, we are involved in over 30 investments, with a significant portion dedicated to HIVE, BTC, and ETH. We firmly believe in avoiding impulsive actions driven by the fear of missing out or chasing unattainable aspirations. Instead, we rely on tried and tested strategies that have proven to be the most effective and secure.

Our guiding principle is to accumulate wealth steadily, adhering to the philosophy of "Get rich slowly." We employ the power of compounding by consistently reinvesting in sound opportunities to amplify our returns over time.

When considering SPI tokens, it is essential to adopt a long-term perspective, aiming to hold them for a minimum of 3-5 years. Our rationale behind this recommendation lies in the belief that substantial returns require patience and allowing investments to mature organically. By committing to an extended investment horizon, you significantly increase the probability of maximizing your potential gains. This aligns perfectly with our overall investment philosophy and strategy, ensuring sustainable growth and profitability in the long run.

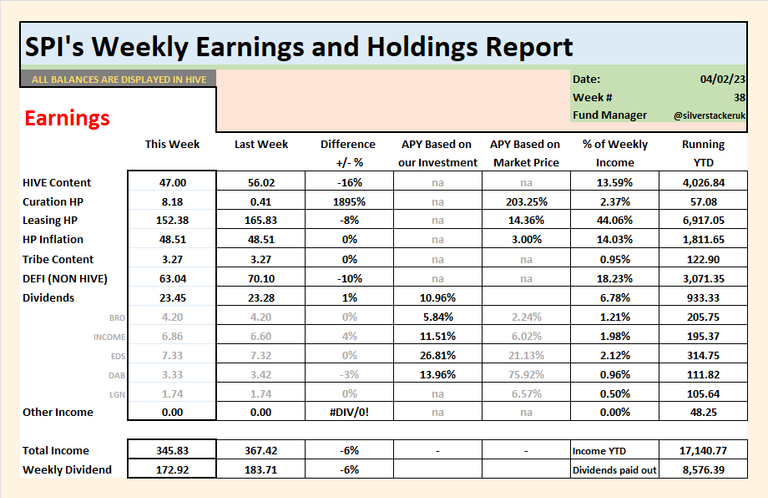

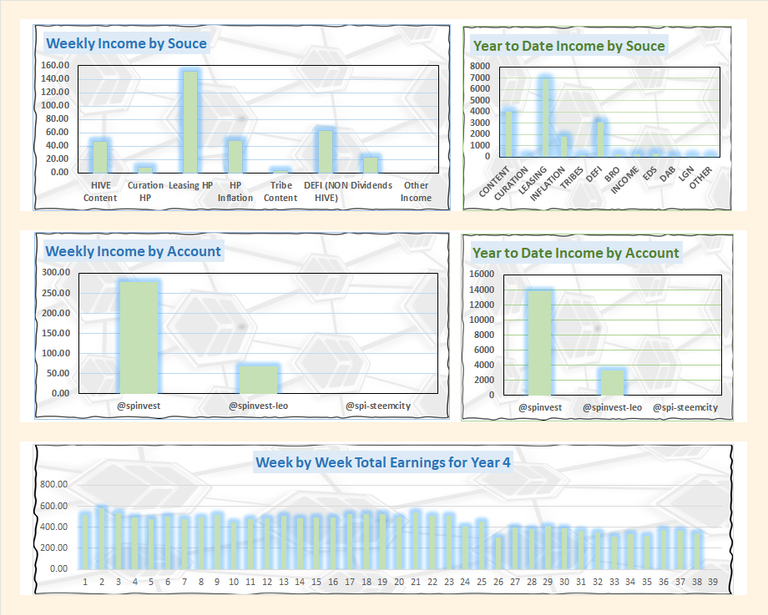

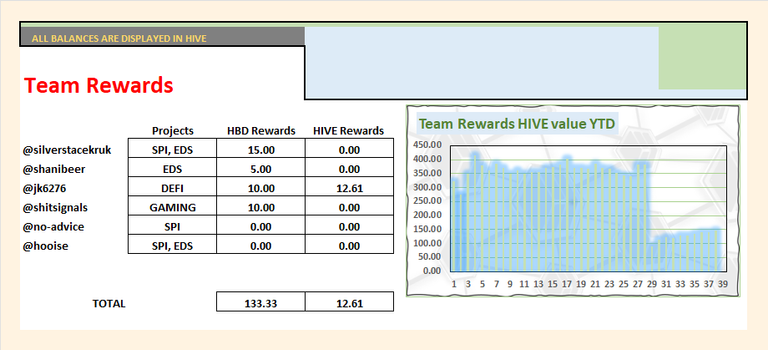

In a bit of a rush this week. Earnings were not good and below average for 2 reasons. Last week, we put out 5 posts so content rewards were down and leo.voter missed payments so bummer. Can't do anything about leo.voter but for the content part, Fri and Sat are days when I have no set thing to write about which means I need to think of something that means i dont post all the time.

I remember back @metzli used to write weekly posts about different HE tokens. I think I would like to be that back because it would keep me on top of all the new things being released. Leave that one with me, i might start that from this Friday and people can use the comments to suggest what HE token to do the following week.

Earnings this week are so so, fingers crossed next week will be better.

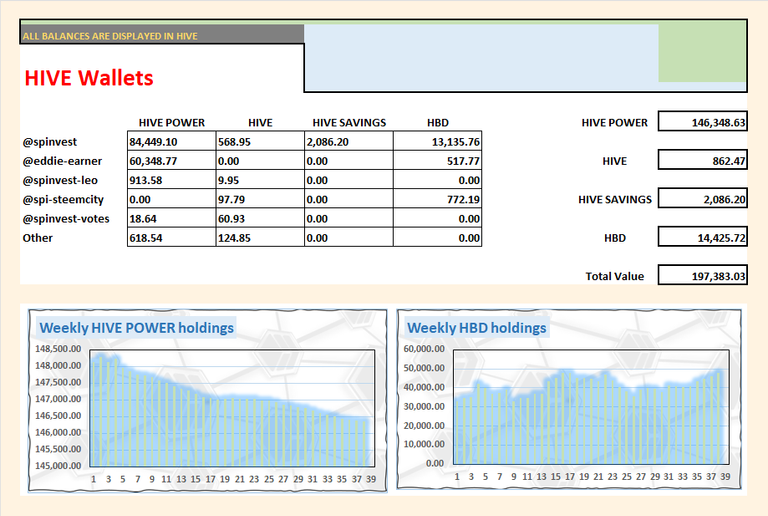

We see a very small decline of 20 HP this week. EDS will be starting a new bigger powerdown this week so in 2 weeks we should get this to break even to grow every week. Our HBD balance has been doing well as a hedge against HIVE declining some. We could see HIVE drop back to 25 cents over the coming months, we need to remember HIVE is a small ALT token and will see 80% of its price growth in a 4-5 week window toward the end of the bull market. If we see 25 cents, im converting all our HBD into HIVE because HIVE is not dropping to 20 cents and 25 cents would be a bargain, a steal.

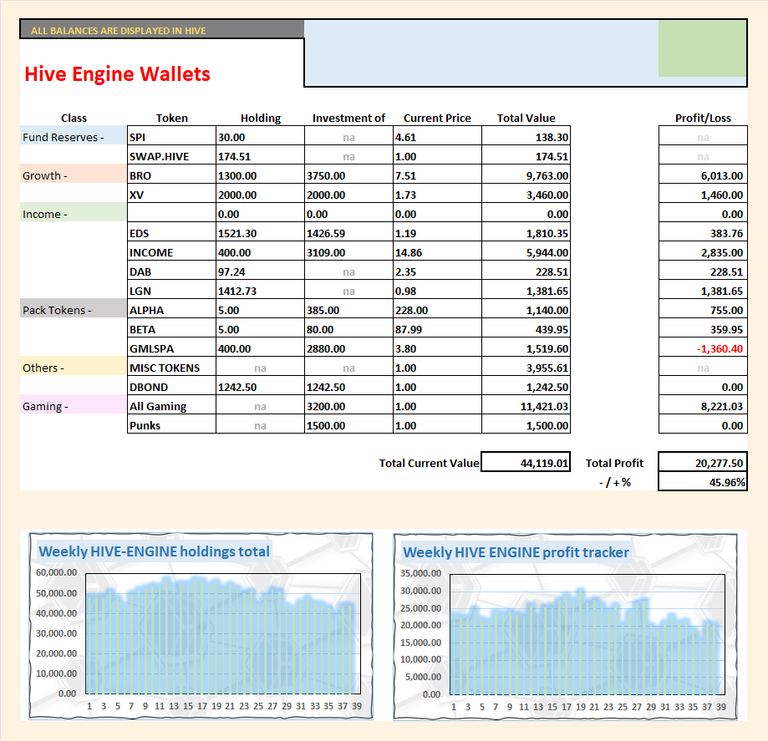

We added a few more DBONDs to our stash. It's not earning us alot but everything counts and they are pegged to 1 HIVE each so we cant lose. We added a few EDS as well from delegating HP to @eds-vote. They say dont get high on your own supply but rules are made for breaking.

Gaming made a small comeback, actually gaming remained the same in dollar value and HIVE dropped 1-2 cents from last week. Not much change in everything else, ALPHA and BETA tokens remain the same price and GMLSPA dropped some which was expected because it was high last week. Just HODLing.

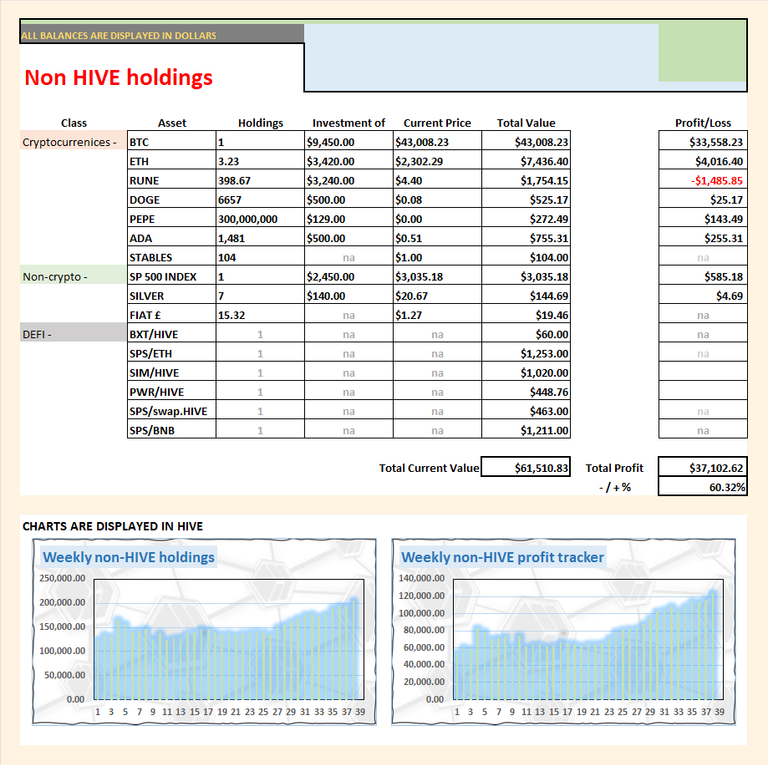

Our non-HIVE holdings this week were a mixed bag. Some things up, some down. For some reason, the SP500 continues to pump and our holdings our worth over $3k for the first time. BTC and ETH did ok this week but the rest, not so good. Most are down only a few percent so not so bad.

This week the BTC to HIVE ratio is 1 BTC to 143k HIVE. I've been talking about this for a few months already and I highlight it each week as we aim to convert 1 BTC into 200k HIVE. I started to talk and make updates from when the ratio was around 1 BTC to 100k HIVE. If BTC outperforms HIVE over the coming week, it will become our biggest single asset. This has happened before during the last cycle so it's nothing to worry about. BTC leads the bullrun and it will 2-3x while HIVE is going sideways to down. BTC 1 year ago was $22k and HIVE was $0.50. This trend will continue and I believe the spread between BTC and HIVE will get wider and we'll get 200k HIVE for 1 BTC. We'll kick ourselves when it goes to 250k HIVE to 1 BTC and then in 2 years we'll not care when its 50k HIVE are under for 1 BTC 🤑 Hello, 2 BTC and 100k worth HIVE converted to HBD 🚀 Hello, big dividends more like 🥳

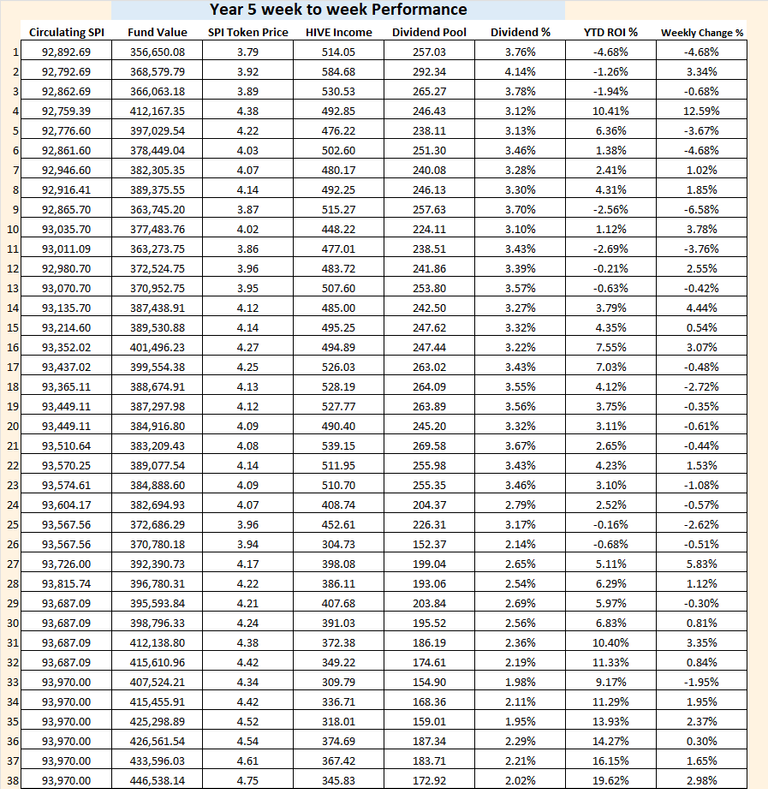

The numbers are looking good this week. The fund is up 2% and we are just shy of our yearly 20% growth target. Each SPI token is valued at 4.75 HIVE. I dont want to keep talking about BTC but last cycle, BTC massively boosted the SPI price as it mooned and HIVE declined to 10 cent after its hardfork and a huge dump from the Steemy Justin Sun fanboys. We're kinda seeing this repeat again this cycle.

EDS is performing well for us and it's so close to the point where it'll be creating more income than its minting EDS tokens. We sitting on a 60k paper profit so losing 50-100 HIVE a week, 50-100 paper HIVE a week is not that painful. I hope by 2025, EDS will be in the green assuming both @eds-vote and EDSD tokens see continued growth.

I will add in @dailydab at some point but for now, it's a small part of SPI but it is making a profit each week because it does not have DBOND miner token. We currently make 60ish HIVE a week from it and have around 1400 HIVE in profit to date. It's small potatoes for now but it's currently selling out its last batch of DBOND tokens, only 4k remaining and then it'll start to see higher growth. Im not going into too much detail but DBOND are a little like EDS, they are both backed and pegged to 1 HIVE and they both pay out an HIVE income but they do it in different ways.

Aside from those 2 things, thats the update for this week. I thinking the markets going to down sideways for a few more weeks and then start to climb again. I dont see the crypto markets dropping too much again, they might and we can never really know. We just have to HODL and go along with the ride.

Have a great week, dividends will go out this evening.

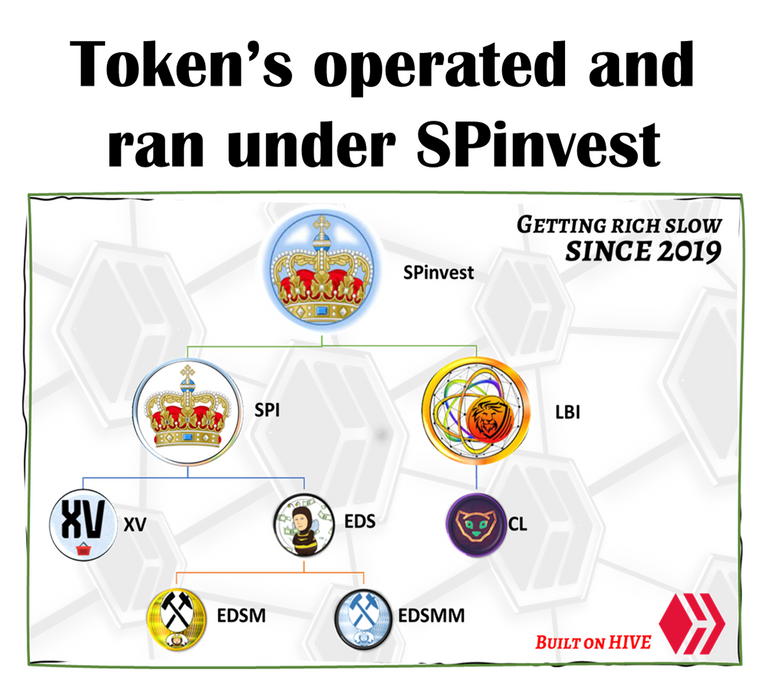

Links to all projects under SPinvest

| Token Name | Main Account | Link to hive-engine |

|---|---|---|

| SPI token | @spinvest | SPI |

| LBI token | @lbi-token | LBI |

| Top XV token | @spinvest | XV |

| Eddie Earners | @eddie-earner | EDS |

| EDS mini miners | @eddie-earner | EDSM |

| EDS micro miners | @eddie-earner | EDSMM |

| DAB | @dailydab | DAB |

| DBOND | @dailydab | DBOND |

Stay up to date with investments, fund stats and find out more about SPinvest in our discord server

Tag @spinvest to a comment below saying "I wanna Subscribe" and I will tag you in future SPI weekly reports.

Sub List:-

@ericburgoyne, @mikezillo, @shanibeer, @oldmans, @roger5120, @lilolns19, @riandeuk