Dear All,

yesterday I was participating at the Austrian Blockchain Conference. It was a whole day event, focussing on the social, financial and technical aspects of DLTs (digital ledger technologies) aka blockchains. The event was actually part of the Vienna Blockchain Week 2024 with other similar events dealing with NFTs, Web3 and innovative blockchain projects from 17th to 20th June, but since I didn´t want to take vacation, I sneaked only to the finance part of the Tuesday´s event.

https://www.eventbrite.at/e/austrian-blockchain-conference-tickets-881814610237

The venue was the Vienna University of Economics, an architectonic masterpiece which I have already featured in this post extensively.

In the breaks there was plenty room for networking.

"Crypto stamp" by the Austrian Post was apparently one of the sponsors (the event was free of charge).

Also food was enough provided, to not let the participants starve.

But what was discussed?

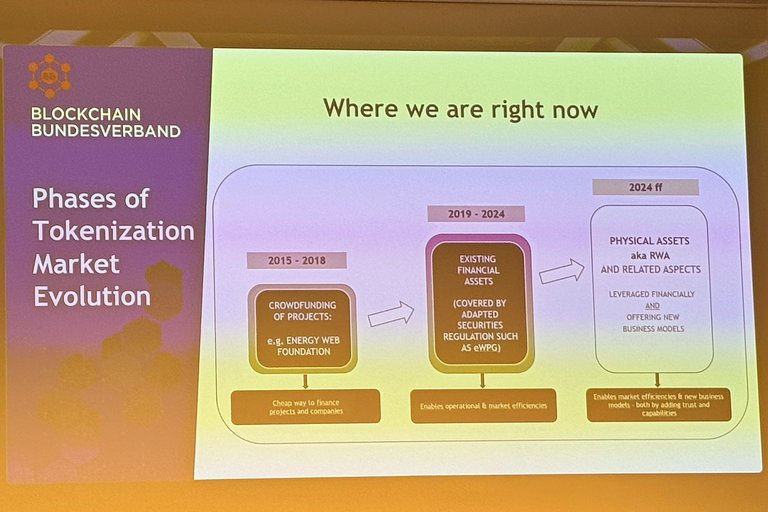

Sebastian Becker, head of the German Blockchain Association gave a historical background of the German blockchain landscape, it´s limitations and it´s opportunities for the next years.

He specifically sees growth in the tokenization of real estate, energy solutions and IP rights & licenses.

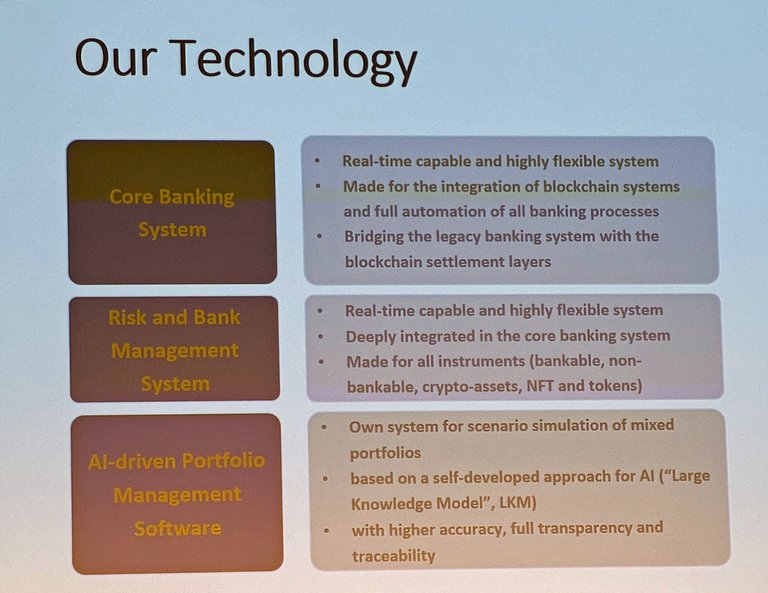

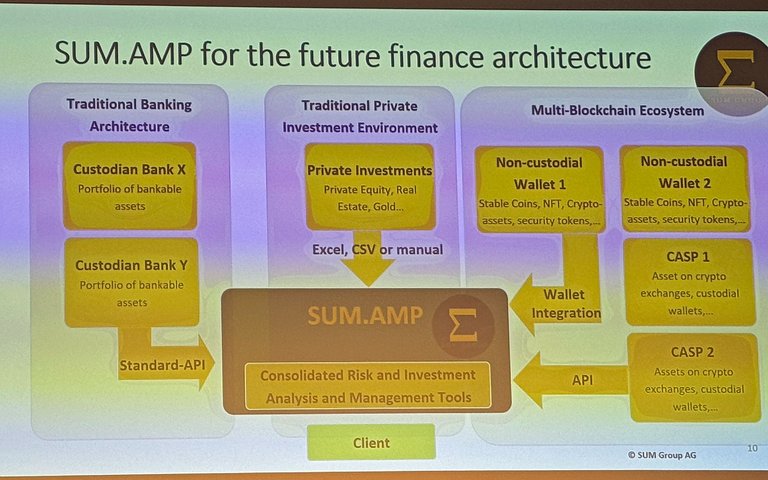

Next was Thomas Dünser, CEO and founder of the SUM group, a bank startup with some very innovative features (for a bank).

However, apart from the marketing-like speech, I didn´t agree with his estimation, that the "digital Euro" (apparently he meant a CBDC) is a pre-requirement for any truly innovative bank in Europe that can fully integrate DLT.

At least he showed how complex it is to start up a bank that fully integrates blockchains, given all the (over)regulation in Europe.

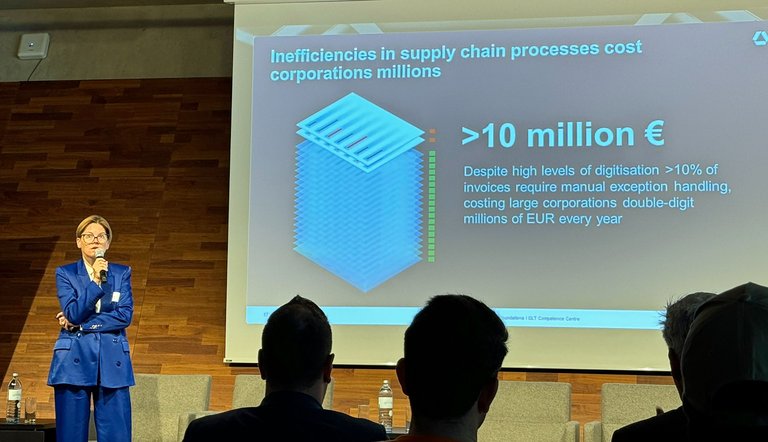

Then Leona Blehová from the German Commerzbank gave a lecture on how this large commercial bank is deploying DLT in improving logistics and removing inefficiencies using smart contracts and tokenization of deposits.

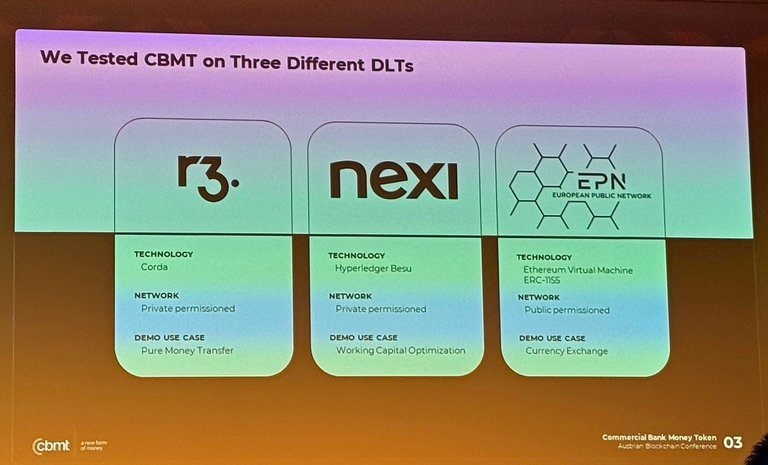

The final speaker was the only tech guy of the session and he spoke about the testing and implementation of Commercial Bank Money Tokens (CBMT) via 3 different systems, one being apparently an ETH second layer.

CMBTs are a kind of CBDCs, but issued by private banks and a digital means to represent tokenized book money, but more seamlessy convertible and fungible across banks and freely exchangeable with central bank money. I didn´t get it fully, maybe the guy wasn´t explaining it well. You can read more about them here.

Summary:

There were 4 keynote speakers and most of them held lectures about how (commercial) banks are trying to embrace blockchain and get fit for future. The good thing is that DLTs are here to stay. Even if no mass adoption yet, companies are eager to get a hold on this technologies and try to integrate it in many ways. In a break I spoke also with a guy from another finance startup who confirmed this view. Will this be also for the advantage of us end users, this is another question (I would doubt it).

Of note, in contrast to most retail blockchain conferences, social media, countless X-spaces, "influencer"´s videos and threadcasts where it is all about decentralization and hailing DLTs for empowering the masses, there was not a single word about this aspect! DeFi was not a topic at all.

Maybe it is good to once get out of the echo chamber we are in, to see how blockchain is seen from people in real life and from people near the money (i.e. banks). At least from this event I got the impression, that blockchain is just a tool for them but not the solution for everything!

Posted Using InLeo Alpha