We cannot expect ourself to be wealthy mere earning and sitting quitely. To be wealthy and financial independent we should need to look out for financial planning that help us to multiply our earning. "Money makes money", this is what taught to me pretty early in life. Thanks to this smart suggestion I always try to plan out things as far as money is concerned. It may relate to investing in stocks, spending in luxuries, buying real estate. The scope of financial decision varies from individuals to individuals. In my case it was my decision to invest in crypto that is proving to much beneficial in current scenarios.

(own edited image)

I am highly obliged to #Hive (previously steem) for letting me create a portfolio in crypto market. Completelly unaware about this Digital economy, it gives me a solid foundation for future. Financial decisions are choices made by individuals or an entity about how to manage their financial resources. These decisions can affect an individual's or company's financial performance and stability in longer period of time.

Financially focused.

Being an individual my financial decision revolves around investment into differrnt asset classes. Belonging from unorthodox indian family, we always relied on tradional so called investment option, like fixed depositis, saving account and government schemes. Some financial decisions for individuals like me include:

Budgeting : A key tool for financial success, budgeting helps people understand their income and expenses, and make informed decisions. It helps people prioritize spending, save for the future, and identify areas to cut costs.

Psychological biases : Behavioral finance teaches that psychological biases can significantly impact financial decision-making. One example is present bias, which is the tendency to prioritize immediate gratification over long-term goals. This can lead to sub-optimal financial decisions like overspending and relying on credit.

Personal circumstances : Personal circumstances that influence financial thinking include family structure, health, career choice, and age. For example, family structure and health affect income needs and risk tolerance, while career choice affects income and wealth accumulation.

Investing into ETH.

Before, I was introduced to crypto sphere, I was mostly involved in Investing into the common financing option that many indian relied upon. But once I was introduced to steem / #Hive platform, I understand the need to switch my investment to the digital economy. I undertood the little insights of crypto economy. But I do not have any holding, but gradually, I started investing through steem earning. When we were shifting to #Hive, I found an oppurtunity to invest all my steem earning into creating a crypto portfolio. I bought some #eth with steem rewards when the prices was $700. Now looking back I must say, it was a smart move as prices has multiplied much more than expectation. I had the option to withdraw but I choosed to Invest and I am not regretting at all. I have now build a mild portfolio in crypto. And the returns is unexpectedly higher than the stereotypes investing option.

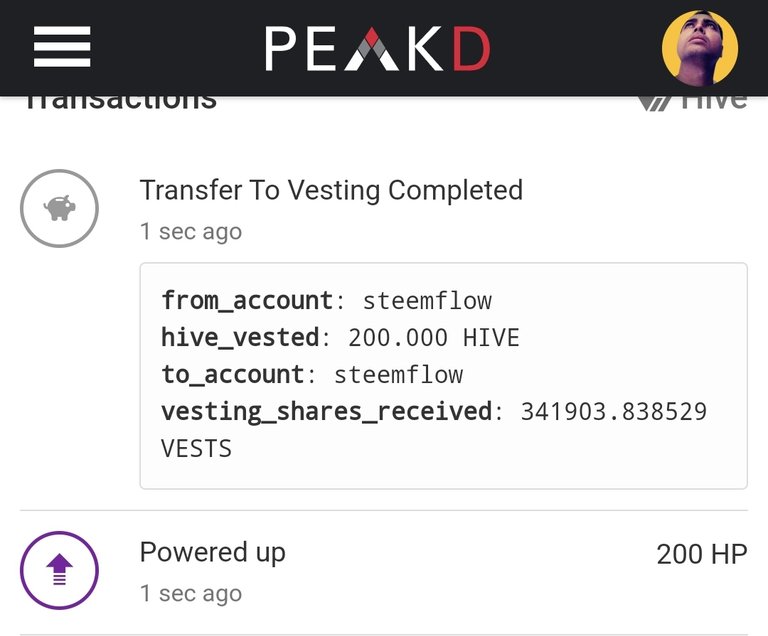

September HPUD

Lately, #hive given me some strong financial support in my life. I have full faith on the platform to last long and help every stakeholder to create an unforseen amount of wealth. On the #hpud I have powered up with 200 Hive.

This is my entry into Day-1 of "September Inleo Writing g prompt". Check here for more details.

Peace!!

Namaste @steemflow

Posted Using InLeo Alpha

)

)