Binance Smart Chain (BSC) was launched in September 2020 by Binance, the largest cryptocurrency exchange by trading volume. The chain supports the creation of smart contracts and is compatible with the Ethereum Virtual Machine (EVM), allowing Ethereum-based applications to migrate seamlessly.

BSC uses a consensus mechanism known as Proof of Staked Authority (PoSA), combining Delegated Proof of Stake (DPoS) and Proof of Authority (PoA). This hybrid model enables fast block times and low transaction fees, making BSC an attractive option for decentralized finance (DeFi) projects and non-fungible tokens (NFTs).

Despite its rapid growth and adoption, BSC has faced criticisms regarding centralization due to the limited number of validators, all of whom are selected by Binance.

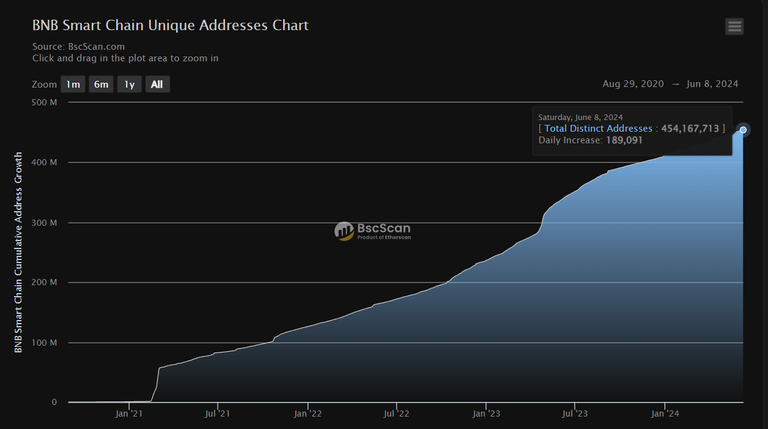

Number of Wallets

BSC boasts over 400 million unique wallet addresses. This substantial growth underscores the chain’s widespread adoption and usage across various applications, from DeFi to gaming and NFTs. The ease of creating wallets and the low transaction fees have significantly contributed to this growth.

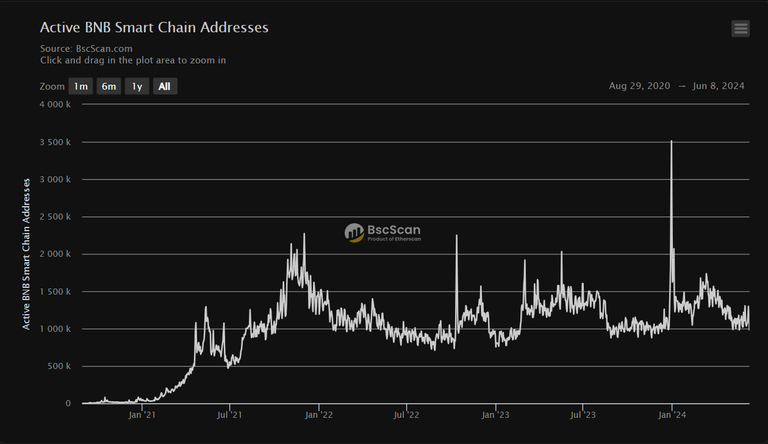

Active Addresses

BSC's active addresses have seen significant fluctuations, mirroring broader market trends and the popularity of specific applications. Currently, there are about 1.8 million daily active addresses, reflecting a healthy level of engagement within the BSC ecosystem. This metric highlights the continuous user activity and interaction with BSC-based applications.

Daily Transactions and Volume

BSC is renowned for its high transaction throughput, capable of processing millions of transactions per day. As now, the network handles approximately 4 million daily transactions, with a daily trading volume exceeding $3.5 billion. This high activity level is largely driven by decentralized exchanges (DEXs), DeFi protocols, and gaming applications that require frequent microtransactions.

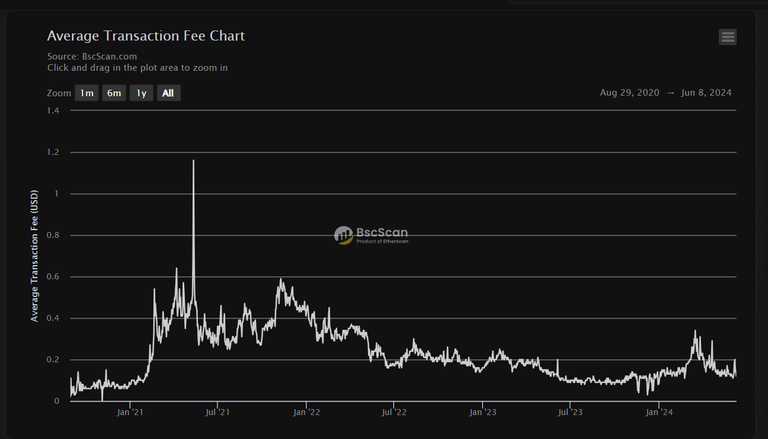

Fees

One of BSC’s major advantages is its low transaction fees. The average transaction fee is around $0.13, significantly lower than Ethereum’s, making it a cost-effective option for users. These low fees have been a key factor in attracting users and developers to the BSC ecosystem.

Staking

BSC's staking mechanism involves validators who are responsible for producing blocks and securing the network. Validators and their delegators earn rewards in BNB, Binance’s native token. The annual yield for staking BNB is around 5-8%, depending on the overall network participation and the total amount staked.

Inflation

BNB, the native token of BSC, has a deflationary model. Binance regularly conducts token burns, reducing the total supply of BNB. As of now, the total supply stands at approximately 150 million BNB, down from the initial supply of 200 million. These burns are intended to decrease supply over time, potentially increasing the token's value if demand remains strong.

Market Cap

The market capitalization of BNB, which powers BSC, is around $105 billion. This positions BNB among the top cryptocurrencies by market cap. The market cap reflects the overall value held within the BSC ecosystem and is a testament to its significant role in the broader blockchain landscape.

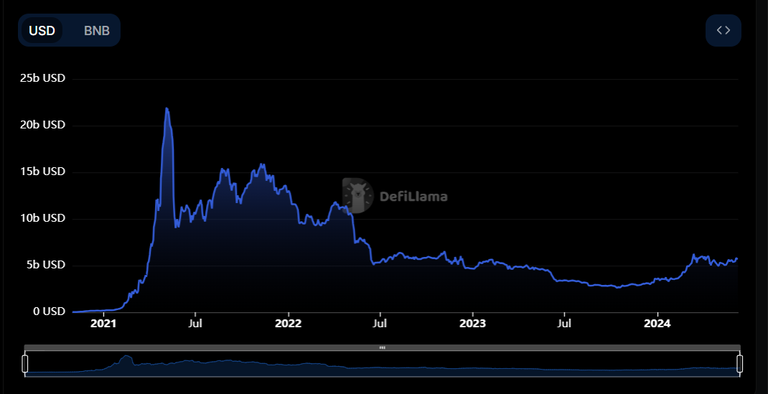

Total Value Locked (TVL)

Total Value Locked (TVL) in BSC's DeFi ecosystem is a crucial indicator of its adoption and growth. The TVL on BSC is approximately $5 billion. This capital is distributed across various DeFi protocols.

The BSC network is among the top 5 most active network I believe that the active TVL is not that great compared to BNBs market cap but it will probably rise in the next months but the volume , active wallets and transactions are at amazing levels.

Sources Links

https://bscscan.com/charts#section-network-data

https://defillama.com/chain/BSC?derivatives=true&tvl=false

https://www.coingecko.com/en/coins/bnb

https://academy.binance.com/en/articles/an-introduction-to-bnb-smart-chain-bsc

Posted Using InLeo Alpha