Hey everyone,

In trading, one of the fundamental debates that constantly surfaces is whether you should be a holder or a short-term trader. However, this discussion isn't black and white. It hinges on a crucial question, What type of investor are you? Are you a swing trader or someone looking to be a long-term investor?

A short-term investor is actively engaged in trading, frequently buying and selling within a day, week, or sometimes extending to months. Conversely, a long-term investor adopts a buy-and-hold strategy, aiming to hold onto investments for an extended period.

Once you've determined your investor or trader profile, you can address the question of which strategy is superior. Both approaches have their merits and drawbacks. There isn't one inherently better than the other, it depends on the individual applying them. Some investors prefer a conservative approach, avoiding volatility by focusing on the long term, while others thrive on short-term market movements.

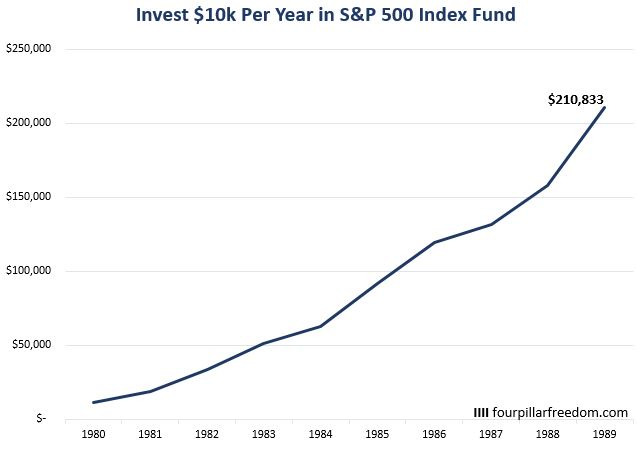

Often, the best returns come from buying and holding for years, patiently waiting for investments to appreciate significantly. Consider purchasing assets like Ethereum at $2 or Bitcoin at $300 and holding them through substantial price increases, such as during previous bull runs.

However, trading can potentially amplify returns for those with knowledge and experience. Skilled traders can capitalize on market volatility, buying low and selling high multiple times within shorter time frames. For instance, buying Ethereum at $70, selling at $700, then buying back at $100 and selling at $2000 can result in substantial gains.

Yet, trading carries higher risk and requires considerable time and effort. It's essential to be adept at analyzing trends and managing risk to succeed. Moreover, market volatility and constant news updates can swiftly affect prices, potentially eroding gains for inexperienced traders.

For me, the optimal strategy involves a combination of trading and long-term investing. This approach requires careful balance and carries higher risk than simply holding. However, it also offers the potential for higher returns. By blending both strategies, investors can capitalize on short-term opportunities while building wealth over the long term.

There isn't a one-size-fits-all answer to the holder vs. trader debate. Each strategy has its place, and the best approach depends on individual preferences, risk tolerance, and skill level.

Posted Using InLeo Alpha