NVIDIA Quarterly Earnings, Breaking Expectations and Setting Records

Yesterday, the entire investment community was focused on one thing, NVIDIA’s quarterly earnings. The semiconductor and AI giant surpassed expectations for both earnings per share and revenue, delivering another exceptional performance.

Let’s break it all down.

Earnings

As expected, NVIDIA knocked it out of the park this past quarter, showing strong growth across the board.

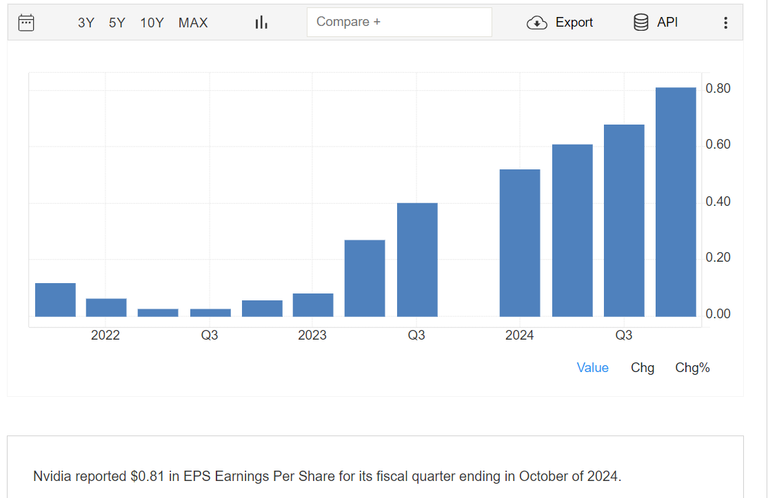

First, let’s talk numbers. The company’s earnings per share (EPS) came in at $0.81, beating estimates by $0.06.

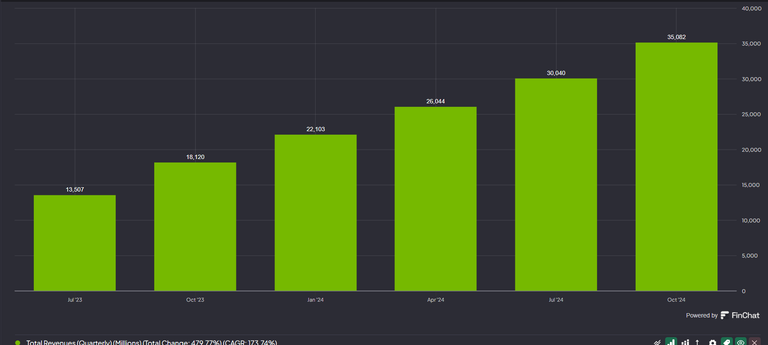

But the real jaw-dropper? Revenue almost doubled compared to the previous year, soaring +93.6% to $35.08 billion, exceeding projections by $1.95 billion! That’s mind-blowing growth.

And it doesn’t stop there. Revenue from Data Centers reached $30.8 billion, shattering all previous records. This marks an increase of 17% compared to the previous quarter and an incredible 112% year-over-year. Yes, you read that right—more than doubled!

So, the biggest share of revenue came from Data Centers? Exactly! Data Centers are now NVIDIA’s primary revenue driver, overtaking the gaming segment, which had long been the company’s main growth engine and it still performed decently this quarter.

CEO Jensen Huang summed it up perfectly, stating:

"The age of artificial intelligence is in full bloom."

The demand for NVIDIA’s Hopper and Blackwell GPUs is enormous. However, the company anticipates supply shortages for Blackwell GPUs well into fiscal year 2026. In short, demand for NVIDIA’s technologies is not just strong—it’s outpacing production capabilities!

Stock Performance

Great results, but why did the stock dip?

Yes, the stock dropped as much as -4.8% in after-hours trading following the earnings announcement. But this isn’t a sign of trouble for the company. The key reason for the decline was the outlook for Q4. Although the guidance exceeded analysts’ expectations, the growth rate wasn’t as dramatic as we’ve come to expect from NVIDIA in recent quarters.

Why’s that? Here’s where mathematical reality kicks in. Basically, NVIDIA has reached such high levels of growth that it’s harder to maintain the same breakneck pace moving forward.

This doesn’t mean the company is losing steam. It just means that after skyrocketing to such heights, maintaining the same speed becomes naturally more challenging. Makes sense, right?

What Does This Mean for Investors?

NVIDIA is the epitome of innovation. As AI becomes increasingly embedded in our daily lives, demand for NVIDIA’s technologies will continue to grow.

And with demand comes revenue. While the growth rate may not remain as explosive as it has been, the trajectory is still upwards. In other words, NVIDIA remains a solid player for the long term and for us that invests in crypto strong AI projects will follow in the same path.

Posted Using InLeo Alpha