Donald Trump’s inauguration finally wrapped up, and the past few days have been absolutely wild in the crypto space. Over the weekend, Trump launched his very own meme coin, which skyrocketed into the top 10 by market cap within hours. Before the weekend was over, his team doubled down and launched another coin—this one named after his wife, Melania.

As you can imagine, chaos ensued. The entire market went into a frenzy as liquidity poured into these coins, with everyone scrambling to get a piece of the action. Meanwhile, the altcoin market took a serious beating, sinking to new lows as funds were drained from elsewhere.

This circus is exactly why I’ve been leaning more and more towards stocks. Here are the stocks and narratives I’m currently focused on

The well-known Morningstar just released its list of the 10 most undervalued dividend stocks for 2025

Kraft Heinz KHC

Johnson & Johnson JNJ

Verizon VZ

Realty Income O

Healthpeak DOC

United Parcel Service UPS

Bristol-Myers Squibb BMY

Devon Energy DVN

Portland General Electric POR

FirstEnergy FE

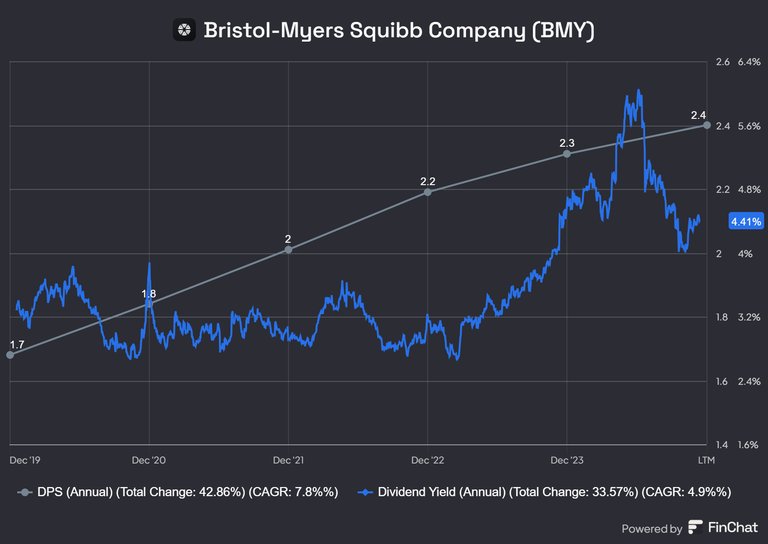

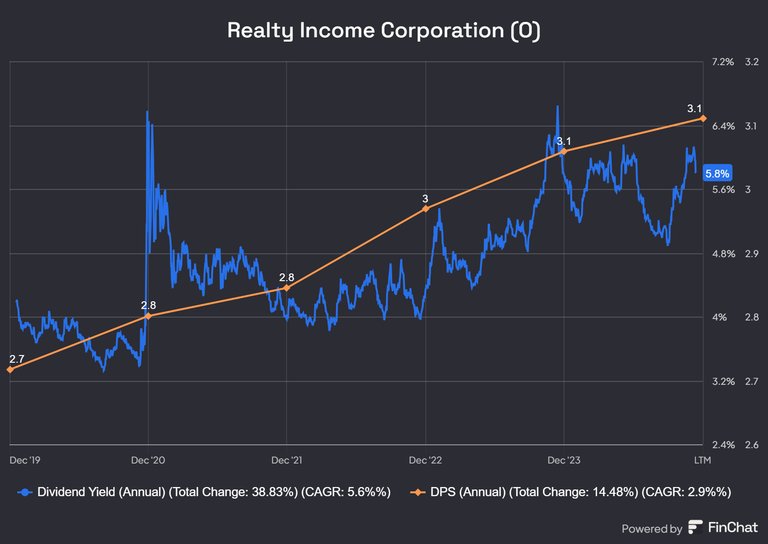

What caught my attention, of course, is that two of my favorites made the list: Realty Income ($O) and Bristol Myers Squibb (BMY) . Both are excellent dividend stocks with a strong track record of consistently growing their payouts.

Intel Stock Surges +12% on Acquisition Rumors

With Intel making headlines, I am looking at turnaround stories with strong brand names

A. Nike

The world’s largest sportswear company has been facing intense challenges recently due to fierce competition. Despite a CEO change, the stock continues its downward trend .

B. Starbucks ($SBUX)

Similar struggles can be seen at the coffee giant. The new CEO is focusing on restoring quality and culture in stores. The stock has shown some positive reaction .

C. Intel ($INTC)

The situation for Intel remains dire, even with billions in government subsidies. The company recently fired its CEO, but a replacement has yet to be announced. Perhaps an acquisition could be a way out.

Which one of these turnaround stories has the most potential I wonder...??

CVS SURGE

We’re not even three weeks into 2025, and CVS stock has quietly climbed +17.2% . Two factors contributed to this impressive performance

A) First, the healthcare sector is significantly undervalued, and analysts are turning their attention to these companies .

B) Second, CVS is a stock that’s been unfairly beaten down, as its fundamentals clearly show .

Is it time to give CVS a closer look?

Posted Using INLEO