src

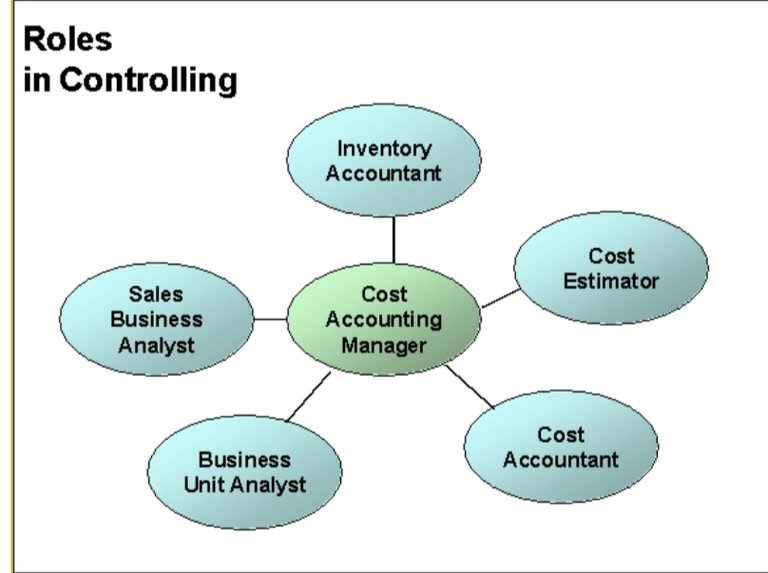

Cost accountant plays an important role in dealing with preparation of various reports enhance provides the same to the management which helps in proper planning and control. Cost Accountants also helps in providing appropriate methods of Costing . Hence without a Cost Accountant an organisation cannot work smoothly.

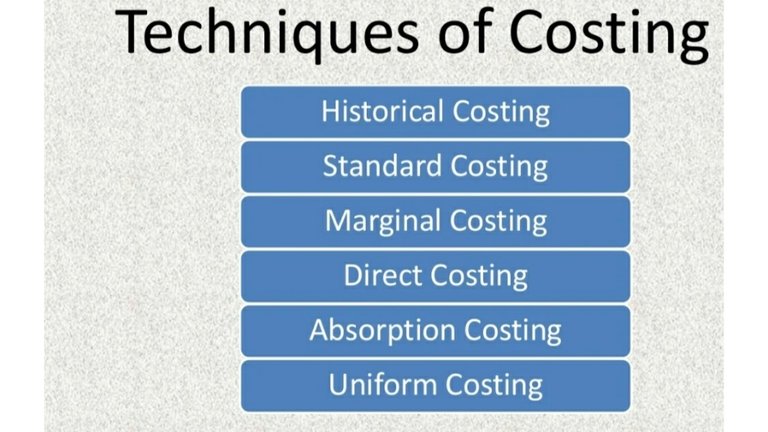

Techniques of Costing

The three techniques of Costing:

•Marginal Costing

•Standard Costing

•Uniform Costing

Marginal Costing: the ascertainment of marginal cost of the products is known as marginal costing . Differential Costing , Variable Costing or incremental Costing are the other terms used for marginal costing.simple words we can understand that variation of cost due to the variation of volumes of output is known as marginal costing. The important feature of marginal costing is valuation of stocks and accurate division of total cost into variable and fixed cost.

Standard Costing: the pre-determined cost or the cost incurred in producing a product is known as Standard Costing it is also known as assumed cost . Standard cost always aims at what should be the cost of products. The main advantage of standard costing is that it's simplifies the costing procedure by reducing the paper works and also provides incentives and motivation to work with more efforts.

The different types of standard cost are Ideal Standard , Normal Standard , Basic Standard and Current Standard.

Uniform Costing: using of same principles and procedures by all organisations under the same management of an association is known as uniform costing. It helps to reduce expenditure on a comparative marketing and also helps in finding the strength and weaknesses of concerns of the same organisation.

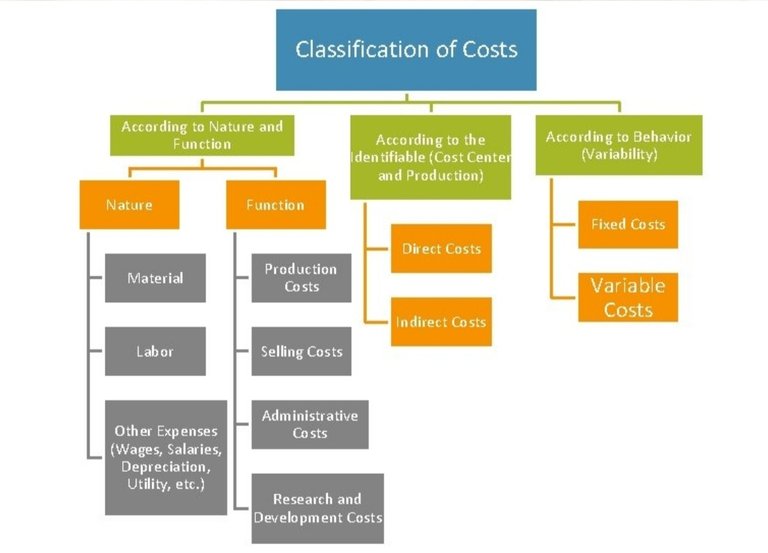

Cost classification by Functions

1)Production or Manufacturing 2) Administration Cost 3) Selling & Distribution 4) Research & Development

Production or Manufacturing Cost :these are the costs which are incurred while producing a product and rendering its services. Production or manufacturing cost are required for operating the manufacturing division its examples are : direct and indirect labour and material , factory overheads etc.

Administration Costs: Costs which are required for management of an organisation is known as administration cost. These costs comes under the category of indirect cost which is used for regulating functioning and controlling the administration. Examples of administration cost are : postage, salaries, telephone expenses and office expenses etc.

Selling & Distribution Costs: Selling & distribution cost are costs which are incurred during selling or distributing the product. Selling and distribution cost also comes under indirect cost . Examples of selling and distribution cost are : salaries or commission of sales agent, advertisement expenses, cost of warehouses shipping and packing, insurance, freight, export duty etc.

Research & Development Cost: research and development of the cost which are incurred for the research work for the betterment of the quality of product or for developing a new product . Examples of research and development costs are Market Research costs, Development of new product's cost etc.