Whether the real estate market will crash or not is of no consequence to this discussion. The simple fact of the matter is that most of the world is shut out from real estate ownership. Even if it is available to the majority in the developed world, in developing and poorer nations, it is a pipedream.

Therefore, we see another avenue where exclusion is par for the course.

Is this something tokenization can alleviate? After all, cryptocurrency is all about access. In the question to democratize our financial world, real estate should be included.

Opening up real estate to the masses could radically alter the financial landscape for much of the global population.

$325 Trillion Market

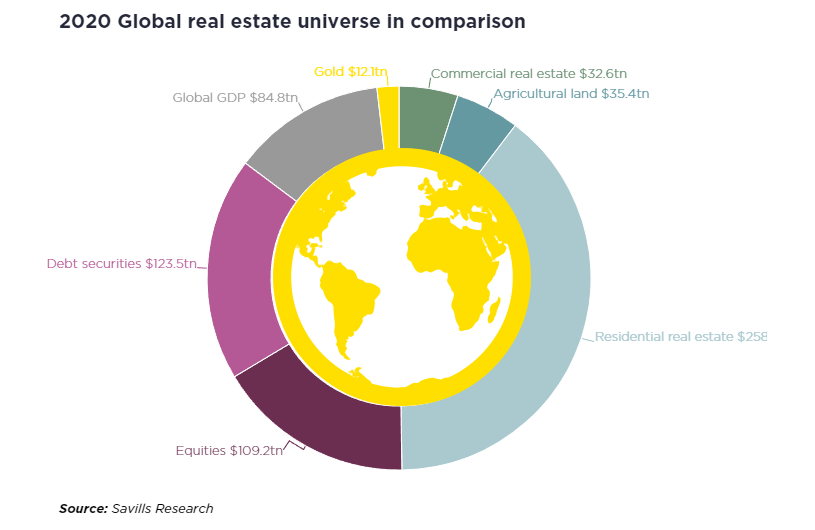

When people ask how big the cryptocurrency market can get, it is vital to think in quadrillions. This is baffling to people until one considers that the worldwide real estate market is over $300 trillion.

Residential makes up the largest component by far. This according to the research by Savillis Research:

As we can see, the money we are discussing is enormous. Even if there is a major market pullback, the total amount is still a healthy sum. In short, it is a lot of money to spread around.

Now let us consider the fact that the overwhelming percentage of humanity is exempt from this value. They cannot participate for a number of reasons. The first is capital. Most people lack money for the basics in life, let alone putting together enough for a down payment.

Also, with real estate, the system is rigged against people. The majority of the planet does not have a credit score that makes purchasing possible. We should also cite how a lack of education in this area is present too.

Therefore, when we see major runs in the real estate, we know that the overwhelming percentage of humanity is only suffering. This shows up in the form of rent to most. Only a small sliver are able to enjoy the financial benefits.

Can we democratize real estate in a way that allows everyone to participate. With tokenization, that is going to happen.

Every Asset Is Cryptocurrency

By now we all heard the saying the tokenization of everything. This is worthy of a deeper look. Many wonder how big cryptocurrency will get. That is the wrong outlook. Stating this believes cryptocurrency is a separate asset class. It is not.

Instead, all assets will be cryptocurrency. The tokenization of everything means we create a digital representation. This takes things to an entirely different level.

That means that, over the next decade or so, real estate will be completely tokenized. Of course, we have a lot of hurdles to overcome with that since it is heavily regulated and governments have their hands in most phases of the process. Nevertheless, when we look at an industry full of friction, real estate fits that perfectly.

Tokenization provides a number of benefits. The first is fractional ownership. This is available to a degree for large real estate projects yet, as mentioned, is exclusionary. The numbers that people deal in are outlandish.

The second change is liquidity. Real estate is non-liquid. Anyone who tried to sell a property knows what this is like. It only gets worse when dealing with multi-million projects. Tokenization solves this by offering a market where the "ownership" assets can be traded.

We can probably add a 5%-10% premium to the total value of real estate by making it liquid. Non-liquid assets usually trade at a discount. Simply adding liquidity to the entire market will add another $30 trillion or so.

Source

Expansion Of Web 3.0

When people think of Web 3.0, they consider the idea of tokenization social media or gaming. While this is a part of it, it is only a fraction of what we are going to see.

Ultimately, Web 3.0 is the merging of our physical, digital, and biological worlds. In other words, everything is going to be data. We will have digital representations for everything. This allows for value and wealth creation to spring in many different directions.

Here is a mental exercise:

Ponder the idea of being able to earn tokens within an ecosystem like Hive. One can get them for engaging in social media activities or playing games. Those proceeds then can be taken and invested in real estate in New York or London. Individuals can buy a few square feet in some of the most expensive areas in the world.

This is the potential that we are looking at.

Web 3.0 is Decentralized Finance (DeFi). Here again, most look at this as a separate industry. Rather that framing it in that manner, think about the fact that DeFi is going to be interwoven through everything. Tokenization will penetrate all aspects of our lives.

Going back to real estate, let us start with the construction. At present, developers go to banks (or other money agents) and get loans. This enables them to build on the property whereby the units are sold to individuals, who also go to a money agent to get a loan.

If this process is tokenized, $50 million can be raised through individuals. Getting $50 from 1 million people is still $50 million. This provides the development costs with the individuals "becoming the bank".

When the process switches from development to sales, the units can also be funded through the tokenization process. Through the use of a smart contract, another set of token holders can fund the individual unit, say for $250,000. This helps to provide a return to the original token holders while the second group acts as the mortgage holder. They get paid each month (or whatever interval) just like a bank.

Beyond First Generation

It is essential to move beyond the first generation of this transition and the need to hang onto our reference points. Whenever something new is introduced, we tend to frame it against what we already know. For this reason, the early personal computers were thought of as merely advanced typewriters. Obviously, those people could not envision the smartphone idea.

By the token, we are simply looking at Web 3.0 against what we already know. This is where we comprehend the idea of social media and gaming. It is easy to see how this is interwoven.

However, pulling these ideas into an industry like real estate gets rather difficult. We can even go further by discussing automation, adding in the idea of tokenizing the equipment and construction process itself.

Ultimately, tokenization is going to provide access where it is presently non-existent. At the top of the list is real estate. Consider what that industry will be like when 7 billion people can take part. Couple that with the fact that tokenization removes a great deal of the friction from the industry and we can see how this could ascent like the stock market did over the last 40 years.

We can certainly expect another level of "network effect" to take place.

Once again we see how cryptocurrency can help to democratize wealth. It is the foundation we are putting into place today.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta