Cryptocurrency is not going to be stopped.

This is a message that I espoused for a number of years. In spite of some harsh stances by governments, including the Biden administration, we saw the growth of crypto progress. My analysis is more about the technological development rather than market pricing. The latter goes up and down, based upon emotions. When we concentrate on the former, a different picture emerges.

Cryptocurrency is part of the technological advancement. We are to the point where asserting that crypto and AI are inseparable is becoming sensible. It is no longer much of a projection.

This means the rapid advancements in AI correlate to cryptocurrency. It will become evident over the next year as AI agents emerge as the next wave in the AI world.

From this, I conclude that we will see wealth generation at a level never witnessed before. Everything regarding technology is being contracted. The conversation regarding investments is in the hundreds of billions. This will soon turn to trillions.

My takeaway is we will see returns that are in the same denomination. There will be companies with market capitalization of $10 trillion. It is only a matter of time.

What does this mean for the average person? We will explode this.

Crypto: Life Changing Money

Bull runs are emotionally driven. So are bear markets. There is a psychology that enters, causing things such as FOMO.

Basically, we are talking about emotion.

Business is not emotional. Development is not subject to sways in sentiment. Instead, we are dealing with problem solving approaches that address issues that ultimately translate into market utility.

For more than a decade people claimed that crypto has no utility. What can you buy with it is the common question. Unfortunately, this was a human-centric view, which is logical considering that is how the world operates....

....or did.

We are quickly moving to a time when computers are responsible for much of the activity. AI agents will revolutionize everything.

Here is where crypto instantly has utility.

With utility comes value. This is the basis for massive wealth generation over the next decade.

Inclusive System

There is a tug-o-war occurring as Wall Street and other established entities try to hijack crypto. We see a lot of focus upon the integrating of cryptocurrency into the existing financial system.

Again, we have a logical thought process, at least from those in charge. However, this deviates from the main premise of crypto. We are not looking at integrating with the existing framework of finance. Instead, crypto seeks to replace it.

So far, the replacing is lagging. We cannot deny how quickly institutions moved to insert themselves in the process. One needs to look no further than Blackrock to see the speed and scale which they are operating.

That said, there is a major advantage the crypto world has: decentralization and open source.

As AI gets more advanced, building becomes easier. This is the track record with technology. In the 1990s, creating a website was a very specialized skill. There were people who trained themselves to build these.

Today, we see a much different story. The ability to generate a website is, in many instances, nothing more than filling in a template. Outside of that, many with some basic coding skills can handle the task.

It is forecast that, within a year or two, anyone will be able to use generative AI to spin up a site simply by using natural language.

This is inclusivity.

Financially, we are seeing the same thing. While the system has fought back, self custody wallets still exist. There are a number of DEX that are not under the control of governments. People can operate in the crypto world without any hindrance from the establishment. The only time it really becomes a major issue is when the need to swap into fiat currency arises.

Essentially, crypto is an overt "black market" which the government is powerless to stop. Even with Bitcoin, they cannot get control of the network. Due to the coin distribution, that can be swallowed up by the money players. The network, however, is outside of control.

If we step back, this is true for all of crypto. While one network or company can be targeted, the totality is untouchable. It is the proverbial game of whack-a-mole. Take one down, three more appear.

Each day the numbers grow. It matters none what the metric is. Number of wallets. Amount of compute power. Storage capacity. Data generated. Transactions.

We are seeing increases in every area. Oddly enough, it is taking place without much in the way of applications.

Data is Wealth

"Data is the new oil".

This a saying most have heard. Data is the centerpiece of everything that is taking place. Basically, the world is moving to the point where data generation, processing, and utility is the key to monetization. Without any facet of this, one is done.

If we look at the totality of the Web 3.0 spectrum, we can see, as mentioned, this keeps growing. This tells me the value (not price) is on the rise. Naturally, this does not presently compete with Web 2.0 but that is only a matter of time.

Value is captured by tokenization. It is true that much of this is moving towards the establishment. What often gets overlooked is a significant amount is outside that realm.

It is where the average person can find opportunity.

Let us take a look at xAI.

Here is a company that was formed by Elon Musk through a funding by wealthy entities. The average person has no way to benefit from the financial progress of xAI.

This company has the largest super cluster in the world even before it doubles in size early in 2025. Here we have the compute that trains Grok, which is fed data from X.

The only thing individuals can do is to engage with X, giving more data, which will financially benefit Elon Musk and his investors.

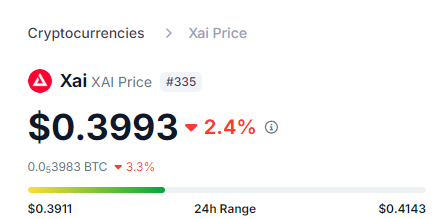

With tokenization, things change greatly. There are two tokens that could provide exposure to individuals who want to get involved.

Please note these are mentioned for informational purposes and not a affirmation on the validity of either of these tokens. As always do your own research.

This is the power of tokenization. It is not the same as owning stock in xAI since they do not carry the same rights. There is no ability to vote on what the company does. If it enters bankruptcy, one is not an owner, hence lacks any claims on assets.

What we have is a speculative vehicle that could follow the fundamental value of xAI. The point is we have a potential opportunity because of tokenization. We could have viable vehicles if these are not scams or rug pulls.

xAI is at the center of the data boom. The traditional system excludes most people from partaking in the financial upside. Web 3.0 solves this problem.

This is why crypto is going to provide many with life changing money. We are at the beginning of this AI age. Crypto will go hand-in-hand with it.

The question, as always, is who benefits. This is where people have to decide.

Are you positioning yourself for life changing money?

Posted Using InLeo Alpha