At what point do we cross the Rubicon towards mass adoption of cryptocurrency?

That is hard to point since there is no percentage that will set things off. What we do know is that the number of people involved in cryptocurrency is growing. The key is to consider that it is one of the faster rates for technological penetration.

Ultimately, people are slow to change. Couple this with the fact that a great deal of infrastructure is required when developing something completely new such as a crypto-economic system. However, the continued progress forward by many development teams is resulting is greater gains.

These are starting to be recognized.

United States Is Looking Strong

While the thought was that cryptocurrency adoption would come from those nations with a sub-par banking and financial systems, we see the world's leading economy holding up strongly.

The United States has its share of unbanked citizens. Cryptocurrency solves this problem. It is estimated that about 25% of the US population is either unbanked or underbanked.

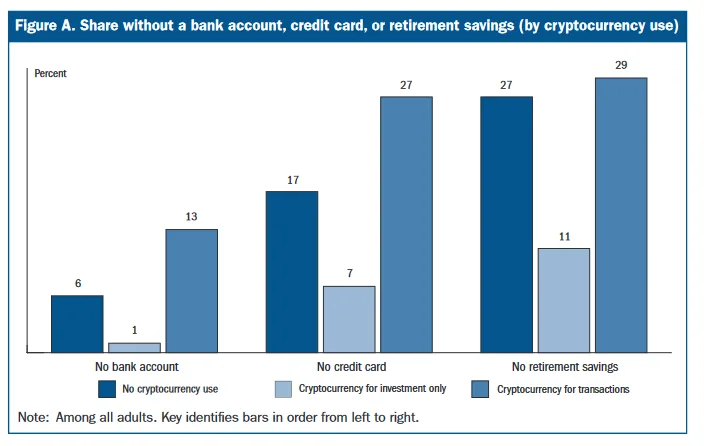

To figure out where cryptocurrency adoption stood, the Federal Reserve did a survey. It questioned 11,000 individuals.

What it found was that 12% of all adults owns cryptocurrency. That means, with an adoption population of 258 million, there are approximately 31 million cryptocurrency holders in the US.

One fact that is falling in line with the traditional system is:

The Fed also found that poorer Americans are more likely to pay for things in crypto. Those who held it for investment purposes were disproportionately wealthy, with 46% having six-figure incomes, and a further 25% earning between $50,000 and $100,000.

Obviously we would like to see the lower rungs starting to accumulate some savings and start the wealth generation process through cryptocurrency.

Either way, the numbers are growing.

The EU Is Holding Its Own

Not to be outdone, the ECB conducted a similar survey within its geographic region to determine how cryptocurrency adoption was shaping up. It found results similar to the United States.

Surveying 6 countries, they found that 10% of the adults own cryptocurrency. This is in the ballpark of the 12% the United States has. At this point it time, this might be the range for the developed world.

Another similarity was the income bracket for those holding cryptocurrency.

Across all of the countries surveyed, investors in the fifth income quintile (or the wealthiest 20% of the population) consistently had the highest proportion of cryptocurrency ownership relative to other income groups.

Unfortunately, this should not come as a surprise. For the most part, the way to get involved in cryptocurrency is to buy one's way in. This will obviously favor those who are in better financial standing. The lower rungs of the economic pie cannot afford to participate.

In this sense, cryptocurrency is exclusionary.

Hive Solves This

One of the advantages to Hive is people can get started with no money whatsoever. Through blogging, commenting, and gaming, there are ways to get rewarded in cryptocurrency. This means that one's activity is able to generate some holdings. Over time, this can grow.

Of course, when one really breaks it down, #Move2Earn is the epitome of this. Here people can be rewarded for the daily activity they undertake.

This is becoming a rather popular topic of conversation within the cryptocurrency realm. Couple this with #Play2Earn and we see how things are starting to expand. This should help to increase the inclusiveness.

It will also grow the number of users.

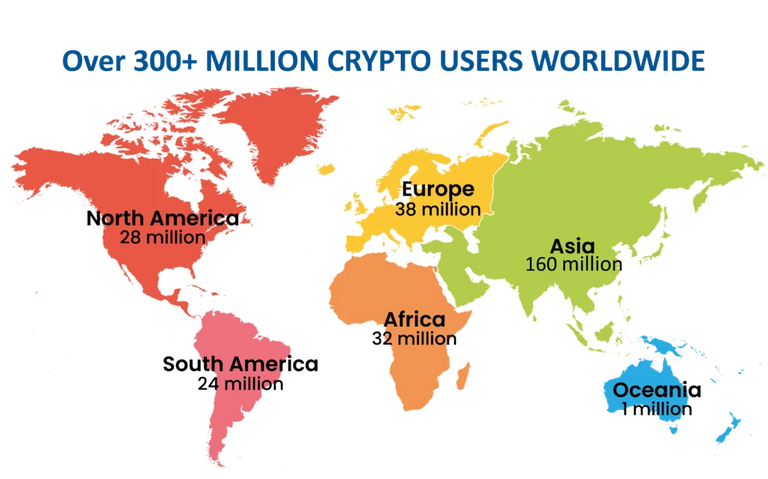

At the end of 2021, it was estimated there were 300 million people involved in cryptocurrency globally. If this was true, it is a number that likely increased over the past 5 months.

While it is hard to get accurate numbers, if the growth rate is 20%, we are going to see the numbers grow by 60 million in 2022. Many feel the rate is much higher.

Ease Of Use

The next wave of entry will help to push the entire world towards mass adoption of cryptocurrency. Once we see the global numbers reaching roughly 10%, the path likely turns exponential.

To get to that point, we still have to advance the entire industry in terms of Ease of Use. At present, we realize things are still too "technical" for most. That said, we are now seeing progress in that area.

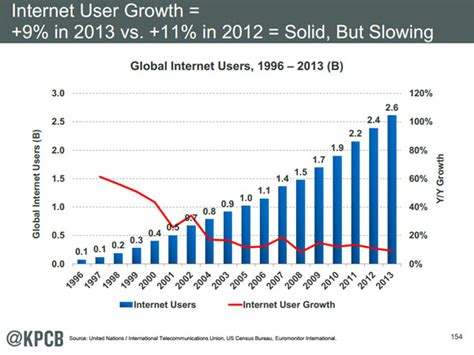

We can see from the Internet, how the growth rate can proceed as more users are added. This is another realm that was once thought to be too "techy" by the average person.

Source

Notice how in the early days the growth rate was very high. Of course, operating from a smaller user base was the cause. As time passed, the growth rate declined but the number of users added each year increased.

There is no reason to think the same thing will not happen to cryptocurrency. We are probably not too far away from adding a couple hundred million people in a single year. This will keep advancing throughout different parts of the world as people start to encounter others who are involved. Word of mouth is still the best for of marketing.

What are your thoughts? Do you think things are going to start getting very exciting within this industry?

Let us know your thoughts in the comment section below.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta