The power of the smaller accounts on Hive is truly underappreciated. When dealing with influence, it is easy to get overwhelmed by the raw numbers. The focus is always upon whales, major upvotes, and their behavior. However, there is another set of numbers that can equally be as powerful.

It is due to this that we can see shifts happen if people would understand and apply a few simple concepts. When concentrating on growth, situations can be changed in a stark manner. This is something we need to highlight.

Have you ever noticed that, when discussing financial matters such as APR, it is always expressed as a percentage? Why is that? How come we see people talking about the percentage that Warren Buffett and Bershire did last year instead of how much money it was?

This is a vital point to understand. We will delve into this in a bit.

Source

Varying HBD APRs

Let us conduct a thought experiment for a moment.

How much different would things look if we established varying APRs on the Hive Backed Dollar (HBD) based upon account size? Wouldn't that be an interesting way to make things "fair"? After all, those large accounts do not deserve to make that much money, or so the thinking goes.

Consider how this would look. If an account has over, say 250K HP, that would only earn 15% APR on HBD in Savings. Anything from the 50K-250K level could receive 20%. Now is where things gets interesting.

We could set the 10K-50K level at 30%. After that, 5K-10K gets 35%. Those with 1K to 5K might get 40%. And what the heck, let us give those with under 1K 50% APR.

Now, let us take this thinking one step further. What if we really boosted the lower levels?

How about a system where 500-1000 paid out an APR of 300% and anything under 500 was granted 500%?

Imagine if this system actually existed. How would it function? Certainly, something like this would change things over a period of time. After all, those with little can get outrageous returns as compared to the larger accounts.

Here is the most surprising part: this system already exists on Hive. Instead of focusing upon HBD, we need to look at Hive Power.

Source

380% Return

Would anyone like to get a 380% APR? How would that make you feel? It is reasonable that any of us would love to have this.

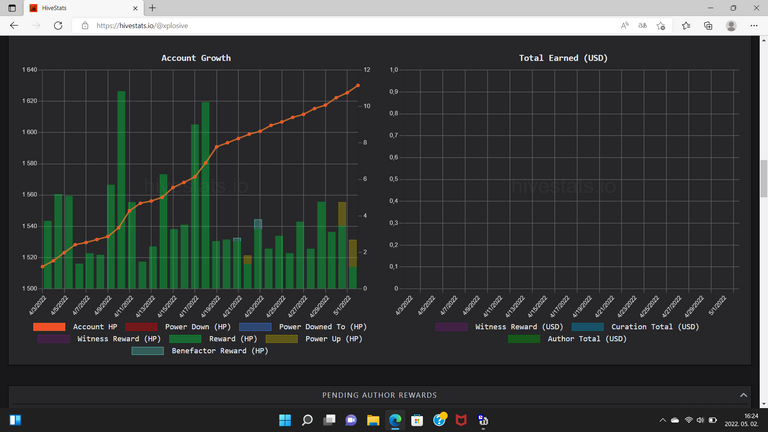

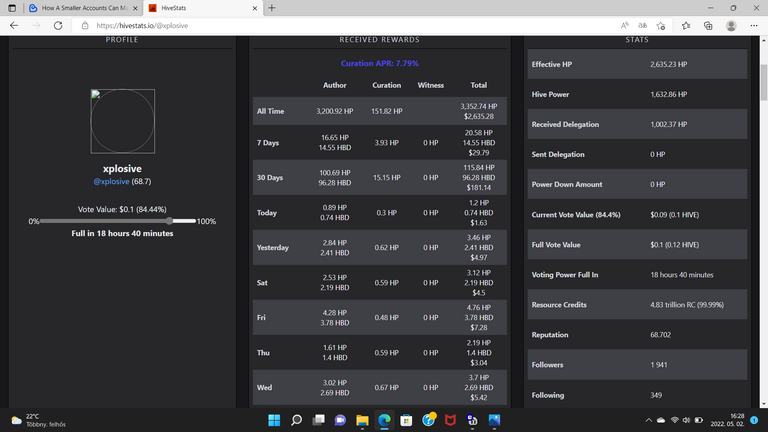

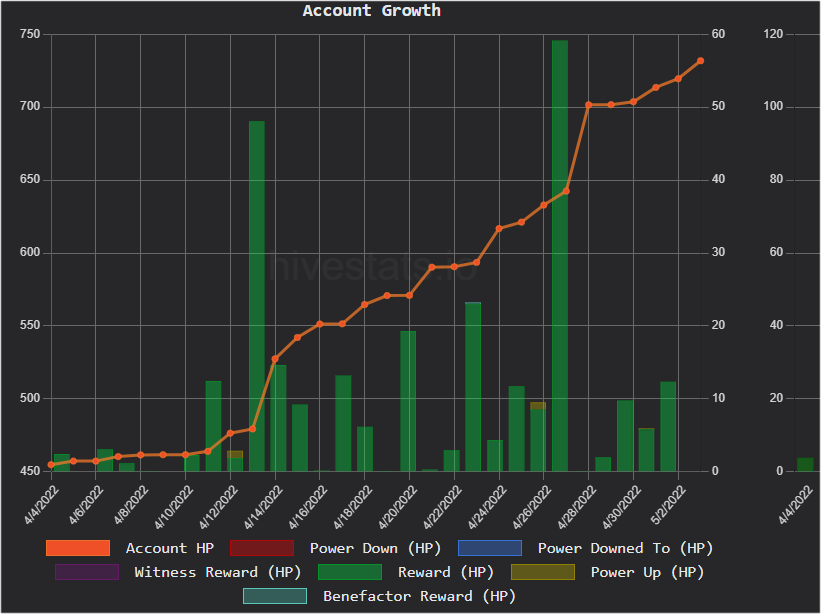

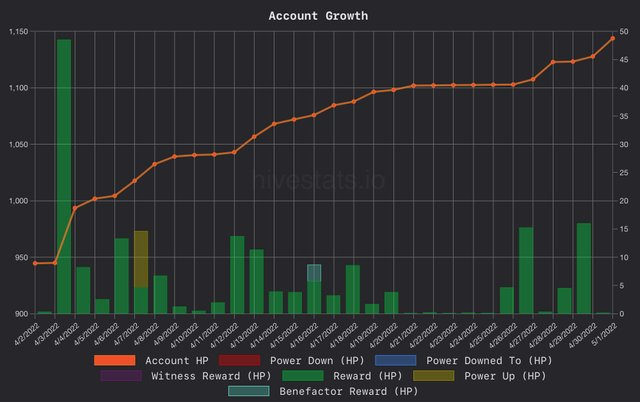

There is one who started monitoring her progress based upon the above-linked article. She noted what took place since February 1st of this year. As of yesterday, her account experienced a return of 380% in a quarter. On an annualized basis, that is over a 1,500% return.

Here is the progression @littlebee4 made:

We have an account that had 265 HP at the start of February and it opens May with 1,275. That is some serious growth.

Over the last month, this is what we see:

Can you imagine having an account that goes almost 5x in a quarter. That would be 20x growth for the year. Obviously, the next 9 months will be more difficult to experience a similar growth rate since the numbers are larger.

And that is the crux of the entire discussion.

Smaller accounts can gain a much higher APR as compared to their larger counterparts due to the raw numbers. It is near impossible for a 1 million HP account to have a 5x in a quarter without a lot of money entering. The idea of a 20x at that level is absurd for most.

Yet here we have a rather obscure account doing it.

Going back to the thought exercise, why do we not apply this same principle to HP as we were doing to HBD? Part of the answer might come from the fact that the achievement here was due to effort. It was the activity that caused the HP to increase. It is not a completely passive situation.

The second reason is simply that people are not thinking about things in these terms. With HBD we see the APR and go crazy when it was changed to 20%. Yet, when it comes to Hive Power, people look at it simple as raw numbers.

That is akin to us ignoring the 15% return Buffett made and instead, focusing upon the fact he made $15 billion or whatever. If someone else has a portfolio of $10,000 and earned 60%, that would crush Buffett. Using the raw numbers, however, would lead to a different conclusion. Buffett making $7K on his portfolio would be a total failure for the year.

Nevertheless, that is how we like to compare HP on Hive.

Source

The Power Of Smaller Accounts

The reality is smaller accounts can far outpace the large ones in ROI. As shown, a 5x can happen rather quickly. This account, if she continues over the next 9 months could see a 800%-1000% growth rate for the year. Would anyone complain about that?

We have another factor to consider. HP on Hive carries influence. Since it is the governance token as well as being used for the distribution of the reward pool, when a move like this is made, it gain a great deal more influence as compared to where it was before. This is another overlooked situation.

Here is where the power of numbers come in. Isolating a single account means very little in the overall picture. That said, what if there were 1,000 accounts that made this same move over the past 3 months? We would have 1K more Minnows as compared to the start of the process.

It is through this that we can see the collective change. Let us look at this account again to see where it might be in 3 months.

Since there was an increase in HP of 1,010 over that period, we will presume a similar added over the next 3 months. That would give the account 2,285 by August first. This from a start of 265 on February 1st.

For the quarter, it would be a 79% growth rate, far lower from the previous timeframe. Here we can see how it gets more difficult as the raw numbers grow. Nevertheless, that is still more than an 8x of the account. This is a very good return for 6 months.

If people would focus upon Hive Power and concentrate on the return one can get there, it is easy to see how the 20% payout on HBD can be dwarfed. The key is that the increase in HP can come most from activity. People are able to concentrate upon building both at the same time.

This is the power of smaller accounts. They can grow at a much faster pace than their larger counterparts. Where the question comes in is with numbers. If there were 10,000 accounts experiencing a quarterly growth rate of 50% or 60%, the change in just 24 months would be enormous.

What are your thought? What type of growth rate do you have on your Hive account? Are you ready to increase it and follow what @littlebee4 did?

Let us know in the comment section below.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta