We all have witnessed what is taking place. Over the last week or so, due to the activity on Upbit, the price of both $HIVE and $HBD pumped. The latter went to an incredible 3x over its peg, something that is counterintuitive for a stablecoin.

How can these be prevented? Is there a way to ensure this does not happen?

This is what we are going to approach in this article. There are a number of challenges when it comes to situation of this nature. One is to maintain a balance between "scarcity" and liquidity.

So let us dive right in.

Scarcity

There is a lot of $HIVE out there right now. This is something we cannot deny.

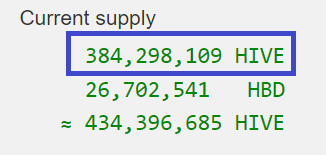

According to Hiveblocks, this is what we are looking at.

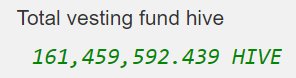

As we can see there is a total supply, just under 385 million. At the same time, the amount locked is just over 160 million.

This leaves us with around 223 million $HIVE floating on the open markets. Many think the solution is for more people to lock up the coin. As explained in the need for Hive Power is going to grow, this will likely be the case. However, does that solve the issue?

The answer is no. When the floating supply of an asset is reduced, volatility will increase. If we get to the point, say, there is only 100 million $HIVE on the open market, we can expect much larger swings. It will also likely be easier to generate pumps even if the price is higher. With less coins available for trade, this lack of liquidity translates into bigger moves.

Of course, the same holds true for $HBD. We know the situation is stark there since we have around 27 million, yet 17 million of that is locked in the Decentralized Hive Fund. So this gives us a float of about 10 million $HBD.

The challenge is we are looking at more than 3 million of that locked up in savings. While this can be liquidated in a few days, it is of little use in a pump. Things simply move too quickly in markets.

Naturally, having more $HBD in savings is a good thing for the Hive economy. This will help to generate more of the stablecoin over time while also enhancing the balance sheet of individuals on Hive.

Once again, the scarcity will lead to volatility, especially since Upbit is the only exchange with any volume of both coins. For a stablecoin, this is fatal.

Liquidity Comes From Derivatives

This is an ideal situation to show how important derivatives are to Hive and how they provide the solution to the paradox of scarcity versus liquidity.

In the world of decentralized finance, we see that liquidity pools are a central part of the equation. Having coins or tokens with many pools is the goal. At the same time, we want depth to those pools so the liquidity is available when needed.

With the Hive coins, this has, so far, fallen to Leofinance. They built out a few liquidity pools using the coins on both BSC and Polygon. The tokens created are derivatives of what is on Hive.

Let us look at the mechanics of $HBD to see how it works.

When one wants to get involved with a LP using either bHBD or pHBD, the coin is first bridged over. This basically created the associated token while putting $HBD in the wallet of the Leofinance team. A portion of this is placed into savings to take advantage of the APR being offered.

An equal amount of pHBD, for illustration purposes, is generated. We now have twice the amount we started with. If there were 100 $HBD moved, that is now in a Hive wallet while 100 pHBD are in a Metamask wallet.

The individual would then swap 50 pHBD for another token, say USDC, and then put both in the LP. Effectively, we just added 100 pHBD to the pool since the "purchase" of USDC likely ended up in one of the LPs.

This is how both scarcity and liquidity can be maintained at the same time. At the moment, since Upbit has such a large percentage of the floating Hive coins, there is little that can combat the pumps. Over time, the course of a day or two, things can return to normal. However, it likely takes some of the bigger holders stepping in. This is fine if they will do it each time. That said, it would be much better if market dynamics were able to take care of it.

Always A Paradox

When it comes to currency, there is always a paradox. For example, with the reserve currency, there is something called Triffin's Dilemma. This basically says the country behind the reserve currency, at some point, is going to have to decide between its own economy or the global one. Where are the resources allocated for growth?

We can see the same thing here. For the US Government and, more specifically the Fed, this paradox was solved by the Eurodollar system. That eventually because a derivative center for the USD. An entire system was built based upon the dollar with, ultimately, no dollars in the it.

The solution for the stablecoin is more $HBD. Of course, to generate this, for the most part, $HIVE needs to be converted. This will eat into the amount of that coin which is out there, something that could be problematic if the need based upon utility increases. This will only create more volatility in end.

Therefore, we can use derivatives to produce the stability desired, especially on the stablecoin while also ensuring the scarcity via use cases. The above example showed how we can have both at the same time. The $HBD that is bridged sees a portion in the savings, generating more of the coin. At the same time, the liquidity pool deepens, ensuring trading can occur as needed. There is a limit to how this progresses since it is all dependent upon $HBD. Here is where the derivative can add value to the underlying asset, in this instance the stablecoin.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta