There is a discussion taking place, along with a push, to lower the APR on HBD that is put into savings.

In reading the reasoning in articles that were posted, I can only say this is wrong. It is a fool's errand based upon a simplification of a complex issue.

Like most things dealing with money, economics, and finance, it isn't as simple as people make it out. I guess we are in the social media, 24 hours news cycle. In the financial world, networks consistently espouse the single reason why markets go up or down on a particular day when, in reality, it is never that simple.

In this article we will sift through the different component that should be in this discussion.

For reference, I will be using this article by @deathwing and this one by @anomadsoul.

Yield Versus Speculation

From a finance perspective, we have to distinguish between HBD and $HIVE.

Here is a quote:

Why would anyone invest in Hive when you can simply get HBD, lock it up, and get an easy 20% every year? To increase the importance of HIVE, I would like to propose to our community that we reduce HBD APR to a maximum of 12% (as I am signalling right now). The reasoning behind 12% is that even if you actively participate in curating content on Layer 1 on top of receiving passive inflation, the approximate yearly APR you're receiving on your Hive Power is about 10 to 11%. I am hoping that these numbers reinforce the aforementioned notion.

What is the APR on Tesla? Amazon? Facebook? What do they pay out each year?

The answer is they do not. The APR comes from the movement in the stock price.

Here is the first major problem. Trying to promote $HIVE based upon APR is misunderstanding the coin from a financial perspective. While there are dividend investors, most of your top stocks are bought because of speculation. The dividend is a bonus unless, the stock goes down. In fact, it is foolish to buy a stock based solely on the dividend because the price can go down in excess of the dividend return.

Thus, the notion of looking at the APR on $HIVE doesn't make a lot of sense when it can go down by 25% (or more). It simply is not an asset that one seeks yield.

That is where HBD enters. This is catering to a different market. Not everyone wants to hold an asset that can decline 70% in a year. In fact, the bond market, which is make up of people seeking yield, is larger than the stock market.

Why would people buy $HIVE?

The answer lies in the fact it is an access token (more on that in a bit). But primarily, it is for the price to go up.

Bonds are commonly not compared to stocks because they are completely different markets and investors. We should not do that on Hive.

Medium Of Exchange

Another important factor is that HBD is a medium of exchange. This is its most vital characteristic.

Since it is pegged, it provides the stability to operate as a payment mechanism. Thus, if we are going to develop a Hive economy, this is crucial.

Of course, for economic activity to occur, money is needed. The problem with HBD is there is not enough of it. Right now that is not a major issue since the utility is rather limited.

The idea of setting the APR on HBD based upon those put forth by other stablecoins makes little sense. HDB has to be the foundation of the economy we are building. Most of the others are built on second layers by centralized entities.

One of the things we need to develop is wealth on Hive. This is not done by messing with tokenomics or monetization factors. These has a part obviously but there is something more concrete than that.

We need commerce and financial applications. What would HBD look like if there was $10 million a day in transactions taking place? $25M? $100?

What would that does for the ecosystem? More importantly, what would that do for the value capture token, i.e. $HIVE?

Hive Marketing

This might seem like an odd component to put in a discussion about tokenomics but hear me out.

Look at this list:

- Verizon

- Saleforce

- Netflix

- Yahoo

- AirBNB

- Kellogg's

Do you think any single person or company ever decided to use one of those companies products because they were housing data on AWS servers?

Will anyone leave any of those companies if they switched to Microsoft?

The answer is obvious.

It also points out a problem within Hive. While we want to talk about this like it is something special, it is nothing more than a decentralized server system that allows for the storage of data.

Anyone who reads my articles know I believe Hive is a technology that is superior to most out there. This is what sets us apart.

However, from a user standpoint, they do not care. Netflix subscribers could give a crap where their videos are streamed from. Their only concern is whether it comes through or not when they want them.

This is why the idea of Hive marketing is fruitless to end users. Nobody is going to care no matter how many races have Hive plastered on it or how many movies you make. Did anyone sign up for Facebook after seeing The Social Network.

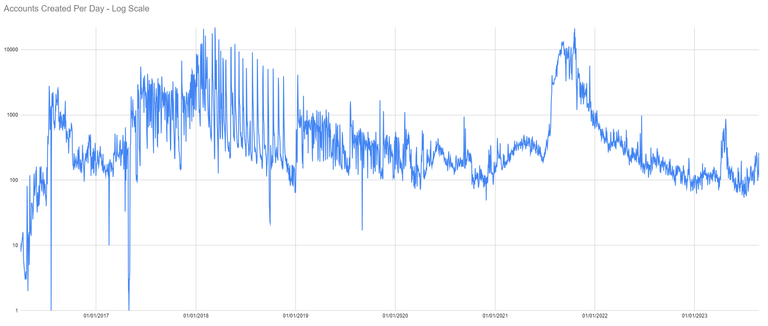

Hive's success to users is going to come from the applications. Of course, we already say this with Splinterlands. That game had a stretch with a lot of sign ups. The reality is few cared about Hive. These were there for a game and as long as it met the players needs, they returned.

Where the data was written became of no use.

Therefore, the best way to increase the value of $HIVE is to support those applications and games looking to grow the users. That is where targeted marketing can occur.

We do have one exception which has never been, to my knowledge, ever discussed.

Who would be interested in the back end capabilities of Hive and the underlying technical components? Developers.

Have we ever had a marketing proposal designed to target them? The answer is no. Perhaps the timing is not right for that due to the ongoing development of HAF and certain levels are required for it to be fully promoted.

Tokenomics

Cryptocurrency seems to have a cancer that is the idea that messing with the tokenomics leads to success. We have seen it repeatedly over the years.

Here is it bluntly: Few cared about $HIVE (or HP) before HBD was at 20% and it will be the same if it is changed.

We have to stop believing that simply changing the tokenomics is going to make something valuable. It doesn't.

What is required is building. For this to take place, people with a mindset need to approach Hive with the idea of creating a business utilizing the base layer features offered. This includes account management, wallet system, HBD for payments, and resource credits for access.

Most of cryptocurrency is focused upon adjusting the tokenomics instead of actually building applications and games that people want to use. There were a few hits here and there but, overall, not much.

But then again, how often have you heard about people talking about growth rates, full blown marketing strategies with tactics, market share and unique service propositions?

These is commonly discussed in the business world yet we see little of it within cryptocurrency. Instead, like we are doing here, the focus is tokenomics.

That is the problem.

Access Token

Here is the biggest issue with this entire proposition.

$HIVE brings a lot to the table. When staked, it provides influence in both governance and the reward pool. We do see how this can potentially translate into a return.

However, the main use case of Hive Power (HP) is access. It allows people to interact with the chain. If we want to get simplistic, here it is.

Once again, we are back to users.

This is another quote:

This 20% APR is a huge tool that we could leverage to onboard investors into the Hive ecosystem, and yet we are currently not doing anything about this.

This is true although perhaps not the greatest area of promotion. Nevertheless, it does emphasize a point that I brought up earlier.

If there is $25 million a day in the Hive economy that takes place in HBD, how much HP is going to be required? This cannot be answered because 1 transaction is much different than 1 million. However, the point is that the more success HBD has, the better it is for the other coin.

For some reason, it seems there is the mindset of these two coins being in competition with each other.

Also remember, HBD is backed by Hive - not the other way around.

That is true. But also remember, for every HBD transaction, HP is required somewhere.

Not Enough HBD

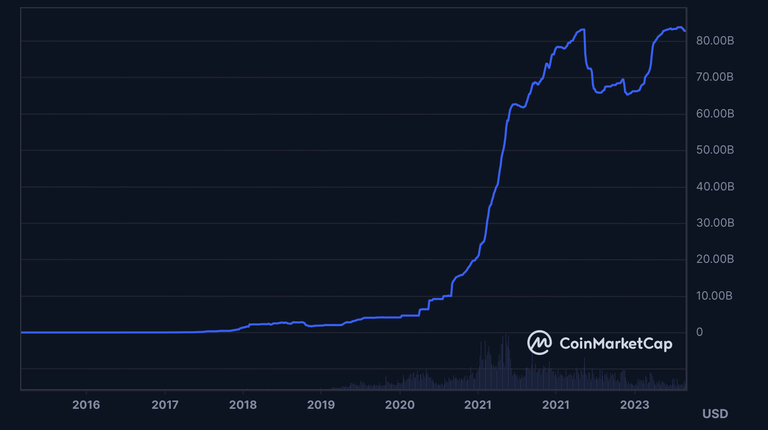

To be a legitimate player in the stablecoin market, a lot more HBD is required. The APR is one of the ways HBD expands.

People question the sustainability of HBD. There is a correlation to $HIVE since the market caps are essentially interwoven. However, it is a mistake to overlook the way successful HBD can impact the value of Hive.

The blockchain needs transactions. This is the simple premise. Hive's success comes from blocks being filled with data. If this occurs at a greater rate, then we are going to see a much more valuable coin.

Consider if Hive was doing 250 million transactions per day. It matters little what they are for the sake of this discussion although we do know there is a difference in pricing of resource credits.

What do you think the value of $HIVE would be at that rate? I can guarantee a lot higher than it is now.

In Conclusion

It is beneficial to have these discussions. We should look at tokenomics periodically. However, it seems this is the focus instead of really concentrating on growth.

My view is what is proposed is going to fail. It will not alter the price of $HIVE one bit. There might be a move higher based upon the market but that is it.

When the premise is to put an APR on a speculative asset, it is bound to fail. As stated, you can bump the APR on HP to 15%, if the price goes from 30 cents to 15, how are people going to feel?

Also, if that price is hit, do you think people are going to buy $HIVE because it pays 15% or because they have a chance to double or triple their money.

Hopefully this article shows the situation is move convoluted that presented. It is not as simple as people like to make it out.

logo by @st8z

Posted Using LeoFinance Alpha