It is time to have a bit of fun and consider where Hive is going to be the future. We often get caught up in short term markets, overlooking the bigger picture. With Hive, the long term framework is starting to change.

Over the last couple weeks, we discussed some topics and developments are starting to change Hive's standing within the world of cryptocurrency. In fact, we can start to claim that Hive is a foundation for Web 3.0. Some might take exception with that but it is really how things are starting to unfold.

The inspiration for this article can from Cathy Wood. Her team is known for their bold predictions. For that reason, we can chart Hive in parallel with what they are doing to come up with a price target.

We will go further and do our best to substantiate it.

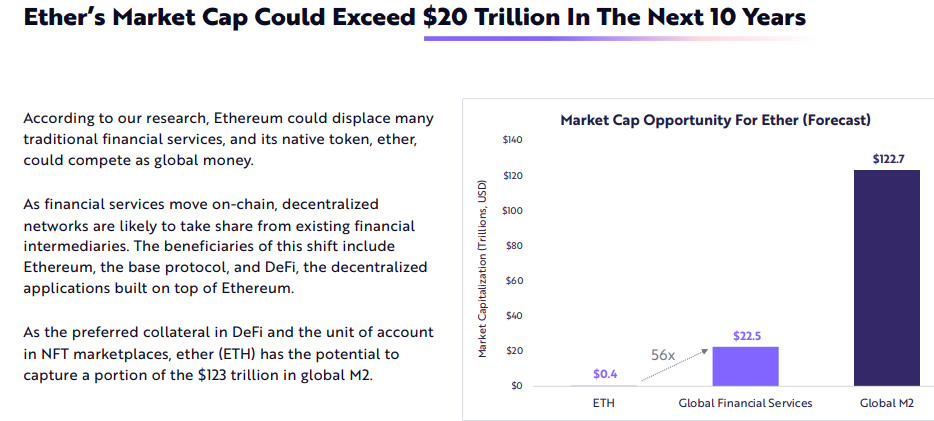

Ethereum Worth $20 Trillion

By the end of the decade, Wood predicts that Bitcoin will be at $1 million per coin. This is nothing outlandish since others made this call. Where the Ark team differs is they put a market capitalization of $20 trillion on Ethereum. That would lead to a per coin price of around $170K.

At present, Ethereum is sitting at just under that $1,700 market.

The core of the thesis is the idea that Ethereum is going to take a great deal of business away from Traditional Finance (TradFi). Since it is the smart contract blockchain of choice, the disruption posed to the existing financial community should benefit Ethereum. That is the view at least.

This was presented in their Big Ideas 2022 report.

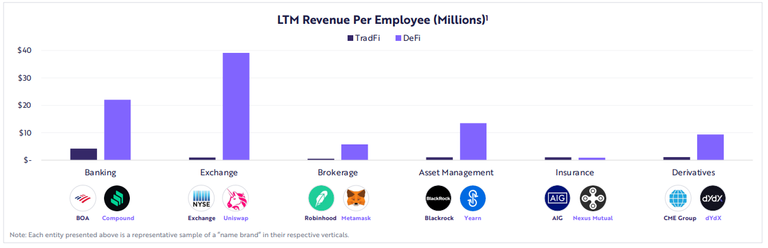

One of the main points emphasized is the Decentralized Finance (DeFi) is much cheaper to operate than TradFi. They way they charted it is the revenue per employee over a 12 month period. If their numbers are correct, it isn't even close. DeFi provides a 10x return per employee.

Presuming this is correct, which seems logical, we can see how DeFi is poised to disrupt the existing financial system. This is something that many in cryptocurrency would agree with. Nothing really Earth-shattering here.

The question is will things unfold as Ark sees it?

HIVE At $60

Before going into some other parts of the analysis, we are going to do some quick math. If Ark is right about a $20 trillion market cap on Ethereum, then we are looking at roughly 100x from this point.

If we apply the same move to Hive, we get a market capitalization of $22 billion.

So while there is nothing that states a lockstep move will take place between the two coins, it does show that, based upon the Ethereum forecast, $60 is in line.

Of course, we know markets do not operate in this manner so we will have to dig a bit deeper.

Hive Is The Blockchain Vitalik Wants To Build

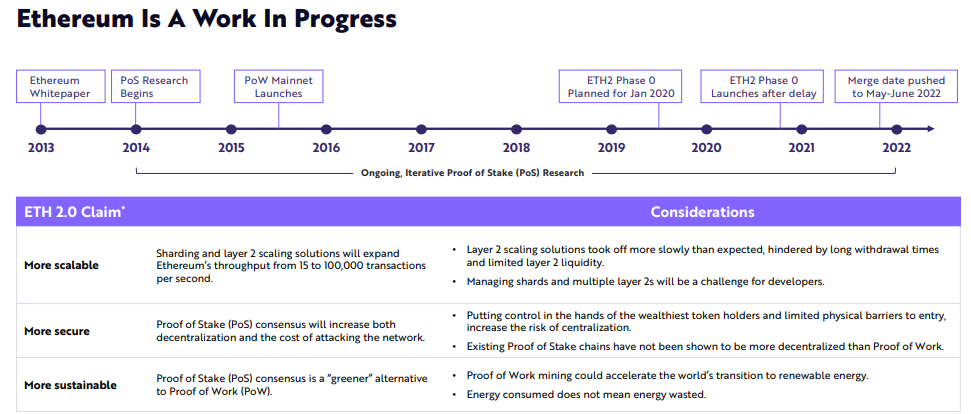

There are challenges with Ethereum. This is something the development team is working on. Vitalik even came out and said after the Merge, they would be about 55% done. This will lead to surge, verge, purge, and splurge.

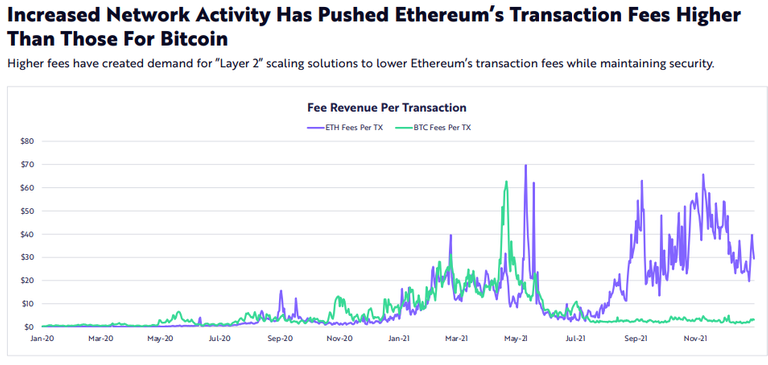

It is cited, to a degree, in Ark's research. They mentioned the activity on Ethereum pushing the transaction fees up.

Here is where it gets interesting. The comparison is to Bitcoin, which makes sense since that is also high on their list. However, as we pointed out repeatedly, Hive excels in this area. Due to the Resource Credit system, this is not an issue. As long as an account has a minimal amount of Hive Power, the RCs exist to conduct a transaction.

This is the most basic use case of HIVE. We recently discussed how the need for Hive Power is going to grow due to on chain activity. With Hive, transactions are possible by making an investment as opposed to incurring an expense like traditional transaction fees.

They also acknowledge some of the major challenges:

Here is where we see the difference in philosophies. Ethereum has smart contracts at the base layer and is looking to Layer 2 solutions to help it to scale. Hive is very tight at the base layer, seeking scalability at this level. The intention is to have smart contract resident off chain.

Web 3.0: An Internet Revolution

This is something we can agree with Ark on. Web 3.0 is going to change the Internet completely.

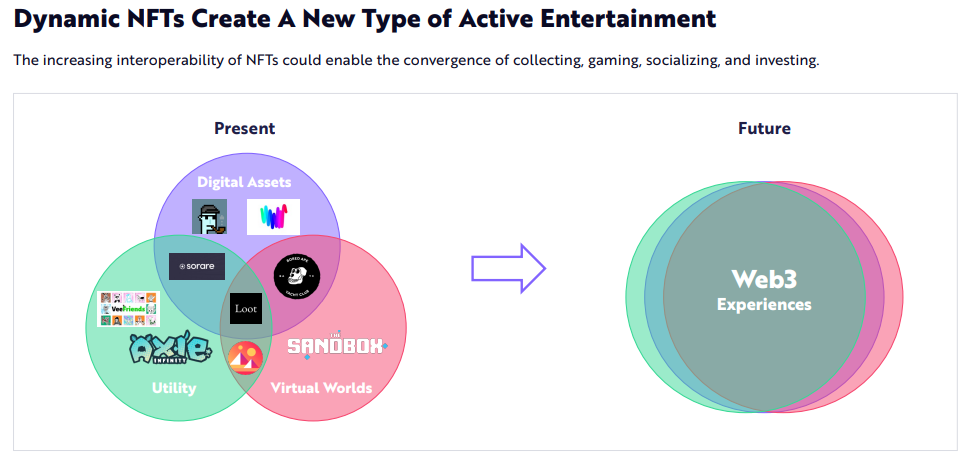

The challenge is their report focused upon NFTs, and the fact that Ethereum, due to base layer smart contracts, is the leader in this realm. To them, change is coming in terms of digital asset ownership.

While it is something that most of us will agree upon, this is just one facet of the larger picture.

They envision a completely new form of entertainment and engagement.

Again, we can agree upon this. However, when socializing, are users going to want to pay transaction fees each time they engage? Is this realistic as we delve further into virtual worlds?

Many believe this simply is not the case. In fact, we covered how Hive is already at the epicenter of Web 3.0 social media.

It is hard to get an estimate on the total value of social media but we do have one comparison: Twitter, and its bots, have a market capitalization of $31 billion. If Hive reaches a price of $100, that would put the market cap around $37 billion.

Thus, we are looking for a little more than Twitter for $100 HIVE.

Is this really possible? One of the things Ark cited was digital ownership. With Hive, users have full ownership of their accounts. This not only applies to social media activities but also financial ones as well. All DeFi built into Hive means full control of one's wallet.

The Final Pieces

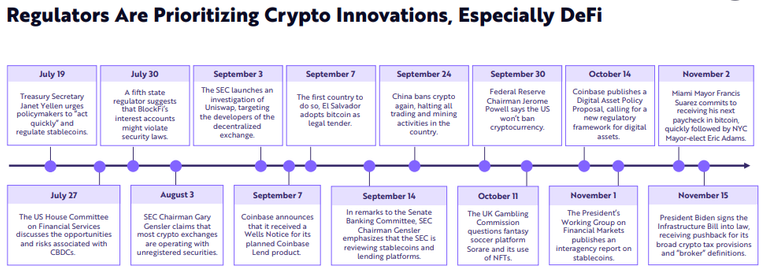

Ark mentioned the fact that regulators are now "prioritizing crypto innovations". That is a nice way of saying, they want to regulate them so they are under control of the present system.

Here is where Hive also excels. Since the coin distribution is such that nobody owns more than 5%, it is hard to make the case it is centralized. With a decentralized system, regulations do not apply since there is no way to enforce it. Who is responsible for filing to ensure Hive is in compliance? The answer is nobody. At the same time, there is no door to knock on if compliance is not met.

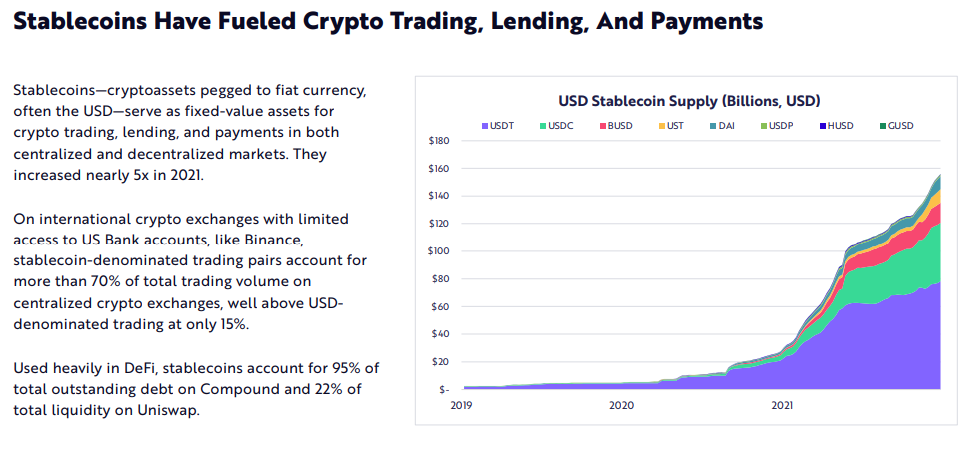

This really applies to another area where Ark promoted Ethereum: stablecoins. They believe there will be tremendous growth in that area over the next decade. Again, it is a concept that is easy to agree with.

Ultimately, any of the stablecoins on Ethereum will have to be in compliance. The entities that issue them will have to register, most likely as a bank, to be able to operate.

Hive has the solution to this: Hive Backed Dollar (HBD).

In this situation there is no registering, for reasons just mentioned. Since the coin is at the base layer, the decentralization of the system means the blockchain is actually behind it, not a company. At the same time, there is an internal exchange, also tied to the base layer, that is outside the regulatory agencies.

Even if exchanges were banned from listing it (few do anyway), this is not much of a problem. The internal exchange means that HBD can be acquired by anyone. We are also seeing derivates being produced that are being dropped into liquidity pools. All this adds up to the fact the regulators can go pound sand.

What is having a stablecoin outside the reach of all governments worth? Over time, that will add billions in value to Hive.

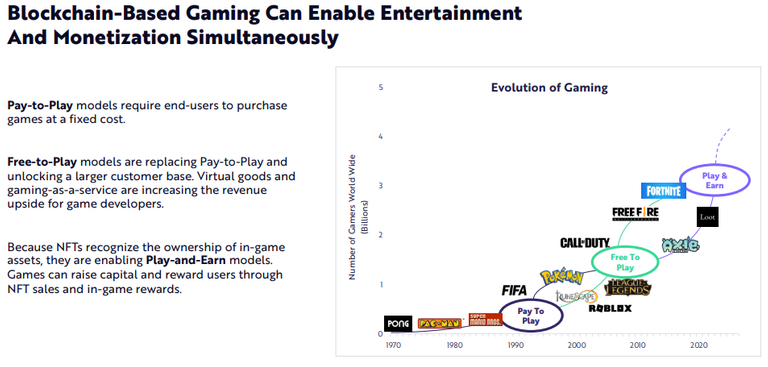

The final piece from Ark that we will cite is gaming. This is where things get very interesting.

Notice what is on the chart they create: Axie Infinity. Do you notice what is missing?

We do not have to say much about this. One thing that is important is that with the expected roll out of Hive Application Framework (HAF), we are going to see life get a lot easier for developers looking to integrate blockchain into their applications and games.

With easier development coupled with the speed of Hive, we might see this place become a destination for some new games. There are a handful in the works already.

In Closing

The price of HIVE going to $100 might seem far-fetched at this moment. However, if we step back and take the long term view, is it really unrealistic?

Having an ecosystem that as near $40 billion in value realized through its base layer coin in a decade makes a lot of sense, especially when we consider what is taking place. Hive with even 10 million users would have a much higher market capitalization.

Right now we are still in the building stage. There are other projects not mentioned in this article that are also going to feed into this.

Cathy Wood is right, much of TradFi will end up tied to blockchain. The same will be said for social media and online marketing.

Hive is actually setting itself up to be a force in all these different areas. Some of the pieces are starting to come together now. The next 6 months should see a few roll outs that make a difference in what people do on chain.

Ultimately, we are talking about industries that have tens of trillions in value. Hive is seeking just a small portion of that.

Therefore, with continued development, we could see $100 HIVE in a decade. The foundation is going in place for that to occur.

What are your thoughts? Let us know in the comment section below.

Images for Ark taken from link to their report

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

. Keep up the fantastic work

. Keep up the fantastic work