This is a post to solicit feedback regarding adding a time vault to the next hard fork. It is always good to have on-chain discussions about these topics.

We have a subject that was talked about in great detail over the last year. It is projected to be on the list to incorporate into the blockchain. This will add another base layer option for people on Hive to utilize.

Let us start with the basics.

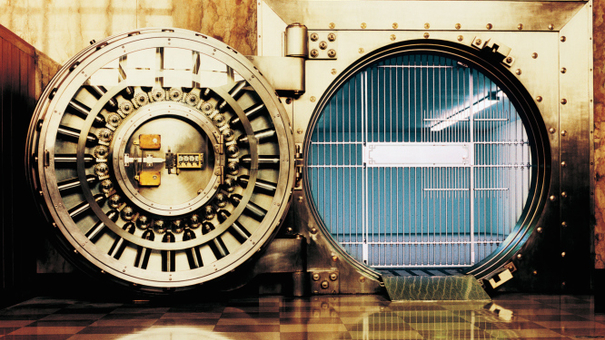

Source

What Are Time Vaults

A time vault will be an extra layer to the Hive savings account. It will allow users to deposit Hive Backed Dollars to earn interest. At present we have a system where people can place HBD in savings and earn 20% APR. There is no lock up period although there is a 3 day withdrawal time on savings.

By adding a time vault, we are incorporating the idea of locking HBD up. This is similar to staking where one is making a commitment for an extended period of time. In return, a higher APR is paid out.

For the sake of this article, we will use a 1 year lock up for a 25% return. The exact rate will be set by the Witnesses similar to the interest rate on the savings account.

Essentially, individuals and applications will have the choice of either keeping HBD liquid, putting it in savings to earn 20%, or locking it up for a year and earning 25% (based upon this example).

Expanding Hive's Fixed Income Offering

The fixed income market is enormous. Over the past year, we saw the problems associated with cryptocurrency staking and DeFi. Basically, counterparty risk was introduced, something cryptocurrency was meant to replace.

Hive can solve this. By adding time vaults, we expand the options to provide another fixed income instrument. Since this is at the base layer, the only counterparty risk is the blockchain. As long as it is running and the haircut rule is not exceeded, the risk is removed from HBD. People can stake without fear of a company going under, rug pull, or the second coming of SBF.

Fixed income is appealing to those seeking yield. While many love to speculate, most investors, especially corporate, prefer to use their treasury to gain yield. Having a time vault could be a beneficial option.

1 Year Time Vault

This is something that, if the community agrees, can expand over time. To start, it makes sense to add one vault and see how it goes.

At this point, it appears that a 1 year lock up is the best option. This is a long enough period of time to be able to monitor the status of the circulating supply of HBD while also enticing to users. A 30 year lockup, for example, would not get a lot of use.

Shorter periods could be useful in the future. A big part of a time vault is what is going to be built on top of it. Hive Bonds is an example of an idea that can be developed as a layer 2 solution using the time vault idea. As we will see in a moment, there is an idea to create longer term assets on the second layer based upon another feature built into the time vault.

Locked In Rate

Interest paid on Hive is actually a free floating rate. The "market" is the consensus of the Witnesses. This can change at any time.

The savings account is set at 20%. That could shift to 22% tomorrow, or drop to 18%. Nobody is in control of this. If a number of Witnesses change their settings, the rate is altered.

A time vault is a way to get a fixed rate locked in. Whatever the individual receives when the transaction is made, that is good for the duration of the lock up period. For example, if we put in 100 HBD today at a rate of 25%, that is what is paid over the next 365 days. A change in the rate the following day, in either direction, will have no impact upon that 100 HBD.

Benefits To Hive

A time vault brings a number of benefits to Hive.

- as mentioned, it expands the fixed income offering that can attract more users

- it is the foundation for more layer 2 solutions/application that can incorporate this into their business models (plans for some of these are already in discussion)

- debt management: since HBD is debt, it allows the Witnesses to monitor the circulating supply and see how the free float is expanding or contracting

- enhanced security since HBD locked up for an extended period is no threat to the blockchain and cannot be used as an attack

We also have the benefit of innovation. In the past we mentioned Ragnarok. The plan here is to accept HBD as payment for in-game assets and entry fees. All money raised will be put into savings, with the prize pools being paid out of the interest. The goal is basically to have HBD enter and never leave. A time vault is ideal for this since it can lock it up for a longer period. If the game grows in users, the amount of HBD being locked up each year only increases.

Having a time vault is an advantage for both the game and the entire ecosystem.

In the past we covered the idea of derivatives on HBD. Moving a lot of the HBD activity to side chains in the form of a HBD derivative moves the defense further out. Under this scenario, we could lock up a portion of the HBD that is backing the layer 2 token (let's call it sHBD) in the time vault. Hence, if there are 10 million sHBD, perhaps 50% is locked up knowing that not all will be bridged back to Hive.

This effectively adds another layer as more is locked up yet liquidity is still present albeit through the derivative.

Once this feature goes live, it is likely that development teams figure out other ways to incorporate this into their business models.

Longer Lock Up Periods

The ultimate idea behind time vaults is to develop something similar to a bond tree. This is the idea where the HBD is locked up and liquidity is provided by having an asset that can be traded on an open market. Hence, if someone needs money, the asset can be sold.

Here is where Hive Bonds enters. This is the concept of building a layer 2 application where creates a token based upon HBD deposited. Since there is a time period, payout schedule, and a rate of return, we effectively are dealing with a bond. This is part of the idea of trying to create high quality collateral.

For this concept to truly take hold, longer lock up periods are needed. As we know, bonds extend out many years.

We can keep adding more time vaults in the future. If it works, we can add 3, 5, and 10 year. This is one approach.

There is another way to develop this which could be coded in immediately.

The 1 year time vault has a "renew" button. This means that one can opt to automatically keep renewing the lock up. Using the Ragnarok example, as the HBD is put into the time vault, the option can be selected to keep redepositing the HBD as it unlocks.

This serves a few purposes. To start, when it comes to managing HBD, it is good for everyone to know what is slated for a longer lock up period. Let us say Ragnarok has 500K HBD locked up for another 6 months, but it is clear an automatic redeposit is taking place, then everyone knows that is effectively off the market for 18 months.

Another benefit is the bond tree could effectively be built at the second layer. An application could use this feature to offer long term bonds, perhaps 3 years, since it is simply a matter of auto-renewing.

Finally, the owner of the account doesn't have to worry about HBD unlocking and just sitting there. If Ragnarok has HBD entering everyday, a year later the reverse will take place. This feature could remove that obstacle for the team.

Of course, there is the possibility that things change and someone does want to reverse the decision. Here we can program the feature to be reversed as long as it is outside a window. My suggestion would be 30 days. The auto-renew can be disabled until one is within 30 days of the unlock. Get in that window and it is too late.

Again, this allows for people to monitor the flow of HBD and how people are operating.

Let Us Know Your Thoughts

What are your thoughts about time vaults?

Do you think the auto-renew (redeposit) idea is an effective way to enhance the features on Hive with regards to this? Will this enhance the potential of applications that integrate this into their processes?

Is there something that we are overlooking? Are there other things that you can see added that could be of benefit to the ecosystem?

Drop your thoughts in the comments.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta