It is no secret that many believe the Hive Backed Dollar (HBD) is a gem for the entire Hive ecosystem. The potential that exists with the coin is amazing. We are still very early in the process yet there are many who are working push it even further ahead.

The witnesses made some news a number of months back with the decision to pay 20% interest on any HBD put into savings. Many were fearful that it would be a destabilizing force to Hive and could provide a point of vulnerability. It was also questioned whether it would be sustainable.

Since the decision to start paying interest took place a little over a year ago, we have amassed some data to see how things are progressing. As it turns out, there is a major use case for HBD which is presently being overlooked. This might not have been by designed but this is how evolution occurs. Sometimes it goes in directions not expected.

For the sake of this article, we will be using the numbers and images compiled by @daltz and posted in this article.

Removing The HBD Threat

Why is HBD a threat?

It is a debt instrument. Each time one is created, the blockchain has to back it with $1 worth of $HIVE. This means that, as more is generated, the market capitalization of $HIVE has to be greater. Of course, this is only an issue if the HBD is converted. If it remains as HBD, it poses no risk.

Here is where use case enters the picture. If we can deter people from converting HBD-to-$HIVE, we can provide additional defense of the ecosystem.

This can be done in a number of ways, some of what was detailed in other articles. However, one of the reasons for proposing the idea of on-chain time locked vaults is to keep the HBD out of circulation. It is how we see the threat removed since the HBD would be locked up and the community would know how much is due to hit the market, and when.

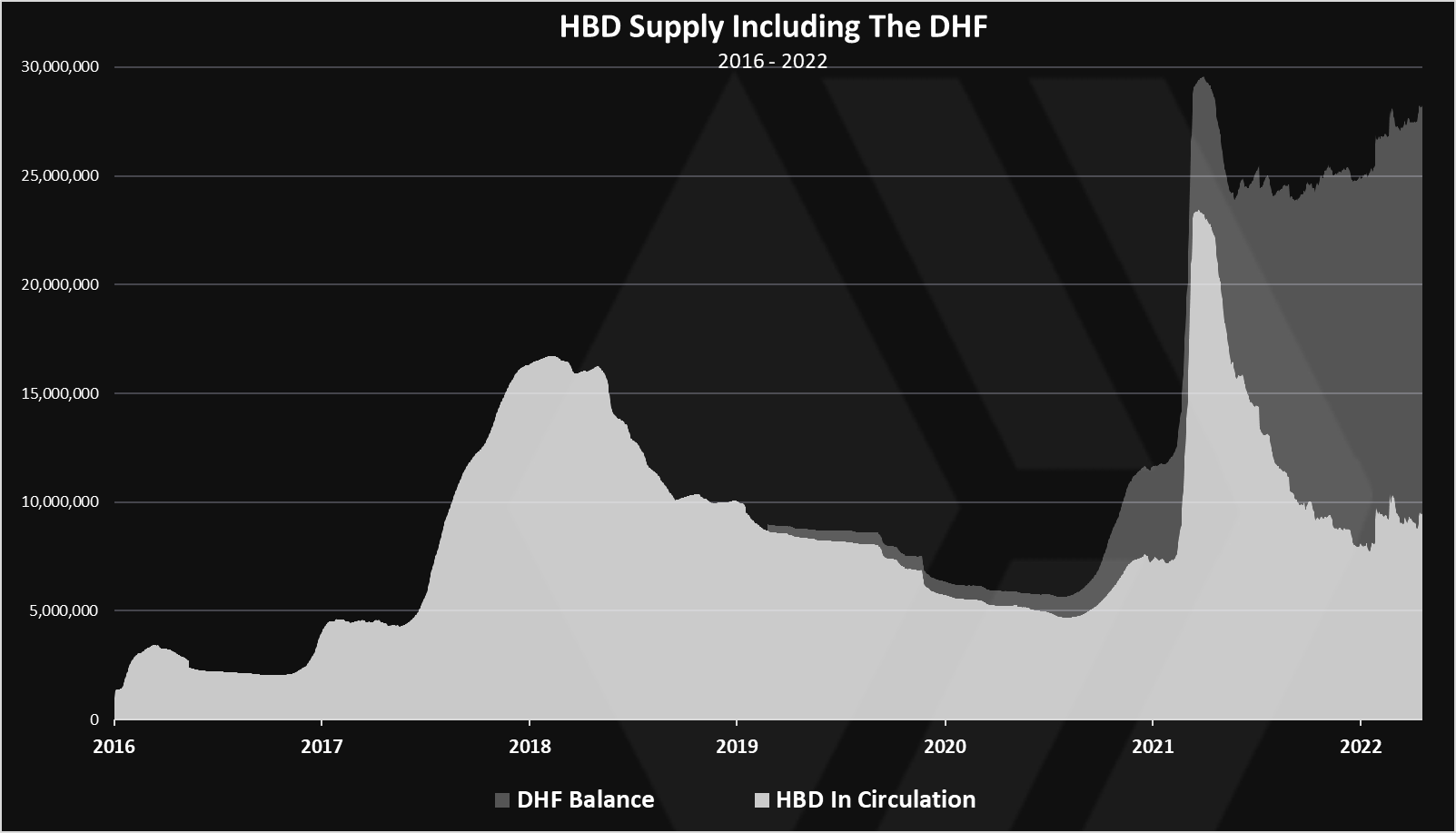

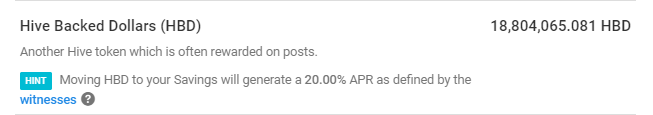

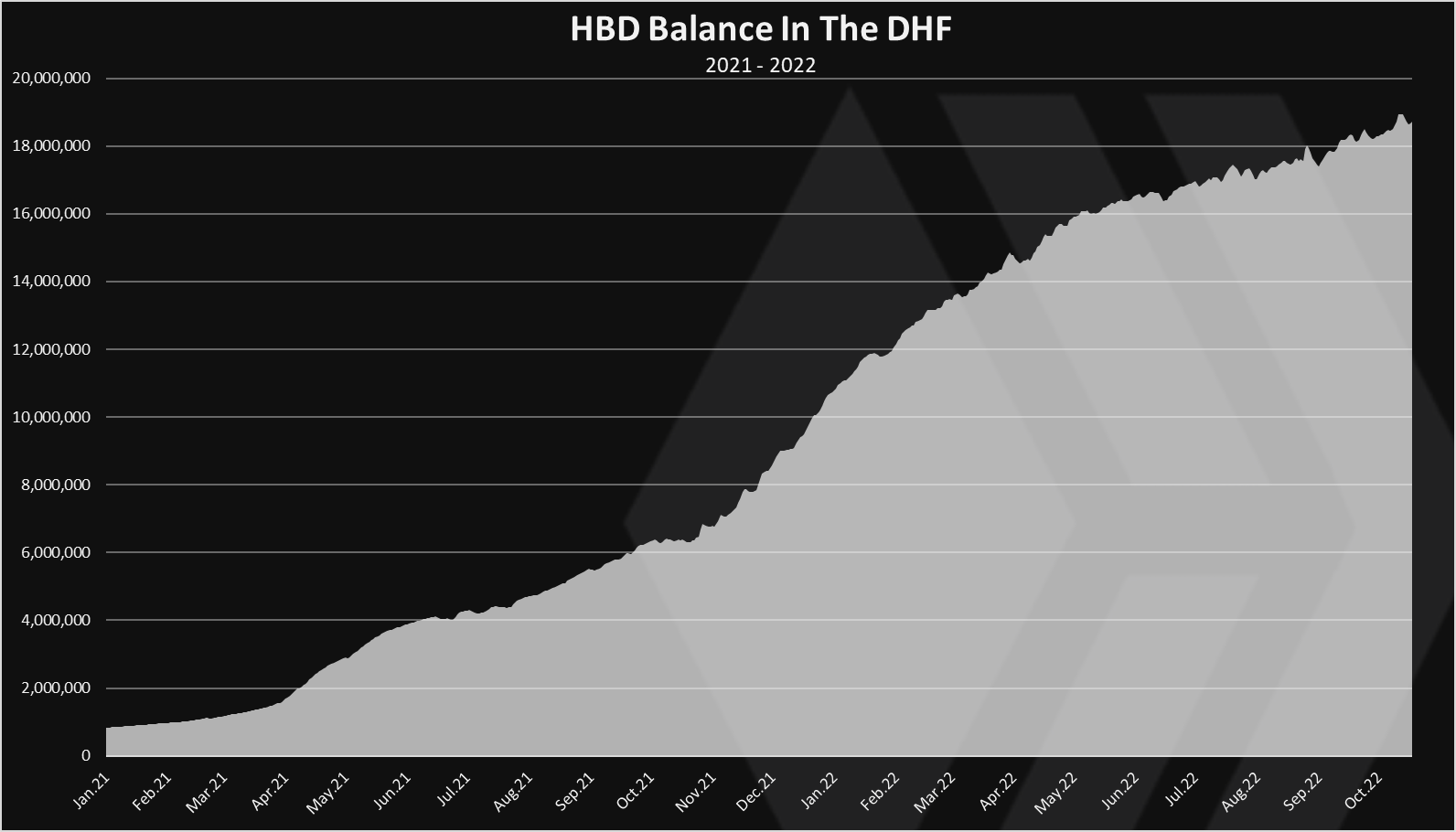

Nevertheless, this is forming without this feature. The HBD Stabilizer is providing the major HBD use case. As we can see from the chart, the tokenomics pertaining to the stablecoin is radically changing.

HBD: Funding Hive's Future Development

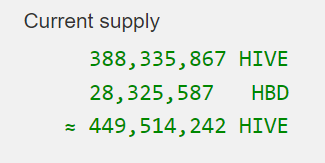

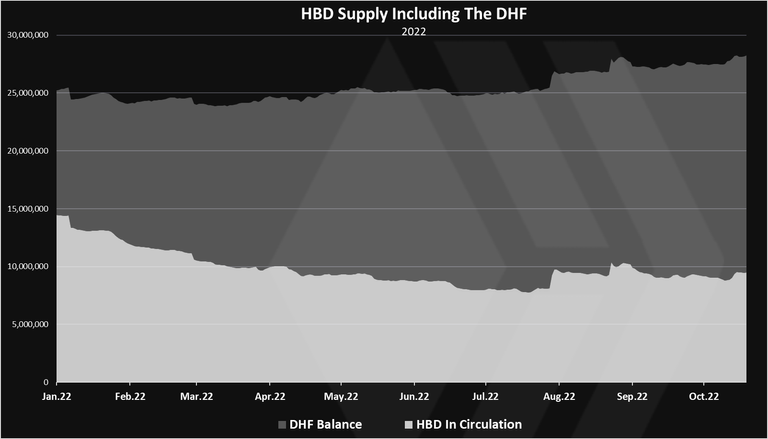

Let us take a look at the most recent numbers.

Here is the total supply of Hive coins as shows on Hiveblocks:

We will cross reference this with the Decentralized Hive Fund's wallet:

This means there is roughly 10 million HBD in circulation. For those who have not been paying attention, this is not a major change from earlier in the year. Thus, even though more HBD was created, it is not out on the market.

Here is a chart that captures it.

As we can see, the total HBD is up about 3 million while the circulating HBD is down by a similar amount.

Ergo, we can have the biggest use case for HBD up to this point.

Due to the efforts of the HBD Stabilizer, more HBD is being fed into the DAO. This is locked up, released over the course of a number of years. Evidently, the decision to pay interest on HBD in savings is resulting in Hive having more money for future development.

The HBD Stabilizer is:

- providing liquidity to Hive's Internet Exchange

- removing HBD from circulation

- funding future development

It quickly becomes evident how this is a major use case going forward. Paying for development is essential. The data is revealing exactly what is taking place. The more HBD that is created, a growing portion is ending up in the DAO.

Fortunately, we have a chart that shows exactly how this is the case.

Another interesting twist is the fact that the more money in the DAO, the larger the daily funding of projects. Here again, since the HBD Stabilizer gets the lion's share of the payout, almost 185K each day, we see a continuous cycle emerging. As the daily HBD grows, the amount returned to the DAO follows the same path.

Ultimately, this means that we will have more money available to fund development tied to the Hive ecosystem. Of course, the goal here is to use this to grow the value of Hive overall, something that the market will eventually pick up on.

Expanding The Fixed Income Market On Hive

The next article is going to expand upon this idea. However, we are now seeing how Hive is offering a low-risk, powerful return at the base layer. The threat risk from the additional debt to the ecosystem is minimized by the locking up of the HBD.

About a week ago, we spelled out a major idea for The Hive Financial Network. Some of the infrastructure is already under construction which is a positive sign for Hive. However, as we will see tomorrow, there is another layer we can add to this.

For now, the key to understanding the power of a stablecoin is to grasp what we need to focus upon. To be successful we are going to need:

- liquidity

- depth

- sophistication

- infrastructure

None of this happens overnight and is a continual process. That said, to be a force in the world of currency, we have to place a great deal of attention on this.

At the same time, four major use cases emerge:

- funding and investing

- payment system

- derivatives

- collateral

So far, Hive is excelling at the first one. By having more HBD in the DAO, we effectively are positioning ourselves to fund more development. That is an investment in Hive's future.

All of this is being done with the idea of security and defense foremost in our minds. We are using a combination of coding, game theory, and actual use case to expand HBD while also protecting the chain.

Now that we have some data to work with, we can move onto the next stage. That will be revealed in the next article.

Other Articles Related To This Subject:

- What Gives HBD Value: Payment System

- What Gives HBD Value: Derivatives

- What Gives HBD Value: Investing And Funding

- What Gives HBD Value: Collateralization

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta