The prevailing mindset is "inflation bad, deflation good'.

This is one of the most absurd concepts that we have. How people botch this up so bad is beyond me. Of course, it leads to a host of narratives that turn into, in some instances, an ideology.

Deflation is 10 times worse than inflation. In the United States the last massive deflationary period was the early 1930s. Look it up, it was not a pleasant time. There was a reason it was called the Great Depression.

China Is About To Teach The World About Deflation

I can see it now, people are scratching their eyeballs. How can anyone proclaim that prices going down is a bad thing?

Don't people get upset when the price of their stocks or crypt go down? Is that something they loo at as positive?

Of course, this is absurd. What is referred to is the price of goods and services that people purchase. That is what people want to go down.

Taking that approach, do you think the lawyer likes to have to take a pay cut, reducing his or her biling rate from $300 to $150? How about the accountant having to reduce the pricing of each tax return? Do you thnk landlords like getting less rent for their properties, at a time when taxes are always on the rise?

Speaking of property, do people like walking into a closing and having to write a check for $10K or $20K because the property is underwarer?

The answer is no.

Japan Is The Shining Example

People in the United States are known for their inability to look at anything outside of it. If people did, they had one of the best examples of deflation from Japan.

This was a country flying high through the 1970s and 80s. Then, as we entered the 1990s, things hit a brick wall. Japan experienced its lost decade. Unfortunately, that decade is over 30 years long.

Here is Japan real estate.

Notice the peak in 1991. More importantly, even with the uptick the last decades, properties bought as late as 2001 are still underwater.

The other problem is the GDP per capita. One can look at this as the "national paycheck".

Looking at this, do you think the average Japanese worker is getting a wage increase or decrease? In 1995 it was $44K, as of the last reading, it is $33K.

Do you like going into work and getting a 33% wage cut? That is what happens in deflationary times.

Of course, that is for those lucky enough to hold onto a job. When deflation hits, companies start laying off. Deflation does not happen in times of growth (unless pushed by technology). Instead, it tends to parallel recessionary times.

If a company has less revenues as compared to the year before, do you think they are going to give out pay increases? The answer is no. Actually, they start cutting personnel.

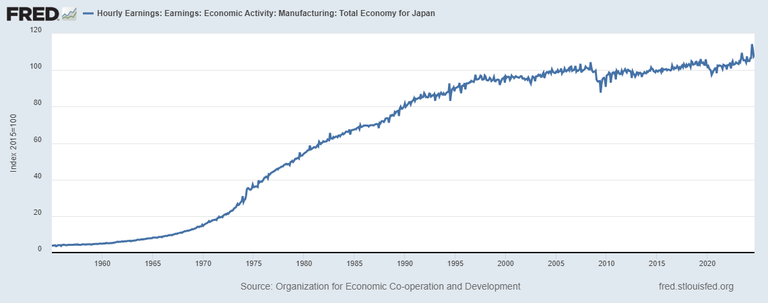

Look at the wages in Japan over the last few decades. They basically flatlined.

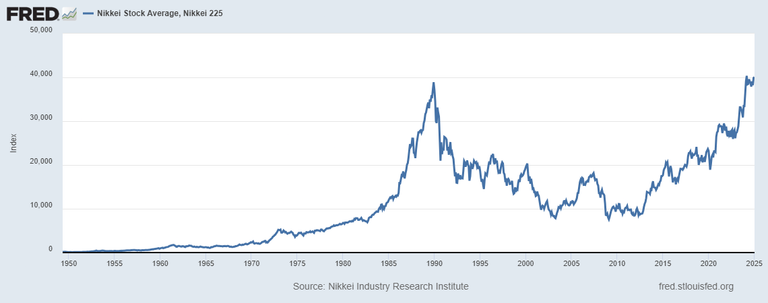

Then we have the stock market. Again we see another situation where 3 decades of loss from the peak.

As we can see, people were in a loss for 20 years. It is only in the last 15 that things started to turn.

China On Steroids

China magnifies everything because of the size of its economy and population. It is also a country, unlike Japan, that garners a lot of headlines.

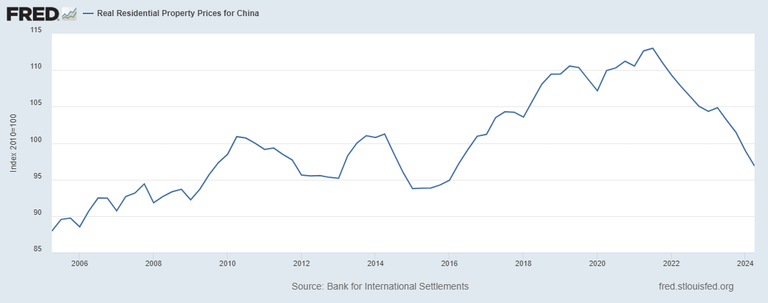

It is also a country of savers. The Chinese people have two places to put their money: stock and real estate. Let us look at the latter.

Remember Evergrande. As we can see, the price of real estate in the last couple years has crashed. Many will state this is a good thing. After all, housing is more affordable.

There are two problems with this view. The first is the condition sucks for those who own properties. We have a tendency to look at things from the buyers perspective. What about the seller?

In this instance, property owners are losing a fortune especially since the Chinese are known for making huge downpayments (50% or more). The price of their assets are crashing, with no end in site.

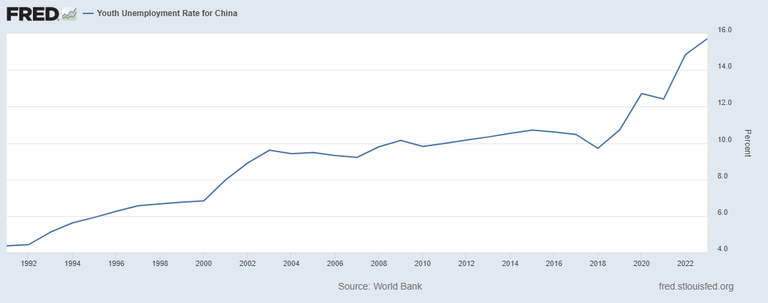

Another issue is unemployment. China is a country with an aging population, meaning the older workers are exiting the workforce.

In spite of this, the unemployment for young people is skyrocketing.

According to these numbers, it is over 15%. Who cares what the price of property is if one is unemployed?

The world could get a lesson on what deflation looks like. Since few walking the planet were around during the Great Depression, we forget how bad those times were. Unfortunately, for many, they are about to revisit those considtions.

Posted Using INLEO