This is the question on everyone's mind. What is the real estate market going to do and how will interest rates affect things?

To start, anyone who follows this blog knows that the Fed's impact upon interest rates is misdiagnosed. Even the Fed itself admits there is no correlation between moves in the Fed Funds Rate (which the Fed set) and the 10 Year, the standard that the mortgage market tends to follow.

However, that does not mean that markets to not react to what the Fed says. Thus, we already see mortgage rates going up even though the Fed has yet to raise rates. It once again seems that the Fed's influence has an impact.

So how do we unwind all of this and how will it affect real estate?

Let us dive in.

Source

Increase In Rates Kill ReFi Market And First Time Buyers

If the Fed has no impact upon rates ultimately, how do we decipher which direction they will head. The reality is that, due to a variety of monetary and economic factors, rates cannot rise for an extended period. Rising interest rates is a sign of a healthy economy. What we are looking at is anything but healthy. In fact, it is easy to see how many are making the case that things are rather sick.

Therefore, we can expect the long-term trend, which was in place since the Great Financial Crisis to continue. We see an economy that is limping along, falling behind all longer term growth lines. Here is where we see rates turning downward again.

We also have evidence of this in both 2013 and 2018. Each time the Fed reversed course, it was bad news for rates. It is true they went up initially before the market realized what was going on. Anyone who looks at the charts sees he reversals were fierce.

Of course, the near-term rise in rates is what applies to real estate.

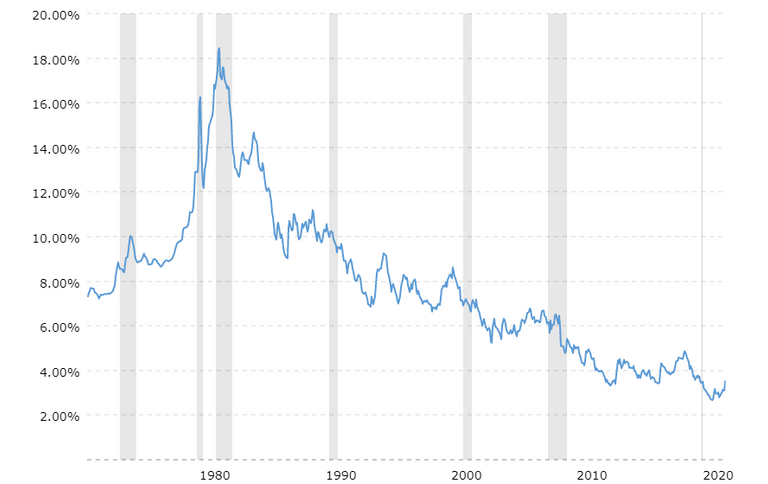

There is little doubt the downward trend that is in place. Look at this 30Y on over the last half century.

In other words, from a historical perspective, the cost of borrowing money is still very cheap. This is where the problem comes in. With a continue decline, the refinance market (ReFi) is about to get slaughtered.

Here is what is happening with mortgages already.

Source

This is going to have a major impact. We are seeing the ReFi business getting crushed since most people already refinanced their homes to lower rates. As rates go up, even if it is for 6-12 months, this stops a great deal of activity in the mortgage market.

It also impacts the first time home buyer. Higher rates do mean larger payments if the price of the home remains the same. Of course, it is likely to bring home prices down but that can take a while. The real estate market can be slow to move. Unlike the equity markets that simply collapse, real estate tends to be more of a process.

Watch for this to unfold throughout the year.

Rental Rates Get Crushed

What is often overlooked in the discussion is the fact that rents tend to drop as the values of homes go down. This is going to cause a world of hurt for those who got in later in the bubble (Blockrock?) and are fixed in trying to get their rate of return.

When things head south, those with a lower cost basis (or ones who join in as prices regress) can adjust their rents accordingly. The enables them to undercut the market while attracting the highest quality tenets. Since they are in a strong position on the cost basis, the cashflow is still present even at lower rents.

This simply is not the case with many of the other landlords. They have to try and get larger payments simply to stay in the green each month. Here we see where the problem can snowball.

As prices decline, newer people enter. Again, with a lower cost, they are able to operate with the present market conditions. This adds more pain to those who are just trying to hang on.

Of course, as the foreclosure process picks up, something that is starting, it ends up putting more inventory on the market. Savvy investors are able to hop on bank deals helping to reset the entire pricing structure for the area.

Markets Do Turn

Many people find it impossible for markets to turn. It seems they forget that there are two directions. Read the headlines of any economic numbers that are high right now and you will see how the sentiment is things will only go higher. Both inflation and real estate prices are only going to moon according to many.

This is absurd. One of the things that can alter a market is affordability. With real estate, this was an issue for a long time. Now, it is being compounded with the rise in mortgage rates. Since this will likely take much of 2022 to sort out, we can expect it to have an impact upon the price of homes. We can offer a simple guess which direction that will take prices.

Anyone with an ounce of sense know it is not a question of "if" the real estate market head south but "when". The same is true for the equities market. Nothing goes in one direction.

Real estate carries a lot of pain with it. To start, it is leveraged. Hence, when things turn, the effects is much greater than if everyone paid cash. Also, it is a major part of the economy. This means the impact is felt outside the real estate industry itself.

Now that we know the real estate market will turn, the big question is when? That is tough to say. Since it is a process, instead of looking for a collapse, try to find some cracks. Mortgage applications, pricing in certain areas, and the exiting of real estate agents are all good barometers to seek out.

The latter is very interesting. During the run up before the GFC, it seemed like every 3rd person was a real estate agent. There were women who were married to attorneys who were pulling down $4K-$5 per month, part time. Of course, when things turned, they went back to doing whatever.

What we know is things leveled off starting in June of last year. This is a normal topping pattern for real estate. What happened in 2006 is not typical. It is a pattern.

That said, things can go on for months without a major change. We could see the leveling off continue well into the Summer. Of course, it is helpful to keep in mind that, the longer things go, the closer it gets to the Boomers unloading. Do not forget, the largest generation in terms of size is going to be downsizing. This could put markets such as the Northeast in a world of hurt as these people finally unload their properties and move to someplace warm.

Therefore, in conclusion, the time is coming near. Over the next 12-18 months it is likely that we see a large pullback in the real estate market. This likely will not be a crash like in 2006 but a grind down. Some areas are going to get crushed while others will hold up well. Nevertheless, the cleansing is not far off.

This is how markets work. Over time, excess gets washed out. And right now, real estate has a lot of excess in terms of market valuations.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta