We are seeing things really taking shape. A few announcements this week got the entire Hive community in general, and the Leofinance community in particular really excited. There is a good reason for this. We are seeing some things rolling out that are truly amazing. It is now up to all of us to keep the ball rolling.

One of the things that we are seeing is the push towards adding more value to token holders. This started with the Leo Ad Revenue being sold for LEO and distributed among the Leo Power holders. This is being done in an effort to increase the APY that is provided.

Previously, the ad revenue was used to purchase, and then burn, LEO. This helped token holders a bit since it reduced the float. However, the idea of burning money is never a good idea and Leofinance advanced passed that stage. There is no reason to head in that direction when the project is undertaking strong business building strategies. It seems in crypto, everyone wants to burn tokens as opposed to actually constructing something.

Nevertheless, we see the shift with Leofinance.

Pushing Value To xPOLYCUB

We do not need to go through all the different ways that are planned to generate revenue that will be fed into xPOLYCUB. This was covered in a number of articles and videos already. However, there is one that was put in a recent article that really caught my attention.

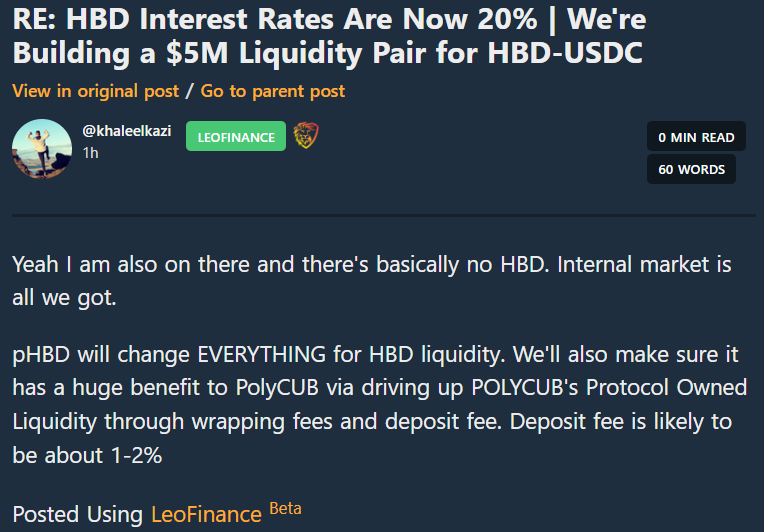

We are all excited about the pHBD-USDC pool that is being built for Polycub. There is little doubt it is needed, and badly. The idea is to get as much liquidity in there as possible for HBD. This is going to be paramount if the 20% HBD savings rate is going to be utilized in any sizeable manner.

While the LP itself is interesting, what caught my eye was this:

- pHBD Wrapping and Unwrapping Fee: a 0.25% fee is accumulated when wrapping and unwrapping. This fee is paid to PolyCUB's Protocol Owned Liquidity and PolyCUB will deposit it back into the pHBD-USDC Vault (meaning that it adds to permanent liquidity for HBD while also bolstering PolyCUB's reserves)

This is huge. We all know the bLEO and pLEO bridge charges 1 LEO per transaction. It is something that makes sense since it is Leofinance's main token. Having that extended liquidity only benefits the entire ecosystem and isn't meant to be a major profit center.

HBD is obviously a Hive token. Here is where we see the ability to help out the Protocol by building the Treasury. Simply put, the more fees that are generated, the more of a stake in the pool the Protocol will have. This means that whatever is generated and owned by the Protocol will be fed into the xPOLYCUB contract.

Certainly this will enhance things for holders of that token.

One of the biggest takeaways from this is the fact that we can see a nominal fee being charged that can generate a large amount of revenue. Since the bridge between Hive-Polygon-BSC will be in place, this could be a great "toll" to collect. Here again, it only goes to enhance the value for the holders of xPOLYCUB.

Over time, this could amount to a large sum of money if the bridge is heavily used. At this moment, accessing Hive is not easy and this might be a great way to do it. Simply pick up some pHBD (or eventually bHBD) and move it over into HBD.

Like anything else, if things become really active, millions of dollars could be traveling through there on a regular basis.

Post-Inflation

Much of the cryptocurrency world cannot envision a situation without rewards coming from inflation. This makes sense since we do not see it very often. Much of the DeFi world say projects crash because the only thing they could provide was rewards via inflation.

Leofinance is taking a different approach. As we can see, there are voids being filled. The team is building things it believes will be used. Does a HBD bridge make sense? Of course it does. So too does a liquidity pool for that token. There are really none out there. What does this do? It generates revenue. I know this is a novel concept but, what the heck, let's try it.

Here is where the leveraging of what is being build in different areas starts to enter. There is already a presence on BSC. Now we are watching Polygon being embarked upon. Down the road we know there will be other EVMs chosen. All of this is going to require cross-chain connection.

The idea of generating value (in the form of revenue) and passing it along to the holder of the tokens is a major step forward. We can see the excitement that was created with the announcement of the new Leo Ads model. Having our returns increased through the rewarding of those who stake the tokens is a winning idea.

We are entering a new era of cryptocurrency. Not only are we seeing the shift away from a realm of nothing more than speculation, we are also seeing the emergence of business operations and how to create revenue.

Leofinance seems to be right in the middle of it.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta