This is how a project should operate. Here is where long term success is separated from the "burst onto the scene and then crash" projects. We all know how some things can emerge with a great deal of hype only to fade away. It was an experience that was common during the ICO craze 5 years ago.

Since that time, through the Crypto-Winter we all endures, the industry moved ahead a great deal. Those that are in strong position today are there because of development. Without it, all is doomed.

Polycub designed, developed, adjusted, re-designed, and re-developed. Not willing to stand still, the project is always willing to take feedback. Here we see the accessing of the Hive-Mind is crucial.

Because of this, Polycub just keeps getting better. Those who are involved are going to be very happy campers. That is not, however, the only ones who are going to be smiling from ear-to-ear. Since Polycub is the template, all that is on there will be rolled into Cubfinance (on BSC). Also, when the next "outposts" are released, we will see all this duplicated on other chains.

It is now official: it is time to get very excited.

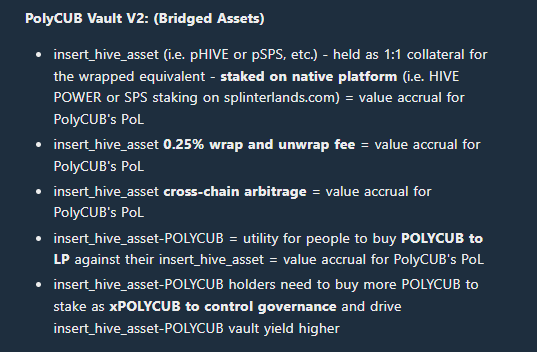

5 Value Accrual Mechanisms

We are now in Vaults 2.0. The most recent adjustment in the Polycub focus is employing this system. In the most recent announcement, the @leofinance team spelled out exactly how the Vaults are changing.

Here is what it looks like:

That is a fair number of ways to keep feeding value into the Protocol. All of this is in line with business building. The adage find a need and fill it applies here. We all know there are some liquidity issue with some of the tokens that could end up here. By building out a strong platform, the idea is to increase the liquidity of all tokens.

What started out as targeting HBD is now spreading. We next will see pHIVE adding to Polycub, increasing the access that token has by wrapping it on Polygon.

We also have to highlight the cross chain arbitrage that is going to take place. This is vital for the pHBD and, eventually, bHBD. From the Protocol perspective, arbitraging any of the tokens can be profitable. However, with the stablecoin is is imperative to get as many arbitrage cases going as we can.

When a pegged asset gets out of line, that carries the potential to profit. Those seeking to bring the peg back can get rewarded. This is how the Protocol will make money while pushing the price back in line with the peg.

Everywhere we look, the Leofinance team is looking to enhance different aspects of the Hive ecosystem.

Lending Feature

We have to keep in mind the lending feature is still slated to be added. This is going to be a very powerful mechanism that will magnify what is already taking place.

At present, and over the next couple weeks, we are going to see more value added to the platform. This is crucial. With more LPs, the TVL ends up increasing. This obviously becomes crucial when looking at the addition of lending.

Basically, people are going to be able to take out loans against the value they locked into the platform. This is going to come in the form of some payout which then can be reinvested. That means, depending upon what is eligible for loans, the value there can be accessed and used to buy more of whatever is staked.

Think of it as taking equity out of your home. However, instead of buying a boat or car, the money is used for investment purposes.

As an example, if one is holding xPOLYCUB, that can be utilized for a loan. Let us say that one has $5,000 in xPC, and the limit is a 50% loan. That means $2,500 can be used to reinvest. If the person decides to get into the pHBD-USDC LP, then we will see $2,500 added. It increases the liquidity in there while also earning a return for the individual doing it. The additional proceeds from entering the LP can be used for loan repayment.

Of course, one still retains the xPOLYCUB and all value accumulated while the loan is outstanding. Again, think of a house where one get the appreciation even if there is a mortgage.

Hopefully now everyone is starting to see the opportunity that is before us. We are seeing the infrastructure being put into place for a larger platform of lending, investing, and collateralization.

And the best part is they set up a DAO to manage it.

As long as the team keeps developing while remaining flexible enough to implement feedback, Polycub along with the other outposts are going to do very well.

This will, of course, further the Investor's Dilemma. Most of us are find more opportunities than we have resources.

It appears the opportunities from Leofinance are only going to keep growing.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta