It is amazing how people fail to even understand even the basics of our monetary system. This results in a lot of misinformation being spread along with people being completely clueless as to what is taking place.

For example, have you heard about the USD being destroyed by the government and that it is going to fail? This is being spewed most by the gold bugs and Bitcoiners (most of whom are the same). In fact, there were some point made on this topic and this article is going to dissect what was said. We will analyze the particular points made and see how accurate they are.

I will post sections of the comments so as to be able to take each point.

What you will see is how the inability to even research some of the most basic data is often overlooked. This means that the entire viewpoint about the USD, fiat currency, and how our monetary system works is completely amiss.

So let us begin.

Government/Fed Printing Too Much Money

This point is negated in the first sentence. The Treasury prints USD? The Fed? Is this true?

Anyone who understands how USD is created knows this is not the case. It is completely false. Neither Treasury nor the Fed prints USD. These institutions are not responsible for the expansion of the money supply.

Treasury creates securities that are sold for USD at auction. That is how spending packages are paid for. The T-bills and Bonds are sold for existing dollars. When entities purchase the securities, they remit USD from their bank accounts.

Hence, USD created from the sale of Treasury Securities: ZERO

As for the Fed, the same is true. It does not print USD. In fact, it is against both the Federal Reserve Act of 1913 and the Banking Act of 1933. The Federal Reserves liabilities are NOT legal tender. This means it is impossible for it to create USD.

What does the Fed create if not USD? It create reserve notes that can only be held by depository institutions. There is not a business or individual in the United States (or elsewhere) who can hold these assets. The giveaway is that none of us have accounts at the Fed.

Since this is not legal tender and can only be held by depositing institutions, what the Fed prints is nothing more than a bank instrument. This the idea there is an excess supply of USD due to the Fed is completely false. None of what the Fed produces can be used to purchase goods or services. In fact, even though it is on the commercial banks balance sheet, it is housed at the Fed. The reserve notes never leave there and can only be transferred between other depositing banks.

USD created by the Fed: ZERO

So who creates the USD? Since we operate under a credit based monetary system, money is created via lending. Therefore, the money supply expands when loans are made and contracts with repayment or default.

Here is something crucial to understand: USD is created by the US banking system. That is who handles the currency. So the question is if the banks were lending a great deal over the last couple years.

The answer is that a total of 2.5% expansion in the money supply took place between April 2020 and December 2021. This is less than half a trillion dollars generated in just under 2 years.

Facing one of the worst global economic crisis since the Great Depression, a 2.5% expansion in the global reserve currency is not going to cause what is claimed.

Biden's Policies Sent Oil Prices Soaring

Here we see a mixture of ideology along with misunderstanding. It is true the Biden administration is not exactly the friendliest to oil. However, to blame all on his is misguided.

To start, oil is a global commodity produced by many different countries. We also have a cartel right in the middle of the entire industry. That said, there are other factors to consider.

Since the focus is upon the US situation, we will focus upon those numbers.

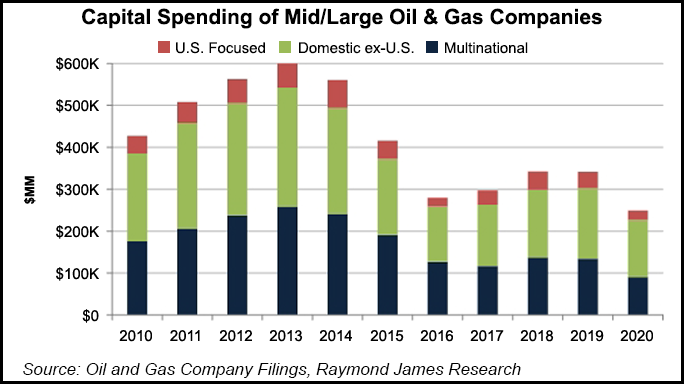

Do you think investment is important in the oil industry? Of course, it is vital. How has that fared of late?

Source

Notice how there is a huge decrease in capital expenditures by the oil companies since 2013. Through 2020, it was reduced by almost 60%.

This shows up in the rig counts. As of January 2019, there were 877 oil rigs in use. By the end of December 2021, that number was back up to 480 after reaching a low of 181 in 2020. Source

Not sure what this has to do with the collapse of the USD but again, we see a claim that is overwhelmingly false. The reality is the oil companies have not been investing in production. We see this in both the CAPEX and oil rig counts.

Governments Tired Of Being Bullied

Here again we have a view that is clouded in unsound judgment. Are countries upset with the United States? Most certainly. Are they going to dump the USD because of it? Of course not.

The idea that people are going to do any large scale international deals in anything other than the USD is almost laughable. What are they going to turn to? The Yuan? Does anyone trust China? How about the EURO? The Europeans have a lot history of nuking their currencies as well as destroying their bond market. So not too many are going to opt for that.

Regardless of how people feel, the USD is the best house on a bad block. There is nothing to replace the dollar with which is why every attempt to replace is fails.

As for the idea of selling the debt, there is one reason they do that. People think it is because they lack the confidence in the US. That is not the case. Has the US ever defaulted on its debt? No it did not. Will the Treasures be paid on? Absolutely.

But getting more to the point, what happens when countries sell their Treasuries; what do they get? USD. So how it the dollar going to collapse if people are moving into it?

The reality is that countries are selling US securities because they need the money. Anyone who takes a look at the global debt levels sees a great deal of it is denominated in USD. That means they need dollars to pay it back. This is in addition to whatever is needed to purchase anything internationally.

All of this is summed up in how the USD behaves. For 30 years, we heard the gold bugs calling for a collapse in the USD. They claimed the Fed printing was going to destroy it yet it never happened (since the Fed doesn't print USD). It is always around the corner.

Let us see where the Dollar Index (DXY) stands:

Who would have guessed we are higher than we were for most of the 1990s (the last time the US actually has a surplus) and are in a channel higher than the previous 10 years. Is this something that looks like it is collapsing? In fact, we are above the levels we were at in 1980.

Ideology, misinformation, and complete lack of looking at data often leads us to hear a lot of claims that have little to no validity.

Hence, if you are waiting for the destruction of the USD, you are going to be waiting a long time. Most who make this claim either have an agenda or are simply do not know how things operate.

Unfortunately, the cryptocurrency world is infected with these cancerous ideas. Here were three arguments are easily refuted.

What is more likely to happen, since there is a global shortage of dollars, we are going to see a major burst higher at some point as companies and countries are forced to convert their currency into USD to make payments on debt. They either do this or face default.

Either way, the US Dollar is only going to be strengthened not destroyed.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta