A few days ago I wrote an article about whether xPOLYCUB would hit $100. Now we can certainly say it is in the cards.

One of the focuses for the development team was the idea of building sustainability. The concept behind the deflationary token was not novel. We see that a lot within cryptocurrency. However, without growth, deflationary tokens are nothing more than garbage. Far too many see this as a path to success when it is misguided. Fortunately, Polycub was approached in a different manner.

Essentially, the idea is to have a deflationary token in POLYCUB which is represented by HODLers as xPOLYCUB. Since all activity on the platform is priced in USD, including POLYCUB, the plan is to have a continued source of buying pressure on the token through the USD value generated via fees. This starts with the Kingdoms yet quickly expands.

We just got an article detailing the immediate road map for Polycub.

For those who do not grasp what is taking place, we will delve into it. This is revolutionary so hold onto your britches.

Bonding

The key to understand here is the protocol is about to get an ownership stake. This is based upon the OHM platform which might not be so encouraging to people.

Looking at the chart, the only word that comes to mind is ugly.

This is nasty. From over $1,000 to $29. That is bad. So why would Leofinance copy this? As with anything, you take pieces and improve upon it.

Remember the goal of Polycub is sustainability. The next section will show how this is the case.

Before we get to that, let us explain how bonding works on that system. I do not have the details of it for Polycub yet presume it will be similar to what is done with the OHM token.

Essentially the protocol is buying the liquidity in a LP. So in this instance, people will bond their LP stake for a discount of POLYCUB. Hence, the person can collect the POLYCUB after a certain period of time (say 5 days) and have an instant profit. This can be rolled into more LP or whatever the person wants to do with the proceeds. Thus it is a way to make a quick 5% or 10% on one's money.

The protocol now has ownership in the LP. This means that the ongoing fees and other ROI generated are fed into the protocol, enhancing the value. Here is the feeder mechanism to the xPOLYCUB contract over time.

One major benefit is permanent liquidity in the pools. This is big for the ongoing operation of the platform. As we know from Hive-Engine, a lack of liquidity can often deter activity. When people cannot get what they need, they will go elsewhere.

The protocol is what does the buying of POLYCUB to feed it to the different areas of the platform. As the emissions dry up, here is the sustainability mechanism to keep value flowing throughout.

Collateralization

Here is where the true game changer enters the picture. On this one, I will not steal Khal's thunder (he so enjoys the build up to announcements so why deprive him of that). However, what I will say is just think in terms of sustainability of the entire system and a positive feedback mechanism on a larger scale.

When Khal mentioned the idea of POLYCUB following Bitcoin, it brings up the idea of collateralization. This is where I think Bitcoin's major use case will be in the future. That said, POLYCUB is not really the mechanism but, rather, xPOLYCUB.

Let us look at where things stand now.

Right now we have $1.75 million in value locked up in xPOLYCUB doing nothing. For the moment, this is not a great deal of money, proportionately speaking. However, as we get further into the program, the thinking is this will increase significantly. Therefore, we are likely going to be looking at tens of millions of dollars over time.

With collateralization, this is guaranteed.

The idea here is to take the value locked up in the xPOLYCUB and use the holdings of the protocol to provide liquidity for further investment. This helps the position of the individual while also providing a positive feedback loop.

For example, if one has $10K worth of xPOLYCUB, that person might be able to get $5K as a loan. Depending upon how the deal is structured, a certain percentage can be fed back to the protocol (once again furthering the holdings there as well as providing more resources to buy back POLYCUB).

The individual can take the loan and put it into something that is providing a strong return. Look throughout the ecosystem and project where things will settle. Forget the 1,000% APR. Let us use the idea of a 60% APR LP or Kingdom. The user, in this example, could take $5K and put it in there for a $3,000 annual return. Out of this yield is how the loan is paid back.

Without the details (and numbers) it is speculation but you can get the general idea.

$100 POLYCUB

Here is where the idea of $100 POLYCUB enters.

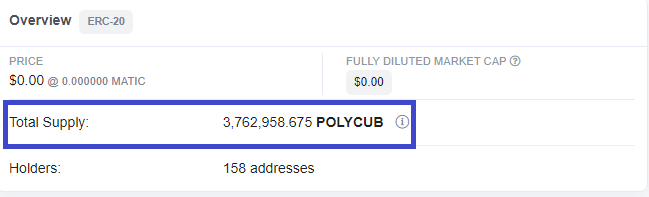

As we can see from the snapshot above, we have a bit over 150K xPOLYCUB right now. Based upon the PC/xPC ratio, using the 7.241 million POLYCUB target, we have a max of a little over 477K xPOLYCUB. Personally, I expect us to end up around 225k-250K. This is where we will top out when the emission rate moves to a level that is of little (to no) consequence.

This is targeting a TVL in xPOLYCUB of over $22 million. How is that possible?

Here is where the sustainability enters the picture. It is one thing to add in bonding, which will help. However, the collateralization is fosters everything on this end.

Basically, it will be foolish for each individual holding xPOLYCUB not to take out a loan and put that value to work. Again, we will have to see the numbers but if the payback to the protocol is reasonable, there is no reason not to free up the value and starting earning another stream of income.

Of course, this provides even more feedback to the system, enriching the protocol which is used to buy POLYCUB. Keep in mind the scarcity of POLYCUB is guaranteed.

As an aside, if the leveling out is 7.241 million POLYCUB, then we are more than 50% of the way there.

We should also note that 2.2 million POLYCUB is already locked into the xPOLYCUB contract.

Thus, we are going to see another 3.5 million POLYCUB emitted over the next 5 months with most of that occurring the next 30 days. This means we will really be slowed down come the end of April.

At that point in time, the only variable that can really change is the USD value. Where do we see this most prominent in the equation: with POLYCUB.

So while it is not guaranteed, there is a great likelihood that the positive feedback loop that will be generated by both bonding and collateralization will send the price (USD) of POLYCUB heading upward.

When the emission rate is .5 per block (month 3) we will see roughly 43,200 POLYCUB created a day. If the activity is strong enough, this will be swallowed up very quickly. The net result will be run up in the price of POLYCUB.

And guess what this does: it means the TVL in xPOLYCUB grows, providing more value to collateralize and further feed the ecosystem.

Here is the best part: Rinse and Repeat.

Do you see how big this is?

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta