Now that I am full time back in the trading markets, I have been making some decisions on how I am putting my money to work. I am now managing the trading of a small family hedge fund and with that came my 2% fee on the fund intake. This money I put all into crypto. It was paid to me in BTC using Cash App, then I dispersed most of it into USDT on BSC that I am using as collateral supply for my own personal crypto credit line on AAVE, then a portion of it has come to Hive and HBD!

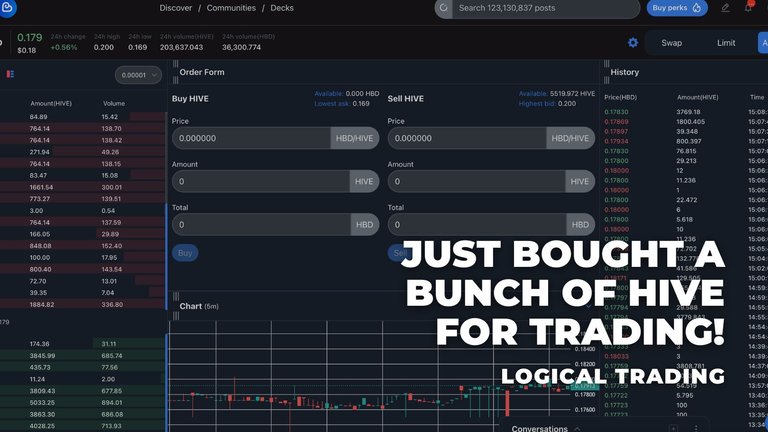

The HBD I have put into my savings to generate that 15% inflation yield that I will use as needed at the end of every month. I have been running it for a week now and trying to get things where I want it for trading and DEFI usage. I made the decision today to move 1000 USDT into HIVE for day trading on the internal exchange!

When I made the move using Simpleswap, which uses Binance mostly for Hive exchanges, I made the price pump! You're welcome, lol!

What this is going to do is give me about $1000 worth of HIVE to start trading with on the internal exchange so I can do my part in boosting the daily volume here! The main reason I decided to move this amount over is because, well, it's free to exchange! On AAVE on BSC, you have to pay gas and LP fees when you trade, this can start getting expensive if you don't realize it and account for it in your profit and loss percentages. The same goes for my leverage trading funds on ApolloX. Although the only gas fees I pay on that are my deposits and withdrawals, I have to deal with exchange fees, which can get expensive when you trade high leverage.

My goal is to build up to where I don't really have to trade on ApolloX anymore and I have enough volume moving through HIVE and AAVE that I can make a decent living in the crypto markets for myself while I use some great strategies in the stock market to make money for the family fund which will grow funds for the farm, my mom's retirement, and eventually mine and my sister's inheritance.

So I am playing it smart, but going to aggressively grow the fund by using a larger passive income dividend account that will be grown by the active traded account that I will be using a cash covered put sell options strategy to buy stocks and a covered call sell options strategy to sell the stocks, and collect contract premiums in-between. It's a great strategy, but you have to have the funds upfront to make it work.

So to wrap it up, I am back to the trading markets pretty much full time at this point, in both crypto and stocks. If you want to talk trading, come join the Coin Logic Discord server! I would love to build a community of traders that all work together for a common goal of gaining some edge and making money in these markets!

Wanna get on a path to financial freedom?

Join the Logical Trader's Club on Coin Logic!

Trading Education | Personal Coaching | Real-Time Alerts | Market Analysis | Custom Trading Indicator

Additional Blog Locations

Many of my cryptocurrency related articles as well as trading articles can also be found on my crypto research site, Coin Logic.

I also post trading chart ideas on my TradingView Profile.

Trade without KYC on the LogicSWAP Exchange!

Click here to trade on LogicSWAP by Coin Logic

Disclaimer:

The information in this trade journal is for educational purposes only and should not be considered financial advice. Please consult with a qualified financial advisor before making any investment decisions.

)

)

Follow

Follow