Patience pays in trading. Sure one can come in really anytime and start trading on the low time frames, but how do you know you are trading in the right direction? This is where zooming out to longer time frames can give you a better outlook on what the market is actually doing and is why I am waiting for Bitcoin to break the current downtrend before I make any big bullish moves.

If you only focus on short term time frames for scalps, you can easily miss the bigger picture and you may actually be fighting against a bigger trend. This is why I always check daily and the 1-4 hour time frames before I go jumping into the 1-5 minute time frames... Yes, I am back trading the 1 minute candle for scalp trades, haha.

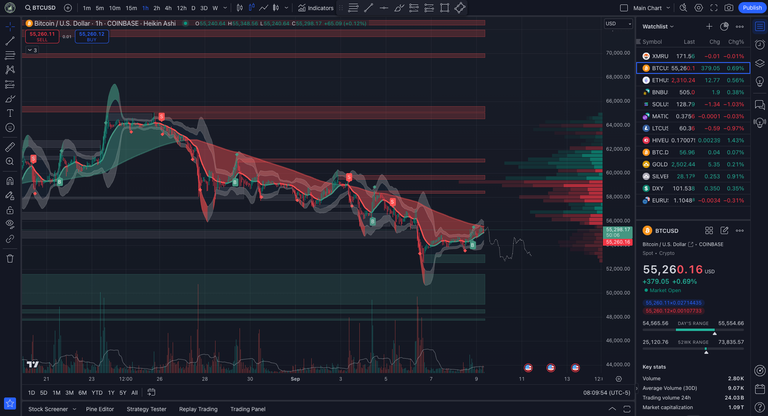

Because of this, I am seeing that the current downtrend in Bitcoin could be coming to an end, but I want to be sure before I go and start putting in buy orders. We are seeing a BUY signal from the Logical Trading Indicator PRO, but I want to wait until the price actually breaks above the long period moving average. What may be even better is to wait until the basis line (20 WMA) breaks the long period moving average. That is a clear change in trend.

Waiting for the bigger trend to turn bullish is a better move, in my opinion, than just jumping in and stabbing away at long trades. For now, since the downtrend is still in play, I am currently looking for shorting opportunities until that bigger trend changes to the other direction. We may very possibly see the 50K-52K level again as there are order blocks stacked up in that area where there are buy orders ready to soak up some cheap Bitcoin.

What do you think? Are you bullish or bearish on Bitcoin? Would love to know your thoughts in the comments!

Wanna get on a path to financial freedom?

Join the Logical Trader's Club on Coin Logic!

Trading Education | Personal Coaching | Real-Time Alerts | Market Analysis | Custom Trading Indicator

Additional Blog Locations

Many of my cryptocurrency related articles as well as trading articles can also be found on my crypto research site, Coin Logic.

I also post trading chart ideas on my TradingView Profile.

Trade without KYC on the LogicSWAP Exchange!

Click here to trade on LogicSWAP by Coin Logic

Disclaimer:

The information in this trade journal is for educational purposes only and should not be considered financial advice. Please consult with a qualified financial advisor before making any investment decisions.