A few days ago I published a poll asking the public What makes someone a good trader?.

It was a simple survey with several options to choose from:

- Entry and Exit point identification

- Selection of the best Indicator/Strategy

-Risk Management - Pattern Identification

- Risk 5% of your budget as maximum in each trade

- Elliot-Waves theory

- Follow the trend

As a result, 50% of the respondents chose that Good Risk Management was the most important thing, obviously, then Entry and Exit point identification was selected by 37.5% of them and Selection of the best Indicator/Strategy was chosen by 12.5%.

It seems that at least half of the trading population knows that developing good risk management is the most important thing, which I will not deny.

In fact, in my experience, risk management is where everyone should start learning first when it comes to trading.

And risk management should not only focus on the amount you are willing to lose on each trade and, of course, on identifying your STOP-LOSS.

Good risk management must also be applied once the operation has entered, and I tell you why.

Throughout my life as a trader I have experimented with dozens of winning strategies in theory.

Some very complex, others super simple. In fact, with the passage of time and my experience, I have been focusing on increasingly simple strategies as long as it is shown that there is a clear "Advantage" to exploit and get the most out of.

It does not matter if the advantage is small, the important thing is that your final balance is positive after time, and by time I mean that the final result is analyzed after having made hundreds if not thousands of trades depending on your available time. The longer the period analyzed, the more chances of knowing if your strategy is really winning.

I can also tell you that striving to find the best entry point and the best reward/risk ratio can sometimes be a clearly losing strategy.

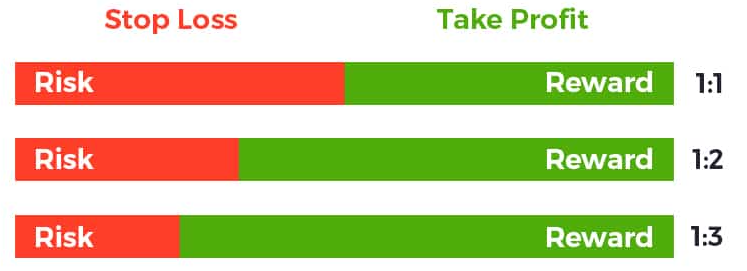

Normally, the higher the reward/risk ratio, the lower the winning ratio. Yes, you must be "PSYCHOLOGICALLY" willing to assume losses in most of your trades and hope that one of them recovers everything you have lost so far, which is assuming that, for example, for a 3:1 ratio you must win at least 25% of your trades, on the other hand, for a 2:1 ratio, it is necessary to maintain a winning rate of 33% and for 1:1 only 50% is necessary.

As you can understand, very few people are able to develop a strategy with a 3:1 reward/risk ratio and psychologically survive losses while waiting for the winning trade.

On the other hand, you can be a winner by being more conservative in your set-up and managing the trade as the operation enters the market.

This means that the set-up, your theoretical entry and exit point, and your maximum risk per trade are important, management during the trade is key.

If you are a conscientious trader, you can wait forever for your strategy to meet all the conditions before entering a trade but once it does, the market can prove you wrong or right in many ways and one of them is the time it takes for your trade to unfold. I am of the opinion that once the operation is within the market it is best to ensure profits by managing the operation as the price develops. This is what I call "TRADE MANAGEMENT".

I never wait for the price to reach my theoretical target before moving my stop, that is, once I'm winning, I move my stop proportionally as I see the volatility of the asset's price... that sometimes leads me not to reach the maximum expansion of the trade but it ensures, on the other hand, that I'm more of a winner than a loser. I already tell you that over time I have become a more conservative and less impulsive trader/scalper.

I focus on a few theoretically winning trades according to the conditions of my trading plan and the time I can dedicate to this hobby, which is not much, for this reason, my trading strategy cannot be complex in parameters since I cannot dedicate the necessary time if it were.

What I have told you is part of Risk Management and I believe that it becomes vitally important when it comes to being a WINNER.

My strategy and setup is fulfilled within the 15' timeframe and it happens many times a day, so I don't have to be aware of market sessions (NY, ASSIAN or EUROPE), however, I trade in the European and American sessions for geographical reasons.

Once the conditions are met, it is enough for me that my set-up has an R/R of 1.5 to decide if it is worth it, again, if it has an R/R of 4 then much better (LoL)...

Once inside the operation, this usually lasts between several minutes and very few hours, that's enough.

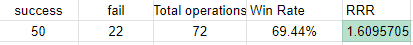

I'm not going to reveal my operations, I'm sorry, but here are my general statistics for this month:

This methodology or strategy provides me with around 11% profit per month on the budget that I allocate to scalping... surely there will be people who think that the profit is not that great either, 11% per month means 132% per year... for me it is enough while I have a good time and continue multiplying my profits.

Also, it must be said that this value does not take compound interest into account, I mean, while you are earning and maintaining your % risk per trade, the benefit on the initial capital also increases but we will talk about this at another time.

My only advice for those who want to learn and have fun while trading:

Forget all those who promise to show you the best trading system, pattern or indicator. Focus on developing a strategy, if you allow me, the simpler the better, with few rules but clear identification and then focus on trade management.

Believe me that even setups with a Reward/Risk ratio of 1:1 or even lower can guarantee you large profits.

This is not Finantial advice and bla, bla, bla 😂