Risk tolerance is a crucial factor in determining an investor's behavior, particularly in regards to "weak hands" behavior. Weak hands refer to investors who quickly sell their positions in a stock or market due to small fluctuations or perceived risks. These investors tend to have a lower risk tolerance, and therefore are more likely to sell their positions at the first sign of potential loss.

On the other hand, investors with a higher risk tolerance are more likely to hold on to their positions, even during periods of market volatility. They understand that short-term fluctuations are a normal part of the investing process and that potential losses are a necessary part of achieving long-term gains.

The role of risk tolerance in weak hands behavior is also important to consider when analyzing market trends. Investors with low risk tolerance tend to sell their positions at the first sign of a market downturn, causing prices to drop even further. This can lead to a self-fulfilling prophecy, as more and more investors sell their positions, further driving down prices. On the other hand, investors with higher risk tolerance are more likely to hold onto their positions, providing a stabilizing force in the market.

Additionally, understanding and managing one's risk tolerance is crucial for long-term success in investing. Investors with a low risk tolerance may miss out on potential gains by constantly selling their positions, while those with a high risk tolerance may take on too much risk and suffer significant losses.

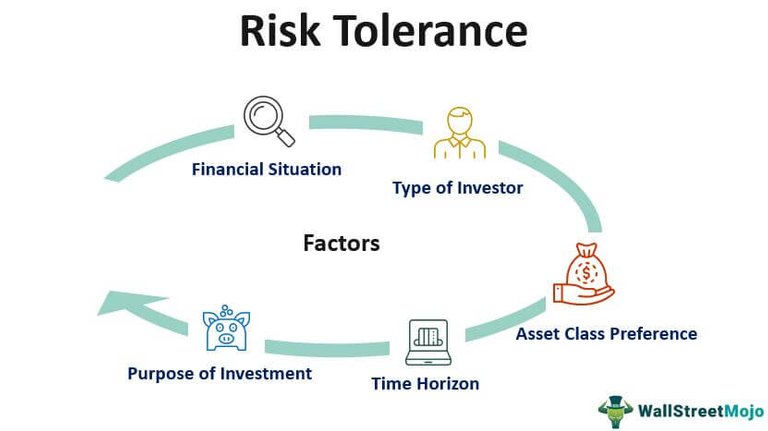

One way to manage risk tolerance is through diversification, which involves spreading investments across different asset classes, sectors, and geographic regions. This can help to mitigate the impact of potential losses in one area, while still providing opportunities for gains in others. Additionally, investors can use stop-loss orders or other risk management strategies to limit potential losses.

Furthermore, investors should regularly review their portfolios and make sure that they are in line with their risk tolerance. This means that they should not have too much invested in high-risk assets if they have a low risk tolerance, and conversely, they should not have too much invested in low-risk assets if they have a high risk tolerance.

Another way to manage risk tolerance is through education and self-awareness. Investors should educate themselves about the different types of investments available and their associated risks. They should also be aware of their own emotional responses to market fluctuations and how that might affect their investment decisions. Additionally, investors should set realistic expectations for their investments and understand that short-term market fluctuations are a normal part of the investing process.

Another important aspect is to have a long-term perspective. This means investors should not make investment decisions based on short-term market fluctuations, but instead focus on their long-term goals and objectives. By having a long-term perspective, investors can avoid being swayed by short-term market noise and make more informed investment decisions.

Additionally, investors should not be swayed by the opinions or recommendations of others, but instead conduct their own research and due diligence. It is important to remember that past performance is not indicative of future results and that no investment is guaranteed.

In conclusion, managing risk tolerance is an important aspect of successful investing. It requires a combination of diversification, risk management strategies, education, self-awareness, long-term perspective, and conducting independent research. By understanding one's own risk tolerance and making informed investment decisions, investors can increase their chances of achieving their financial goals.