KEY FACTS: Elon Musk's X, formerly Twitter, has partnered with Visa to launch the X Money Account, a real-time payment service set to debut later this year as part of Musk's vision to transform X into an "everything app." The service will enable instant funding of X Wallets via Visa Direct, peer-to-peer payments, and seamless bank transfers, as a step toward integrating social media and financial services. Inspired by platforms like China's WeChat, X aims to combine messaging, networking, and payments to enhance user engagement. The development will position X and Visa to capitalize on the growing digital payments market. The duo will face regulatory and competitive challenges from established players like PayPal and Apple Pay. The success of X Money will rely on user adoption, regulatory compliance, and innovation.

Source: Elon Musk's X is partnering with Visa

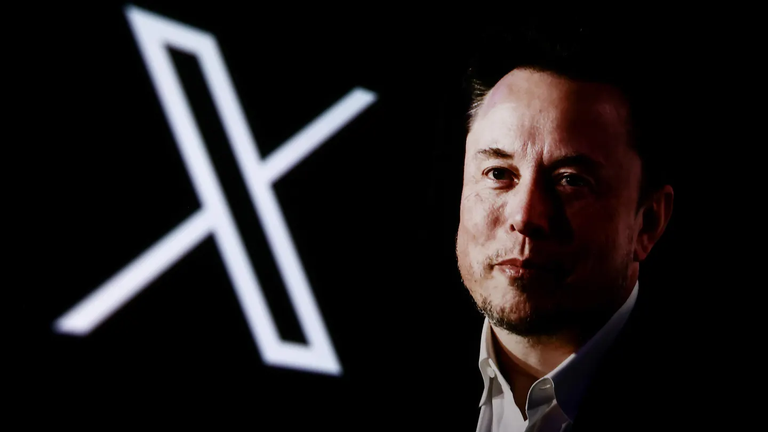

Elon Musk’s ‘X Money’ Partners with Visa For Payments

Elon Musk’s social media platform, X, formerly known as Twitter, has announced a partnership with Visa to introduce a real-time payment service named "X Money Account." This service is slated to launch later this year, as the most tangible step toward creating an “everything app,” in line with Musk's vision to integrate diverse functionalities into the platform.

We’re excited to partner with @XMoney on the launch of X Money Account. Visa Direct will make it possible for US X Money Account users to fund and transfer money in real-time with their debit card.

Source

The X Money Account is designed to offer users a seamless and efficient payment experience within the X platform. According to X CEO Linda Yaccarino, the service will support: instant funding, peer-to-peer payments, and bank transfers.

With instant funding, users can securely and instantly fund their X Wallets via Visa Direct. Peer-to-peer payments service allows for peer-to-peer payments connected to users' debit cards, facilitating quick and easy transactions between individuals. Users will also have the option to instantly transfer funds from their X Money Account to their bank accounts, enhancing the flexibility and utility of the platform. Yaccarino emphasized the significance of this development, stating,

Another milestone for the Everything App: @Visa is our first partner for the @XMoney Account, which will debut later this year.

💰Allows for secure + instant funding to your X Wallet via Visa Direct

🪪 Connects to your debit card allowing P2P payments

🏦 Option to instantly transfer funds to your bank account

First of many big announcements about X Money this year.

LFG.

Source

Elon Musk's acquisition of Twitter in 2022 for $44 billion and its subsequent rebranding to X signaled his ambition to evolve the platform beyond traditional social media functionalities. Drawing inspiration from China's WeChat, Musk envisions X as a super app encompassing messaging, social networking, and payments. The collaboration with Visa is a strategic move to integrate financial services, thereby enhancing user engagement and creating new revenue streams.

The digital payments ecosystem in the U.S. has experienced rapid growth since 2020, driven by increased online activity and a demand for convenient peer-to-peer payment solutions. Traditional card networks like Visa and Mastercard are investing heavily in digital payments to compete with tech firms such as PayPal, Apple Pay, and Google Pay. Visa's partnership with X positions both companies to capitalize on this expanding market by offering integrated payment solutions within the social media platform.

While the introduction of X Money represents a significant advancement, it also brings potential regulatory and competitive challenges. Integrating financial services into a social media platform may attract scrutiny from financial regulators concerned about data privacy, security, and the potential for financial misconduct. Additionally, X will face competition from established payment platforms and other tech companies aiming to offer similar services. The success of X Money will depend on its ability to navigate these challenges while providing a secure and user-friendly experience.

The partnership with Visa marks a significant milestone in X's evolution into an all-encompassing platform. As the company continues to roll out X Money and other planned features like X TV and Grok, it aims to redefine user engagement by offering a diverse array of services within a single application. The success of these initiatives will depend on user adoption, regulatory compliance, and the platform's ability to innovate amid competitive options.

Information Sources:

If you found the article interesting or helpful, please hit the upvote button, and share for visibility to other hive friends to see. More importantly, drop a comment below. Thank you!

This post was created via INLEO, What is INLEO?

INLEO's mission is to build a sustainable creator economy that is centered around digital ownership, tokenization, and communities. It's Built on Hive, with linkages to BSC, ETH, and Polygon blockchains. The flagship application: Inleo.io allows users and creators to engage & share micro and long-form content on the Hive blockchain while earning cryptocurrency rewards.

Let's Connect

Hive: inleo.io/profile/uyobong/blog

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

Posted Using INLEO