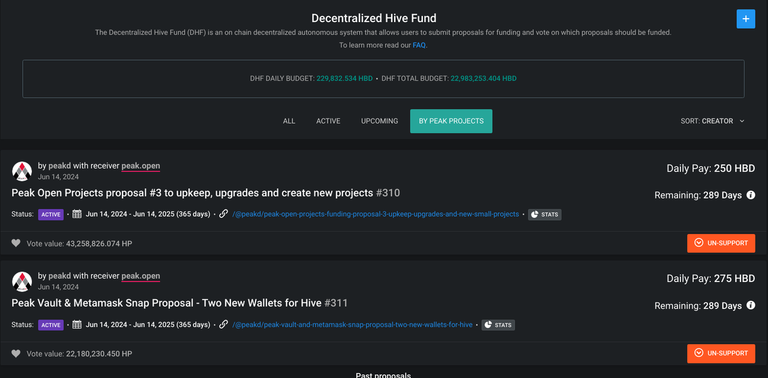

This is not the fault of the developers. This estimated loss is the result of certain trade-offs that have been made for DHF. The loss is directly proportional to the total budget of Decentralized HIVE Fund. If you have done some calculations in your head, you may have figured out about the guaranteed loss we are facing every year.

$20 used to be an ounce of gold in 1933. By the curse of one of the worst presidents of USA (Franklin D. Roosevelt), the dollar was devalued to $35 per ounce and Richard Nixon brought the world out of the gold standard in 1971. When you see gold price rising, what it means is that the value of USD relative to gold is falling.

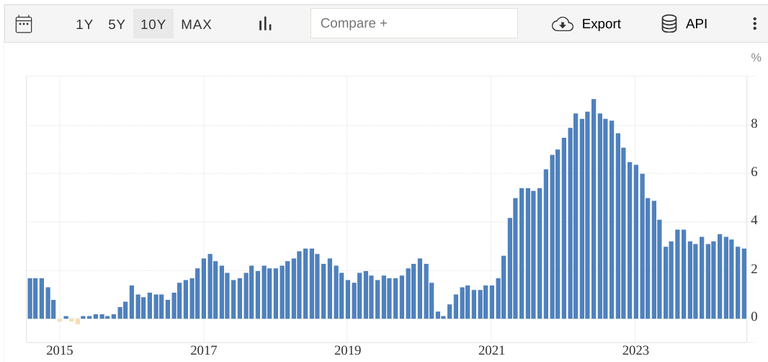

CPI Has Its Problems

The following is generated by Brave Search. It shows one of the reasons why it feel like CPI to be lower than the inflation felt by the consumer.

Hedonic Adjustment: A statistical technique used to account for changes in product quality when calculating the Consumer Price Index (CPI). It aims to remove price differentials attributed to quality improvements or deteriorations, allowing for a more accurate measurement of inflation.

In hedonic adjustment, economists use regression modeling to estimate the value of various characteristics, such as features, materials, and technologies, that contribute to a product’s price. For example, in the case of men’s shirts, characteristics like sleeve length, cotton content, and collar style are analyzed to determine their impact on the shirt’s price.

When a new version of a product is released, with improved or altered characteristics, the hedonic adjustment method estimates the value of these changes and subtracts or adds it to the original product’s price. This ensures that the CPI accurately reflects the change in price due to inflation, rather than quality improvements.

Alternative Indicators of Inflation

There are no perfect indicators I can think of. What we know is that gold has been "money" for the longest period of time and despite the price suppression of Gold, what you can exchange for the price of an ounce of gold has remained quasi-stable.

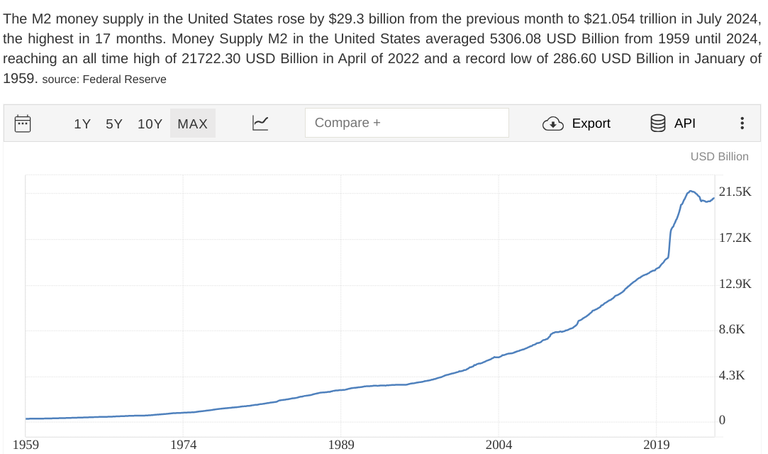

Another argument to be made regarding inflation is that when the supply of dollars increase while the goods and services available remain the same, the relative value of the dollar falls down.

While you are looking at the above, it would be a good idea to learn about the Cantillon effect. You may have already noticed the effects described when observing how currency work.

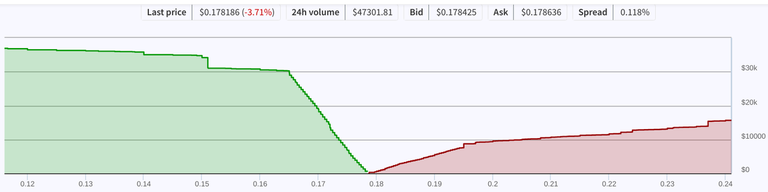

Burn HIVE Off of Exchanges

What do you think about using DHF to buy and burn HIVE off the market as a temporary measure? It is very easy to move up the price of HIVE based on the current liquidity levels. If there was a script that buy and burn HIVE from market at random intervals, could this be a positive (at least for the short term). I'm merely exploring possibilities. I have not fully analyzed the potential side effects.

HIVE price going up will mean more HBD getting added to DHF. I have not done any calculations. There must be some levels where burning HIVE + any pumps caused by it leading DHF to gain more HBD than it spend.

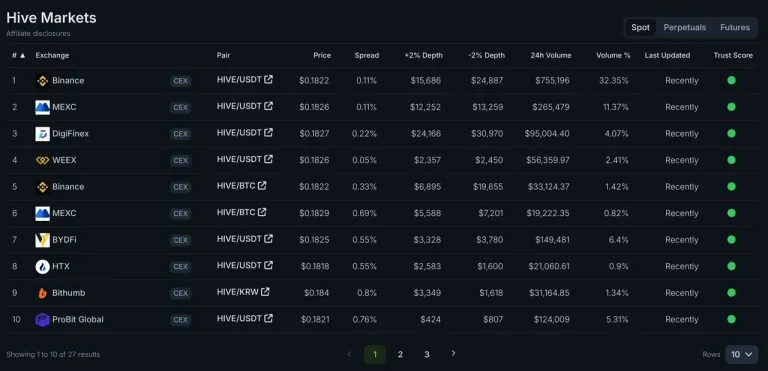

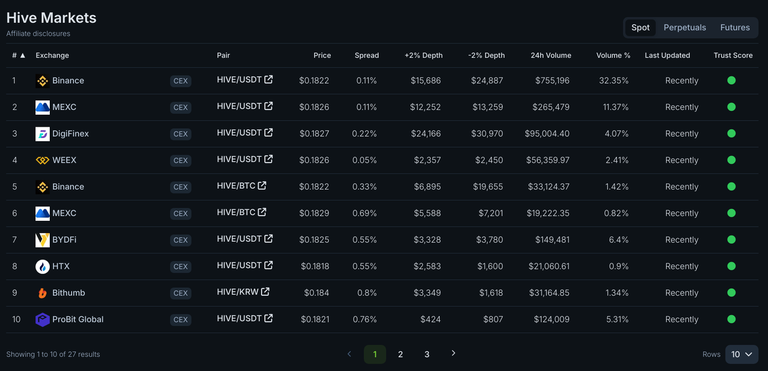

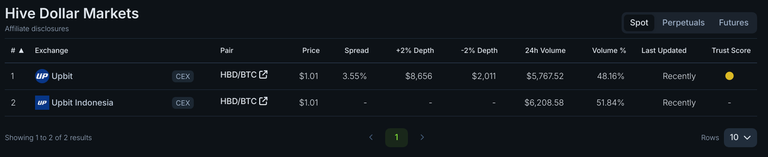

Take A Look At Markets for $HIVE and $HBD

There are other paths to acquire HIVE (mostly thanks to @leofinance team) including wrapped versions of HIVE on EVM Chains. What happen on blockchain can be easily audited. Using a CEX will have to rely on a trusted HIVE community member/s with skin in the game. Wrapped HIVE has a higher risk compared to the native asset.

The Beginning of The Idea

I first mentioned this idea of DHF doing a HIVE buyback and burning them under the above linked article as a reply to @starkerz. "Possible!! Worth considering", was a better than what I expected and I finally decided to write an article on the matter.

Potential Drawbacks

It is a good advice to look at life in terms of pros and cons rather than an oversimplified good vs bad binary. Using $HBD as the way to store the wealth of DHF has massive benefits for a bear market. There is $HIVE in the DHF wallet left and 1% of theme get converted to HBD everyday as per my understanding. The best we could do is to get the best of pros while minimizing the cons.

- Burning HIVE is not a long term strategy. Investors will soon price in regular burns and after some time, buybacks will not generate significant positive price action.

- Removing HIVE from CEXs take extra risk and potential legal problems.

- HBD price could get adversely affected.

Feel Free to Brainstorm

Discussing wild ideas give birth to some of the best strategies. I have started the discussion. It is upto the readers to carry the torch. End of bear markets are the best times to get the most out of a stablecoin fund. Only 8.04% of Daily Budget is being utilized at the moment. Inflation eats away a this value and we should come up with effective uses for this money. Saving doesn't build success; investing does!

Posted Using InLeo Alpha