I love Splinterlands, it's a funny game, it's a valid investment asset, it's surprising every day, what else could you want?

Well, a few days ago we had got a foretaste of how SPS validator nodes will work. And how, with the licenses system, the whole consensus mechanism will be a blessing for small investors who would like to participate in the decentralization of the chain even without real chances to close a single block.

The community reacted really well to the announcement, and all around you can find content with rosy forecasts for SPS and VOUCHER prices and for the ROI of the node running activity.

I am very bullish too, but I found some of these predictions a bit naive, and I wasn't satisfied with the math, thus I decided to go a little bit deeper without relying on huge price spikes.

You can find the original Splinterlands post at this link. I'm sure there's no need for that, but to keep all in here I will summarize the numbers:

From the launch on, a total of 3,750,000 SPS/month are going to be distributed as a reward to the node runners. 10% of that pool is reserved for validators who actually close blocks. In order to receive a block to be validated, a node need to win a "lottery" where every single staked SPS is a ticket. Here I'm going to indagate returns for small investors, therefore this 10% slice will be taken away from the calculation.

The remaining 3,375,000 SPS/month will be equally distributed to every license associated with a working node.

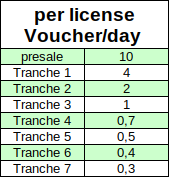

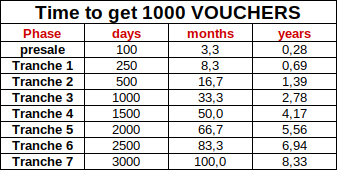

Moreover, VOUCHERS will be airdropped accordingly to the same principle from a reserved pool of 20,000 tokens/day.

Finally, a total of 60,000 licenses will be sold in 8 wawes at different price requirements:

| Phase | Quantity | Price | VOUCHER | Discount Rate |

|---|---|---|---|---|

| Presale | 2,000 | $1,000 of SPS | 500 | N/A |

| Tranche 1 | 3,000 | $3,000 of SPS | - | $3.00 |

| Tranche 2 | 5,000 | $5,000 of SPS | - | $5.00 |

| Tranche 3 | 10,000 | $7,500 of SPS | - | $7.50 |

| Tranche 4 | 10,000 | $10,000 of SPS | - | $10.00 |

| Tranche 5 | 10,000 | $15,000 of SPS | - | $15.00 |

| Tranche 6 | 10,000 | $20,000 of SPS | - | $20.00 |

| Tranche 7 | 10,000 | $40,000 of SPS | - | $40.00 |

We can start repeating some considerations already made by everyone: every VOUCHER will guarantee a discount in $, which means that, as long as the license sale lasts, in the case the licenses are a desirable product it will act as a product backed peg, locking the price somewhere close to the discount rate.

The following inference is, that 1000 VOUCHERS will ensure a license in any selling phase. Regardless of the price, one can exchange 500 for SPS on the secondary market, and use the rest to get a 50% discount.

So...

How long would it take to get a second license from vouchers airdrop?

- Airdrop shouldn't start before the launch, thus, it will with Tranche 1

- Tranche 1 won't remain unsold for months, probably neither for hours

- The same could happen with some following Tranches

So how long?

well it depends on how fast we pass from one selling phase to another, the speed will decrease accordingly, we can use the following table to get an idea

We don't know if there is a planned pause between one selling phase to another. But, assuming there isn't, at what phase do you believe we will be at the end of day one?

Answering this is quite relevant for any further analysis.

My educated guess is Tranche 3

It's an opinion, and I could be wrong, but I will keep writing assuming this is the case.

Moreover, we cannot expect that Tranche 3 will remain unsold for 3 years, that could be the case only if Splinterlands collapses, which we don't believe. Therefore, the 1000 VOUCHERS target from the airdrop gets farther and farther in time.

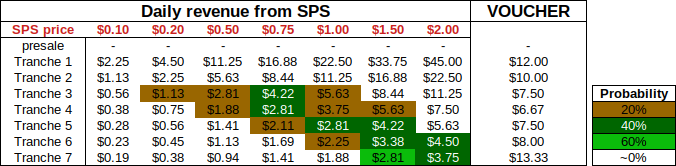

What about SPS returns?

This is going to be the most arbitrary section. In order to make a prediction we need to hypothesize the future price action of SPS. Here and there we can find respected and influential opinions on the matter, but I need to make a guess that I personally believe to be realistic.

I don't know how to put it, so I'll go straight on, I believe that a 10x from now (0.12$) is conservative.

I saw some pointing at a 5$ target with some good arguments, but at the moment I cannot follow that reasoning.

So I decided to stay conservative and use the Tranches as time indicators to gradually move up the SPS price. I also added a probability to price ranges to get some error tolerance.

If you foolishly believe that there is a need for a 5$ SPS column, just take the revenue from the 2$ column and multiply it by 2.5. And, after that, send me a sample of the ultra bullish weed you clearly have in abundance because I will very much appreciate it! 😆

[voucher revenue is calculated assuming the peg is working]

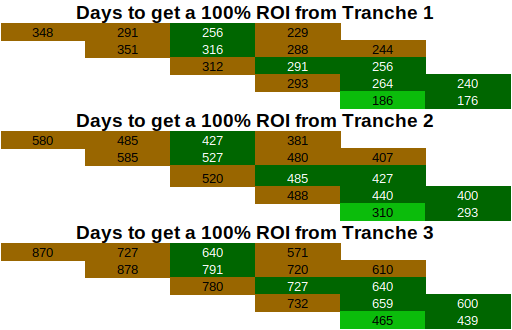

Now. That said, for us plebs who cannot rely on actually validating a single block, how long would it take to repay the license counting both SPS and VOUCHERS rewards?

Well, of course, it will depend on how much we paid for that license. Here too, we need to be conservative and make some guesses:

- we missed presale (dammit I sware i clicked it fast)

- secondary market may be less than rationale and sell licenses at more than 3k (who knows?)

- we may miss the Tranche 1 (oh come on again?)

- Tranche 2 is gone while we were shouting obscenity (WTF, that was fast)

- On Tranche 3 we get our cookie!

Ok maybe it goes better than that, let's make a case for T1, T2, and T3

These tables use the same "time (tranche) x price probability" I made for the revenue table. We could make an educated guess on how fast we will pass from one Tranche to the other. You know, in order to have a final number of days, but at this point, we have too many hypotheses and that will lead to a number that is somewhere in between the green ones and will be mostly random.

If you like you can do it like that:

- raw by raw, multiply the brown numbers by 2, the dark green by 4, and the light green by 6, add the results, and divide by 10. That is a weighted average

- raw by raw, decide how many days we will pass on the corresponding tranche (first raw tranche 3, second tranche 4, and so on)

- starting from the first raw, if are lower, divide the days of permanence by the weighted average. If not the weighted average is your final result.

- from the second raw on, multiply the weighted average by (1- the result of the ratio done on instruction 3), that is your "new" weighted average. Now, if the day of permanence in the current tranche is lower than that, repeat instruction 3 on this raw, and add the new ratio to the previous. If not the sum of the days passed in the previous tranches, plus your "new" weighted average is your final result

If you followed these instructions, now you have a number that is almost certainly wrong, but it has been properly calculated. You should be proud, and you should thank me with a sample of that self-punishing weed you clearly abused, I will appreciate it too!😁

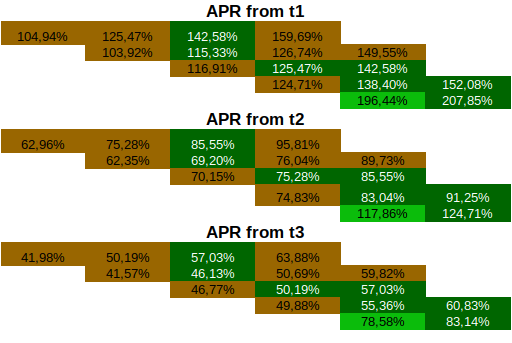

Finally, if we ignore the fact that the following question is formally incorrect, what would be the APR of a license investment in T1, T2, or T3?

here you have an answer

I started this post seriously and I ended it badly. It's ok, at least if I messed up with the guesses I can still hope you enjoyed it. Let me know and c u soon.

W