Liquidity pools are one of the fundamental building blocks of decentralized finance. They enable users to trade assets without relying on centralized exchanges, which can be slow, expensive, and subject to regulatory restrictions. By providing liquidity to a pool, you become a critical part of the DeFi ecosystem, and you can earn rewards for your participation.

However, liquidity pools also come with risks, and it's important to approach them with a clear understanding of the potential rewards and drawbacks. In this post, we'll explore some strategies that can help you optimize your returns and minimize your risks as a liquidity provider.

Diversify Your Hodlings

One way to reduce risk and increase returns is to diversify your holdings across multiple liquidity pools. By spreading your capital across several pools, you can minimize the impact of any individual pool's performance on your overall earnings. If you don't diversify then there's a high chance of one major liquidity pool disrupting your earnings in the event of a huge market swing.

You should also consider diversifying across different asset types. For example, you might allocate some of your capital to stablecoin pools, which typically offer lower returns but are less volatile, and some to pools that contain more volatile assets like traditional cryptocurrencies. By diversifying your holdings in this way, you can balance risk and reward to achieve a more stable and sustainable income stream.

Monitor Pool Performance

Do you monitor pool performance or do you just add liquidity and be done with it? To optimize your returns, it's important to monitor the performance of each pool you're invested in. This will allow you to adjust your allocation over time and reallocate capital to pools that are performing well.

One way to measure performance is by looking at the pool's trading volume. A pool with high trading volume will generate more transaction fees, which usually translates to higher returns for liquidity providers.

Another metric to consider is the pool's price impact. This measures how much the price of an asset changes as a result of a trade on the pool. A pool with lower price impact is generally more attractive to traders, as they can trade larger amounts of assets without affecting the market price as much.

Take Advantage of Incentives

Nowadays, many liquidity pools offer incentives to liquidity providers in the form of rewards tokens or additional transaction fees. By taking advantage of these incentives, you can increase your returns even further.

However, it's important to be aware of the risks involved in chasing high rewards. Some pools may offer very high incentives in order to attract liquidity, there's nothing wrong with that but these rewards in many cases may not be sustainable in the long term. Always properly do your research and consider the overall health of the pool before investing.

Consider Impermanent Loss

Impermanent loss is a risk that liquidity providers face when the price of the assets in the pool changes usually on the downtrend. If one asset in the pool increases in value relative to the other, liquidity providers will lose out on potential gains compared to if they had simply held the assets themselves.

While impermanent loss cannot be entirely avoided, you can minimize its impact by choosing pools that have lower volatility, and by avoiding pools that contain assets that are likely to experience constant or significant price swings.

Understand the Risks

Before investing in any liquidity pool, it's important to understand the risks involved. While providing liquidity can be a lucrative way to earn passive income, it also comes with potential downsides.

One of the biggest risks is impermanent loss, which I mentioned earlier. This occurs when the price of one asset in the pool changes relative to the other, resulting in a loss (temporarily) for liquidity providers.

Another major risk is smart contract vulnerabilities. Liquidity pools are built on top of smart contracts, which can have bugs or be subject to hacks. While many DeFi protocols have rigorous security audits, it's still important to be aware of the potential risks and to only invest what you can afford to lose.

Finally, it's important to be aware of the potential impact of overall market conditions on your liquidity pool returns. For example, during periods of high volatility or market downturns, liquidity providers may experience lower returns or even losses. It's part of the market cycle.

Conclusion

Liquidity pools can be a valuable source of passive income for those willing to take on some risk. By diversifying your holdings, monitoring pool performance, taking advantage of incentives, considering impermanent loss, and understanding the risks involved, you can optimize your returns and minimize your exposure to potential downsides.

Remember to always always do your research and carefully consider the risks before investing. With the right approach, liquidity pools can be a powerful tool for earning passive income in the rapidly evolving world of decentralized finance.

All images created via Nightcafe Studio.

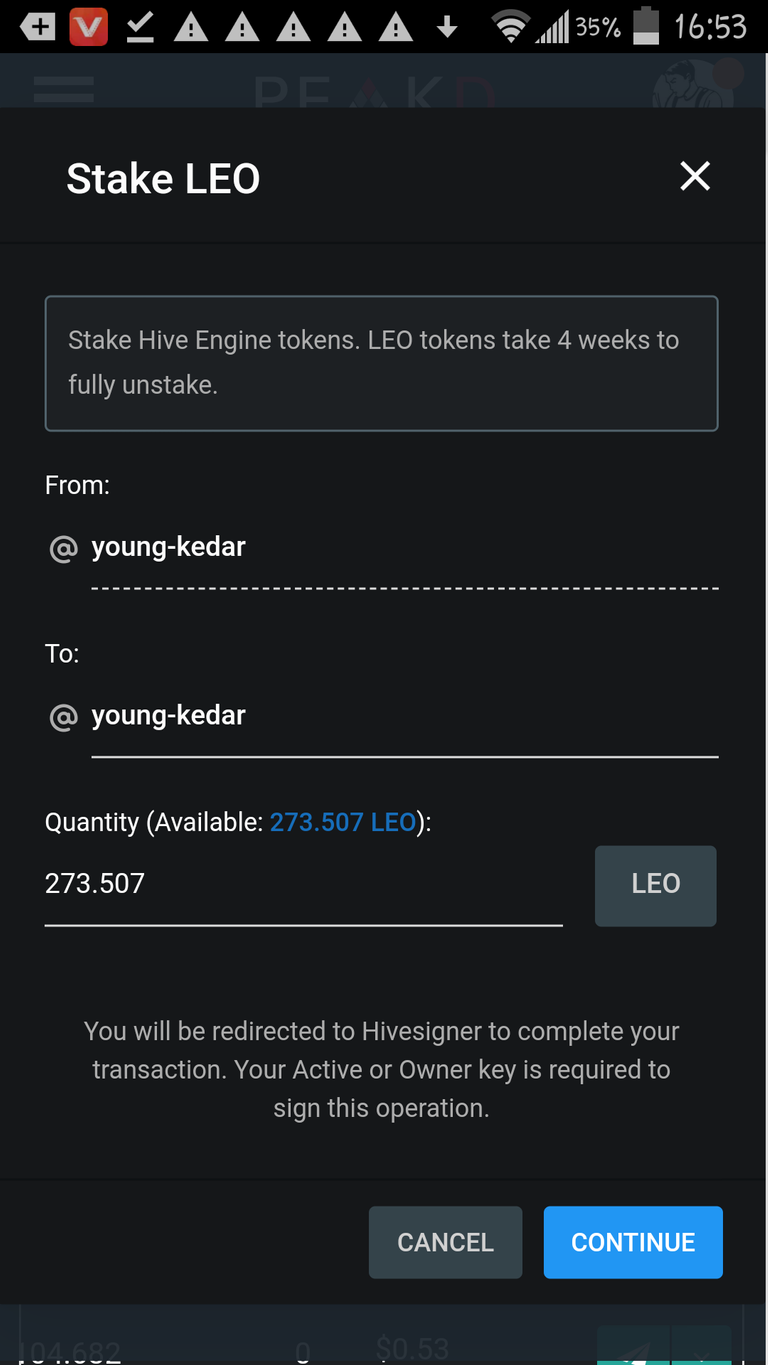

2nd LPUD Of The Year!

LPUD is here again. It's getting better with each edition as the pool of amazing prizes keeps increasing. But more importantly LPUD is about community growth, support and commitment. My main goal about from increasing my stake is to unlock all the LPUD hivebuzz badges for this year.

This is my second participation of the year. Looking forward to the third and the fourth and the fifth till the twelfth....

Happy LPUD Everyone!!!

Thanks For Reading!

Profile: Young Kedar

Recent Posts;

● Market Competition and Innovation: How Rivalry Drives Progress

● The Power Of Perception

● Crypto Micropayments In Live Streaming

● Crypto And Digital Lending: Revolutionizing the Financial Landscape

● The Cost of Convenience: How It's Impacting Our Finances

● The Risks and Challenges of Being Reliant on Technology: Part 2

Dolphin Support: @cryptothesis

Posted Using LeoFinance Beta