We all know that the media has a significant impact on how we perceive the world around us (more than 90℅ of information we receive is from the media), including the economy. Whether it's a news report, a television show, or an online article, the media 'helps' in many ways to form our opinions and understanding of complex economic concepts and events. But how accurate is this information, and to what extent does it shape our perceptions of market decisions and economic events?

First and foremost, it's important to recognize that the media is a business, and as such, its primary goal is to attract viewers, readers, and clicks. To do this, the media will often focus on sensational and dramatic stories, rather than more nuanced and complex economic issues. This can lead to a skewed portrayal of the economy and can contribute to public misconceptions about these subjects.

For example, in times of economic downturn, the media often highlights the negative aspects of the market such as job losses, company closures, and declining stock prices. This naturally creates a sense of panic among the public and results in irrational decisions being made, such as selling stocks en masse.

Take the recent job layoffs reported in the media. When you look at it, it does look like these mega corporations have laid off more than 90℅ of their workforce but the reality is that it's less than 20℅. According to Macrotrends, Meta(Facebook) had around 86,000 employees in 2022. If we remove the 11,000 laid off employees we will get 75,000 employees.

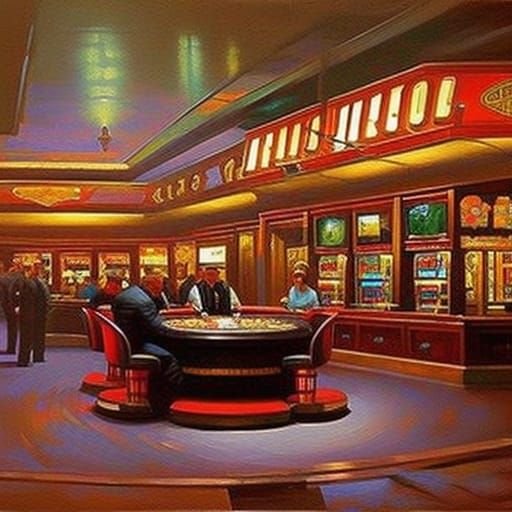

Don't Get Near 'The Casino'

Moreover, the media portrays the crypto market as a casino, where individuals can make quick profits or suffer devastating losses. This sensationalist view has led to the public perceiving the crypto market as a high-risk, speculative investment, rather than a long-term strategy for building wealth.

I believe investing in the crypto market could be viewed as a long-term strategy, with the goal of building wealth over time. It's important to understand that while there may be wild fluctuations in the crypto market, over the long-term, the market has historically trended upwards.

Side Note: Not investment advice! Please Do Your Own Research!!

This perspective is often lost and buried in the sensationalist reporting of the media, which influences individuals into making impulsive and irrational investment decisions that would get them rekt. Who to blame? The media or themselves?

Perception Really Matters

The media in many instances, lacks the expertise to accurately report on complex economic events and their implications. Time and again we have seen the results of that. Which is incorrect or misleading information being disseminated to the public further shaping public perception in a negative way.

This is how it usually happens. The media will report on a market crash without explaining the underlying reason(s) for the crash, leading the public to perceive the market as inherently unstable. The reality is that every market can be affected by a variety of factors such as interest rates, economic indicators, and geopolitical events. So I believe it's important to understand the underlying reasons for market movements in order to make more informed investment decisions. The surface is always a cover, we have to learn how to dig deeper into the source of things.

Another factor to consider is the impact of media reporting on investor sentiment. Research has shown that investor sentiment can have a very significant impact on the market, with negative sentiment (FUD) often leading to decreased market prices, and positive sentiment (FOMO) leading to increased market prices.

Whether we realise it or not, the media plays a huge role in shaping public sentiment, and as such, has the power to positively or negatively impact the market.

Conclusion

The media plays a crucial role in shaping public perception of market decisions and economic events. The problem with that is the perception the media shapes is usually incorrect because it is not entirely rooted in reality.

While it is still an important source of information, it's important we recognize its limitations and biases, and to seek out additional sources of information to gain a more complete understanding of the economy. By doing so, we can make more informed and better decisions about our financial futures.

All images created via Nightcafe Studio.

Thanks For Reading!

Profile: Young Kedar

Recent Posts;

● Crypto Micropayments In Live Streaming

● Crypto And Digital Lending: Revolutionizing the Financial Landscape

● The Cost of Convenience: How It's Impacting Our Finances

● The Risks and Challenges of Being Reliant on Technology: Part 2

● The Benefits of Being Reliant on Technology: Part 1

● An Examination of Digital Gold

Dolphin Support: @cryptothesis

Posted Using LeoFinance Beta